Holiday Entitlement on a Zero Hour Contract | Complete Guide

Posted by Robin on 01 Oct, 2025 in

Yes, absolutely. Workers on a zero-hour contract are legally entitled to paid holidays. It's a really common point of confusion, but UK law is crystal clear: even with irregular hours, you still build up paid time off. You are entitled to 5.6 weeks of paid leave per year, just like any other employee.

Your Fundamental Right to Paid Holidays

There’s a persistent myth that the flexibility of a zero-hour contract means giving up fundamental employment rights like paid leave. This just isn't true. The reality is that your holiday entitlement is protected by law, making sure you get the rest you've earned.

This protection isn't some company perk or a discretionary bonus; it's a statutory requirement. It guarantees that every single hour you work contributes towards your paid time off, providing a vital safety net against burnout.

Key Protections Under UK Law

The core legislation behind all of this is the Working Time Regulations 1998. This law makes no distinction between full-time, part-time, or zero-hour workers when it comes to the right to paid annual leave.

This legal framework was designed specifically to prevent a two-tier system where workers with irregular hours are treated less favourably. It establishes a baseline of rights for everyone, including:

- A minimum of 5.6 weeks of paid holiday: This is the standard for all workers, which is then pro-rated based on the actual hours you work.

- Accrual from day one: Your holiday entitlement starts building from the very moment you start your job.

- Fair payment for leave: Holiday pay should reflect what you would have normally earned if you'd been at work.

The crucial takeaway is that your contract type does not eliminate your legal right to paid time off. Understanding this empowers you to ensure you receive the correct holiday pay.

Grasping this core principle is the first step. To see how this fits into the broader picture, check out our ultimate guide to UK statutory holiday allowance. This foundation will help you navigate the specific calculations and rules that apply to your unique working situation, which we'll explore next.

Why Are Zero-Hour Contracts Everywhere These Days?

To really get to grips with your holiday entitlement on a zero-hour contract, it helps to understand why these agreements have become such a massive feature of the UK’s job market. They used to be a niche arrangement, but now you’ll find them everywhere.

This boom didn't happen by accident. For employers in sectors with constantly changing demand—think hospitality, retail, and logistics—these contracts offer incredible flexibility. They can scale their workforce up for the Christmas rush or down during a quiet spell, all without the fixed overheads of permanent staff.

Picture a café on the coast. It’s going to need a lot more hands on deck during a sunny bank holiday weekend than on a drizzly Tuesday in November. Zero-hour contracts are a straightforward answer to this kind of unpredictable staffing puzzle.

A Look at the Numbers

The sheer scale of this shift is staggering. Back in 2017, the Office for National Statistics reported that over 900,000 people were on these contracts, a huge jump from previous years. And because many people juggle multiple jobs, the total number of contracts was even higher, topping 1.8 million.

For any business relying heavily on a flexible workforce, slick HR procedures are non-negotiable. Having well-structured systems, like effective employee onboarding processes, is crucial for setting clear expectations from day one and making sure everyone’s employment rights are respected.

This widespread use means a huge and growing slice of the UK workforce has to figure out how to manage variable hours and income. It pushes the issue of holiday pay from a tiny legal detail into a critical, everyday concern for hundreds of thousands of us.

The View from the Worker's Side

For workers, it’s a classic trade-off. The flexibility can be a real plus for students, semi-retired people, or anyone balancing other big life commitments. It gives you the freedom to fit work around your life, not the other way around.

But that freedom comes at a price: income instability. Not knowing how many hours you’ll get from one week to the next makes budgeting a nightmare. This uncertainty is exactly why every single one of your employment rights—especially paid leave—is so vital.

Claiming your holiday entitlement on a zero hour contract isn't just about getting a well-deserved break; it’s about making sure you receive the full, fair compensation you’ve rightfully earned.

Right then, let's get into the nitty-gritty of how you actually calculate holiday pay. The go-to, government-approved method for workers on irregular hours is what’s known as the 12.07% method. If you're on a zero-hour contract, this is the approach you'll almost certainly come across.

Think of it as a simple savings plan for your time off. For every single hour you work, you're popping a tiny fraction of a paid holiday hour into a pot. This makes sure your holiday entitlement builds up in direct proportion to the hours you actually put in – it's the fairest way to handle things when your work schedule is all over the place.

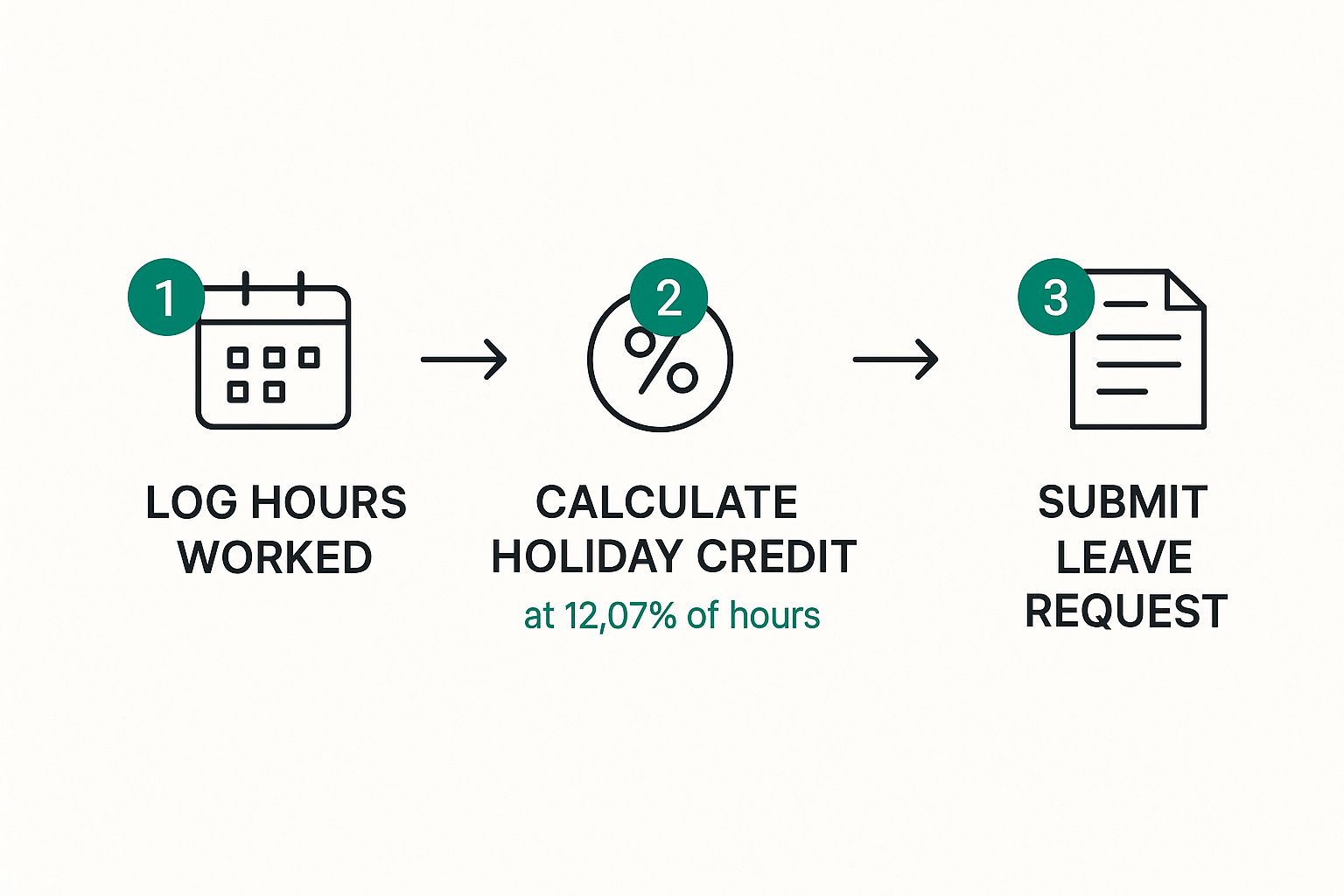

This little infographic breaks down the core steps, from tracking your time right through to getting your leave approved.

As you can see, the whole system really boils down to three things: logging your hours accurately, applying the right percentage, and then putting in a proper request for the time off you've earned.

Where Does 12.07% Come From?

That 12.07% figure looks a bit random, doesn't it? But there’s a solid legal reason behind it, and it comes straight from the statutory holiday entitlement of 5.6 weeks per year.

The logic is based on a standard working year. Since everyone gets 5.6 weeks of holiday, that means you're only actually working for the other 46.4 weeks of the year (which is just 52 weeks minus 5.6 weeks).

Here’s how the maths works out:

(5.6 weeks holiday ÷ 46.4 working weeks) x 100 = 12.07%

Using this percentage guarantees that the holiday you earn is the pro-rata equivalent of the statutory 5.6 weeks, no matter how many hours you work.

Putting The Calculation Into Practice

So, how do you use this in the real world? It’s refreshingly simple. To figure out how many hours of paid holiday you've racked up, you just multiply the total hours you've worked by 12.07%.

The formula is: Total Hours Worked x 0.1207 = Paid Holiday Hours Accrued

Let’s say you worked 100 hours in a month. You’d have earned 12.07 hours of paid holiday. Simple as that.

Key Takeaway: Your holiday entitlement isn't just a number plucked out of thin air. It's a precise calculation based on the hours you work, making sure you get a fair share of the statutory 5.6 weeks of leave.

Once you know the hours you've accrued, the next step is figuring out what that's worth in pounds and pence. You just multiply your accrued holiday hours by your average hourly pay rate. If your pay rate varies, your employer has to calculate an average based on your last 52 weeks of work. For more tools and details, our team has put together a useful UK holiday calculator guide.

Holiday Accrual Examples Based on Hours Worked

To make this crystal clear, the table below shows how quickly holiday hours can build up depending on your work patterns. It's a quick reference for how much paid time off you're earning.

| Hours Worked in a Month | Calculation (Hours x 12.07%) | Paid Holiday Hours Accrued |

|---|---|---|

| 20 hours | 20 x 0.1207 | 2.41 hours |

| 60 hours | 60 x 0.1207 | 7.24 hours |

| 100 hours | 100 x 0.1207 | 12.07 hours |

| 150 hours | 150 x 0.1207 | 18.11 hours |

As you can see, the more hours you work, the more paid holiday you earn. It’s a straightforward system that keeps things transparent and fair for everyone involved.

Understanding Rolled-Up Holiday Pay

Right, let's get into a topic that has tripped up employers and workers for years: rolled-up holiday pay.

In simple terms, it's a method where your employer adds a bit extra to your hourly pay to cover your holiday entitlement. Instead of getting paid when you actually take a holiday, the money is 'rolled up' into your regular wage packet.

Imagine your holiday pay isn't kept in a separate pot for when you need it. Instead, you get a small slice of it every time you're paid.

For a long time, this was a definite no-go in the UK. The courts ruled it was unlawful because it could put people off taking the time off they're legally entitled to. After all, if you're not getting a specific payment when you go on leave, the financial incentive to take a break is gone. The principle was clear: holiday pay is for the holiday itself.

The Recent Legal Shift

But things have changed. The government has recognised that for workers with very irregular hours, the old way of calculating holiday pay was a real headache. So, new legislation has come into play.

As of 1st January 2024, rolled-up holiday pay is now a legal and above-board option for employers, but—and this is a big but—only for irregular-hour and part-year workers.

This change is designed to make life simpler for businesses that depend on a flexible workforce. However, this new legality isn't a free-for-all. It comes with strict rules that employers absolutely must follow to protect your rights.

How Rolled-Up Holiday Pay Must Work Now

If an employer wants to use this system, they can't just sneak a few extra pence onto your hourly rate and call it a day. The whole process has to be completely transparent. You need to know exactly what you're getting and why.

Here are the non-negotiable rules an employer has to meet:

- Calculated at 12.07%: The holiday pay part of your wage must be worked out using the standard 12.07% of your total pay for that specific pay period.

- Clear on Your Payslip: This is crucial. The amount you get for holiday pay must be listed as a separate, distinct item on your payslip. It can't be hidden or bundled into your main hourly rate.

- For Specific Workers Only: This method is strictly reserved for those officially classed as 'irregular-hour' or 'part-year' workers. It is not a legal option for staff on regular, fixed hours.

The most important takeaway here is transparency. If your employer uses this system, your payslip must clearly show something like, "£X.XX Basic Pay" and a separate line for "£Y.YY Holiday Pay". This is how you can be sure your holiday entitlement on a zero hour contract is being handled correctly.

This legal update is a significant shift in how holiday pay can be managed. While it offers a practical solution for complex working patterns, it puts the responsibility squarely on employers to be transparent and accurate. Always check your payslip for that separate line item—it's your best way to confirm your employer is playing by the new rules.

Your Holiday Pay Rights When Leaving a Job

So, what happens to all that holiday you’ve built up but haven't had a chance to take when you leave a job? It's a common question, and thankfully, the answer is pretty straightforward.

By law, your employer has to pay you for any statutory holiday time you've accrued but not used up. This is non-negotiable.

This final payout is often called a "payment in lieu of holiday". It’s not some discretionary bonus; it’s a legal requirement to make sure you get the full value of the leave you’re owed, right up to your last day on the payroll.

And this right applies no matter what kind of contract you're on. Whether you’re full-time, part-time, or on a zero-hour contract, the principle is exactly the same. The crucial part is getting the calculation right.

Calculating Your Final Holiday Pay

For anyone on a zero-hour contract, the method for calculating this final holiday pay should look very familiar. It’s almost always based on the same 12.07% method used to figure out your holiday accrual while you were working there.

In simple terms, your employer should look at your total earnings during the current holiday year up to your leaving date and then apply the 12.07% formula. The number that comes out is the holiday pay you're due.

Here’s what you should look for on your final payslip:

- A clear, separate line item for “Holiday Pay” or “Payment in Lieu”.

- The amount should match up with the total accrued, untaken leave you’ve calculated.

- The calculation should be based on your average pay, not just a minimum rate.

When that final payslip arrives, give it a proper look-over. The holiday payment should be clearly itemised. If it’s just bundled into your final week’s wages without any explanation, you’re well within your rights to ask for a breakdown.

If you think there's been a mistake, bring it up with your manager or the HR department straight away. Just ask them politely how they worked out the figure. This is where having your own records of hours worked becomes incredibly valuable. A clear, well-defined company policy can stop these headaches before they start, and you can learn more about how to simplify leave management with our template annual leave policy.

Knowing your rights during the off-boarding process is vital. Making sure you get every penny you’re owed gives you a bit of financial breathing room as you move on to whatever’s next.

Common Questions About Zero Hour Holiday Pay

Even when you think you’ve got a handle on the rules, real-life situations can throw up some tricky questions about holiday pay on a zero-hour contract. This section is all about tackling those common queries head-on, giving you direct, practical answers to help you navigate the grey areas.

Think of it as your go-to guide for those nagging "what if" scenarios.

Can I Claim for Holiday Pay I Wasn't Paid in the Past?

Yes, you absolutely can. If you've realised your employer hasn't been paying your holiday entitlement correctly, you have the right to claim any pay you're owed. This is officially known as making a claim for an "unlawful deduction from wages".

There are time limits to be aware of, though. Generally, you need to kick off the claim process within three months less one day from the last time you were underpaid or not paid. The first step is usually to raise the issue directly with your employer before considering an employment tribunal if that doesn't work.

It's so important to act fast once you spot a problem. Keeping detailed records of your hours worked and copies of your payslips will be your best evidence if you need to make a backdated claim.

Do I Get Extra Pay for Working on Bank Holidays?

This is probably one of the biggest points of confusion out there. You might be surprised to learn there’s no automatic legal right in the UK to be paid extra for working on a bank holiday. It all comes down to what's in your contract.

Many employers do offer an enhanced pay rate (like time-and-a-half or double time), but this is more of a company policy or goodwill gesture than a legal requirement. If your contract doesn’t mention a higher rate, you should expect to be paid your normal hourly wage.

- Check Your Contract: This is the first place to look. It should clearly outline the company's policy on bank holiday pay.

- No Mention in the Contract: If it’s silent on the matter, the default is that you’ll be paid your standard rate.

- Taking Bank Holidays Off: If you decide not to work on a bank holiday, you can simply book it as part of your paid leave, and it will be taken from your total 5.6-week allowance.

What Should I Do If My Employer Refuses to Pay My Holiday?

Realising your employer isn't paying the holiday pay you're entitled to can be incredibly stressful. But don't panic, and definitely don't ignore it—there's a clear process to follow. Your holiday pay is a legal right, not an optional perk.

The first step should always be to try and sort it out informally. It’s entirely possible that the non-payment is just down to an honest mistake in payroll, rather than a deliberate refusal.

- Talk to Your Employer: Start by raising the issue in writing (an email is perfect) with your line manager or HR. Politely explain that you believe you are owed holiday pay, referencing your hours worked and the 12.07% accrual calculation.

- Raise a Formal Grievance: If a friendly chat doesn’t resolve things, your next step is to raise a formal written grievance. Make sure you follow your company’s official grievance procedure.

- Contact Acas: If the internal process hits a dead end, you can get in touch with Acas (the Advisory, Conciliation and Arbitration Service). They offer free, impartial advice and can help mediate a solution through "early conciliation" without needing to go to court.

- Employment Tribunal: As a last resort, you can make a claim to an employment tribunal. Just remember that strict three-month time limit from the date of the dodgy payment.

Knowing how to handle these situations is vital, both for protecting your rights and for trying to maintain a professional relationship. Your holiday entitlement on a zero hour contract is legally protected, and these steps are in place to make sure you get what you’re owed.

Managing leave for a flexible workforce doesn't have to be a headache. Leavetrack replaces messy spreadsheets with a simple, clear system for tracking accruals, managing requests, and giving everyone visibility. See how Leavetrack can simplify your absence management today.