Statutory Sick Pay for Part Time Workers Explained

Posted by Robin on 07 Oct, 2025 in

Of course. Here's the rewritten section, crafted to sound like it was written by an experienced human expert, following all the provided guidelines.

Yes, part-time workers in the UK are absolutely entitled to Statutory Sick Pay (SSP), as long as they meet the right criteria. It’s a common myth that SSP is just for full-timers, but the law doesn't see it that way. What really matters is your employment status and how much you earn, not how many hours you work. This is a legal safety net, designed to cover a wide range of employees.

Your Right to Sick Pay as a Part Time Worker

Let's clear the air: when it comes to SSP, the law doesn't distinguish between full-time and part-time staff. If you're off sick for four or more days in a row, your employer is legally required to pay you, provided you tick a few key boxes. Think of it less as a company perk and more as a fundamental employment right.

This guide will walk you through everything you need to know about statutory sick pay for part-time workers. We’ll cut through the jargon and give you the confidence to understand exactly what you're entitled to, making sure you get the support you’re owed when you're unwell.

The Foundation of SSP Eligibility

Before we get into the nitty-gritty, it's worth understanding the core principles behind sick pay. They aren't complicated, but getting them right is crucial for both employees and employers trying to manage absences properly.

A huge piece of the puzzle is your employment classification. You have to be certain about determining employee or self-employed status, because only people classed as 'employees' can get SSP.

Here are the main conditions we'll unpack:

- Employment Status: You have to be legally considered an employee.

- Minimum Earnings: Your average weekly earnings need to meet or go over the Lower Earnings Limit (LEL).

- Sickness Duration: You must be sick for at least four days in a row (including weekends and non-working days). This is officially called a 'period of incapacity for work'.

- Proper Notification: You must have told your employer you’re sick within their required timeframe, or within 7 days if they don't have one.

Getting your head around these points is the first step. For a deeper look at this topic, our guide to managing absence from work is a great resource. In the rest of this article, we'll break down each of these requirements, making the rules clear and straightforward.

Checking Your Eligibility for SSP

Knowing you might be able to get Statutory Sick Pay (SSP) is one thing, but understanding the specific rules is where you really take control. Think of eligibility as a simple, four-part checklist. You have to tick every box to qualify, and these rules apply just the same whether you work five hours a week or fifty.

Let’s walk through each requirement so you can see exactly where you stand. The criteria are pretty straightforward, but it’s vital to understand how they can play out differently for part-time workers.

The Four Pillars of SSP Eligibility

To get SSP, you have to satisfy all four of these conditions. If you miss even one, your employer won't be able to pay you for that period of sickness.

You are classed as an employee: This is the starting block. You need an employment contract and must have done at least some work under it. This also covers people on fixed-term or agency contracts.

You have been off sick for 4 or more days in a row: This is officially called a 'period of incapacity for work'. Crucially, this period includes non-working days like weekends or any other days you weren't scheduled to work.

You have notified your employer correctly: You must tell your employer you're sick within their own deadline, or within seven days if they haven't set one.

You earn above the Lower Earnings Limit (LEL): For part-time workers, this is often the biggest hurdle. Your average weekly earnings have to be over a certain amount.

Unpacking the Lower Earnings Limit

The Lower Earnings Limit, or LEL, is the minimum you need to earn on average to qualify for certain state benefits, SSP included. For the current tax year, the LEL is £123 per week.

Your employer works out your average earnings over a "relevant period," which is usually the eight weeks just before you became ill. For part-time staff with variable hours, this calculation is everything. One quiet month could easily drag your average below that £123 threshold, making you ineligible for SSP if you fall sick afterwards.

Key Takeaway: It’s not about your contracted hours, it’s about your actual average earnings. If your hours fluctuate, it’s a good idea to keep an eye on your payslips to see if you’re consistently meeting the LEL.

Statutory Sick Pay in the UK is a flat weekly rate, currently £116.75, no matter how many days a week you actually work. This means a part-time worker who qualifies gets the same weekly amount as a full-time colleague. The catch, of course, is that because part-time staff often have lower overall incomes, relying on this fixed rate can create real financial pressure, a point that has been raised in recent government analyses. You can read more about the financial impact and potential reforms for SSP on the official UK government website.

At the end of the day, checking these four points is the only way to know for sure if you qualify. By getting to grips with the LEL and your average earnings, you can avoid any nasty surprises when you need that support the most.

How Your Part Time Sick Pay Is Calculated

Figuring out Statutory Sick Pay (SSP) for part-time workers can feel like a headache, but the principle behind it is actually quite simple. One of the most common myths is that SSP is paid pro-rata based on the hours you work. That’s just not true.

An eligible part-time employee is entitled to the very same weekly rate of SSP as a full-time colleague. The trick is understanding how that standard weekly amount applies to your specific work schedule.

Identifying Your Qualifying Days

First things first, you need to pin down your ‘qualifying days’. These are simply the days you normally work. If your set pattern is every Monday and Tuesday, then those are your only two qualifying days for the week.

SSP isn't paid for the first three qualifying days you're off sick—these are called ‘waiting days’. Your payments only kick in from the fourth qualifying day you’re unable to work. This three-day rule is the same for everyone, no matter their work pattern.

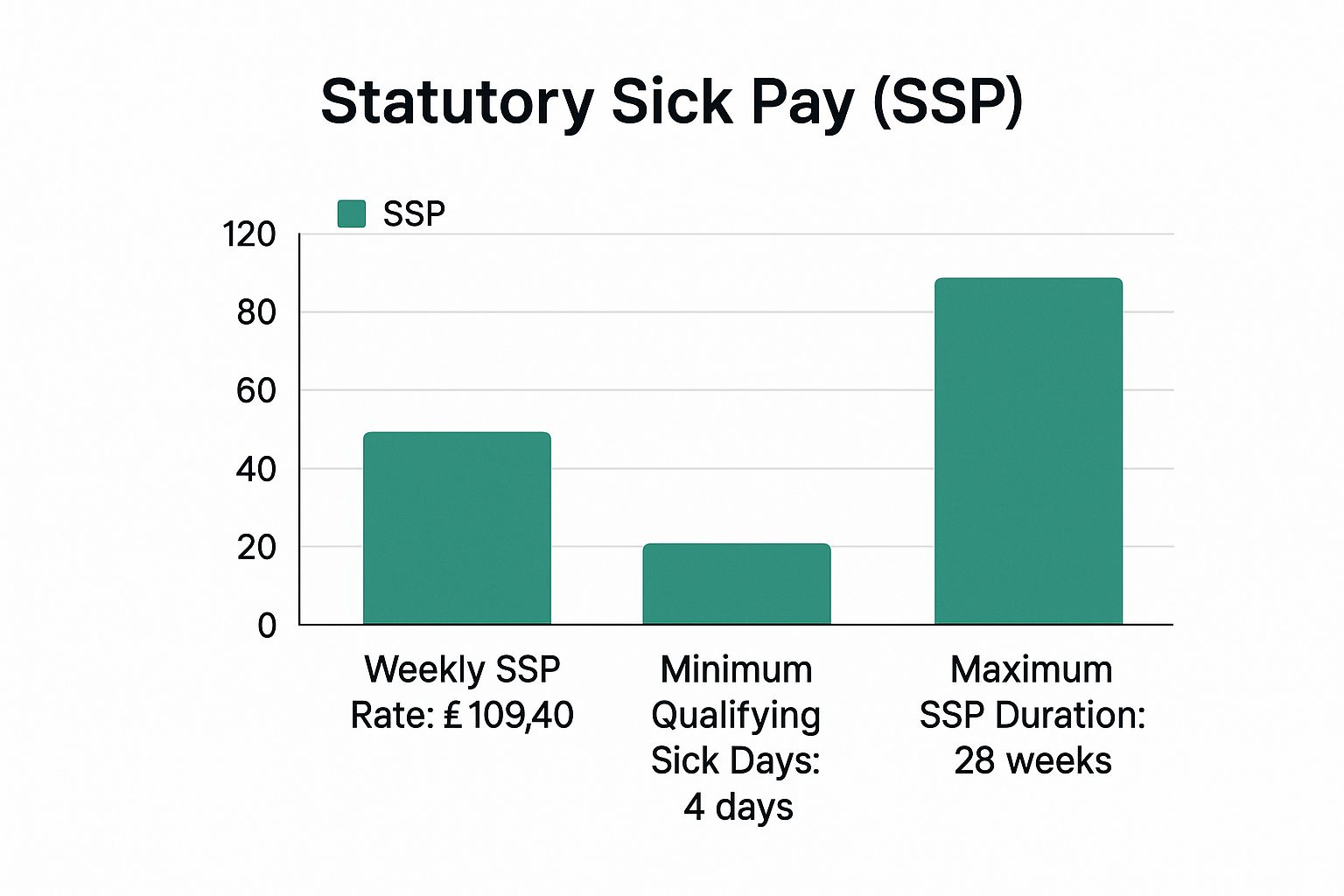

This infographic breaks down the essential figures you'll need.

It gives you a quick snapshot of the standard weekly rate, the minimum length of sickness needed to claim, and the maximum time you can receive payments.

Applying the Weekly Rate to Your Schedule

Once you’re past the three waiting days, you get paid a slice of the weekly SSP rate for each remaining qualifying day you’re sick in that week. The current weekly rate for SSP is £116.75.

To work out the daily rate, your employer will divide this weekly amount by the number of qualifying days in your working week.

Let’s walk through an example:

- Scenario: You have a fixed part-time schedule, working every Tuesday and Wednesday.

- Qualifying Days: 2 (Tuesday and Wednesday).

- Daily SSP Rate: £116.75 / 2 = £58.38.

- Sickness: You fall ill on a Monday and are off for the entire week.

In this situation, Tuesday and Wednesday of your first week of sickness, plus the following Tuesday, would be your three waiting days. You wouldn’t get any SSP for these days. Your payment would only start from your fourth qualifying day, which would be the following Wednesday. It's a bit of a mind-bender, but it makes sense when you map it out.

The table below provides a few more examples to show how this works across different schedules.

SSP Calculation Examples for Part Time Workers

| Work Pattern | Normal Working Days (Qualifying Days) | Illness Period | Waiting Days (First 3 Days) | Payable SSP Days | Total SSP Payable |

|---|---|---|---|---|---|

| 2 days/week | Tuesday, Thursday | Sick for 2 full weeks | Tue (Wk 1), Thu (Wk 1), Tue (Wk 2) | 1 (Thu, Wk 2) | £58.38 |

| 3 days/week | Monday, Wednesday, Friday | Sick for 1 full week | Mon, Wed, Fri | 0 | £0.00 |

| 1 day/week | Wednesday | Sick for 4 consecutive Wednesdays | First 3 Wednesdays | 1 (Fourth Wednesday) | £116.75 |

As you can see, the waiting days are always the first three normal working days you miss, which can sometimes push your first payment into the following week.

Handling Variable Work Patterns

But what if your workdays change from week to week? This is a common setup for people on flexible or zero-hour contracts. When this happens, figuring out qualifying days means looking at an average over a set period, usually the eight weeks right before you became ill.

This is where it can get a bit tricky, especially with inconsistent hours. Some businesses use systems like annualised hours to manage fluctuating schedules, which helps paint a clearer picture of a typical work pattern. If you don't have a fixed schedule, your employer has to agree on the qualifying days with you. If you can't reach an agreement, the law steps in and defaults to using every day from Monday to Sunday as a qualifying day.

Understanding Your Employer's Responsibilities

Knowing your rights to Statutory Sick Pay (SSP) is one half of the equation. The other half is understanding what your employer is legally required to do. Businesses have specific, non-negotiable duties when it comes to managing SSP for everyone on their payroll, including their part-time staff.

When you’re off sick, your employer’s role isn’t just to mark you as absent. They need to follow a clear set of government procedures to handle your sick pay correctly. This framework is there to protect both you and the business, making sure everything is done by the book.

Core Duties of an Employer

When it comes to statutory sick pay for part time workers, an employer’s responsibilities boil down to three key areas. Getting these wrong can quickly lead to disputes or even legal trouble.

Accurate Record-Keeping: Employers are required to keep detailed records of all sickness absences that last four or more days in a row. They also need to log all SSP payments they make and keep these records for at least three years.

Timely Payment: If you’re eligible for SSP, your employer has to pay it on your usual payday, just like your regular wages. They're also responsible for taking care of the tax and National Insurance deductions from it.

Issuing the SSP1 Form: This is a big one. If you don't qualify for SSP, or when your SSP is about to run out, your employer must give you a form called SSP1. This form is vital because it explains why you can't get SSP and is what you'll need to apply for other benefits like Universal Credit.

An employer can never force you to take paid holiday when you're sick. Holiday leave and sick leave are entirely separate things. It’s your choice whether you want to use a holiday day to receive holiday pay instead of SSP.

Common Employer Mistakes to Watch For

Most businesses get SSP right, but mistakes can and do happen. This is especially true for part-time staff where work patterns can get a bit complicated. Knowing the common tripwires means you can spot if something's not right and make sure you're being treated fairly.

A frequent slip-up is assuming a part-timer isn't eligible for SSP just because they work fewer hours. As we've already covered, eligibility is all about your average earnings, not the number of hours on your contract.

Another classic pitfall is miscalculating your average weekly earnings, particularly if your hours fluctuate. Your employer has to use the correct eight-week reference period to check if you meet the Lower Earnings Limit. A simple mistake here could lead to you being wrongly disqualified from receiving sick pay.

Understanding these employer duties means you know what to expect. If you suspect something is off, you can question it confidently and calmly, backed by the knowledge of how SSP is supposed to work. This is where systems like Leavetrack come in handy for businesses, as they help automate these processes, cutting down on human error and ensuring they stay compliant with all the rules.

What Happens When Statutory Sick Pay Runs Out?

Statutory Sick Pay (SSP) is a vital safety net, but it's important to remember it's a temporary one. It's designed to help you through shorter periods of illness and has a hard stop after a maximum of 28 weeks. So, what are the next steps if you're a part-time worker and still not well enough to go back to work?

The thought of SSP ending can be stressful, but it doesn't mean you'll be left without financial support. It's simply the point where you transition from a short-term sick pay system to other government benefits designed for longer-term health issues.

Exploring Your Options Beyond SSP

When your employer gives you an SSP1 form, it's your official key to unlocking further support. You'll get this either because your 28 weeks of SSP are coming to an end or because you didn't qualify for it in the first place.

This form is the proof you need to apply for other benefits. The two main ones to look into are:

- Employment and Support Allowance (ESA): This is specifically for people whose illness or disability impacts their ability to work. It offers not just financial help, but also personalised support to help you get back to work when you're ready.

- Universal Credit: This is a much broader payment to help with general living costs. You might be eligible if you're on a low income or out of work, and in some situations, you can claim it alongside ESA.

The moment you know your SSP is ending is the best time to start this process. Acting quickly helps avoid any potential gaps in your income.

Remember: That SSP1 form isn't just a piece of paper; it's essential evidence. Your employer is legally required to give it to you within seven days of your SSP ending.

Planning for Long-Term Absence and Return

While state benefits provide a crucial foundation, some people also look into private cover for more comprehensive protection. Policies like Accident and Sickness Insurance can offer another layer of support, helping to cover any financial shortfalls when SSP is no longer an option.

As you start to feel better, your focus will naturally shift towards getting back to your job. This doesn't have to be a big leap back to your usual hours all at once. A gradual approach is often best, and many employers are supportive of this.

Our guide on how to manage a phased return to work walks through the practical steps for making this a smooth process. A flexible transition can be particularly helpful for part-time workers, as it allows you to ease back in at a pace that supports your full recovery.

What's Next for Sick Pay for Part-Time Workers?

The current Statutory Sick Pay (SSP) system is a vital safety net, but it's far from perfect. Many people agree it needs a refresh to better support the UK's modern, flexible workforce, and thankfully, conversations about reform are well underway.

These discussions are all about building a fairer system that truly reflects how people work today, especially those in part-time roles. The goal is to move away from a rigid, one-size-fits-all model towards something more balanced. Getting to grips with these potential shifts is key to understanding where SSP is heading.

Potential Reforms on the Horizon

So, what’s driving these proposed changes? At its heart is the simple fact that the current rules can leave many part-time and lower-income workers in a really tough spot financially if they get sick. A huge sticking point is the Lower Earnings Limit (LEL), which currently blocks anyone earning less than £123 per week from getting SSP at all.

One of the biggest proposals on the table is to get rid of the LEL completely. This single change would open up SSP to hundreds of thousands of workers, a huge number of whom are in part-time jobs. Another major idea is to make SSP payable from the very first day of sickness, scrapping the three 'waiting days' that are currently unpaid.

A Fairer System for All: The whole point of these reforms is to make sure that a sudden illness doesn't spiral into a financial crisis. For a part-time worker, this could be the difference between paying the bills and falling into debt while trying to recover.

These efforts are moving forward, aiming to make SSP a much more accessible and realistic safety net. As recent legal updates have outlined, the proposals include making SSP available from day one, removing that earnings threshold, and calculating pay as a percentage of a person's usual income. These changes, potentially taking effect from April 2026, are designed to stop sickness from causing immediate financial hardship.

For part-time workers, this would mean receiving sick pay that actually reflects what they earn—a massive boost to their financial stability when they need it most. If you want to dive deeper into the details, you can read expert insights on what you need to know about SSP reforms.

While none of this is set in stone just yet, the direction of travel is clear: we're moving towards a more modern, supportive sick pay system. For the millions of part-time workers across the UK, these potential changes represent a long-overdue step towards greater security and fairer treatment.

Your SSP Questions Answered

When you're dealing with Statutory Sick Pay for part-time workers, a few common questions always seem to pop up. Let's tackle some of the most frequent ones we hear from employers and employees alike.

I Have More Than One Part-Time Job. Can I Get SSP from Both?

Yes, it’s entirely possible to claim SSP from each of your employers. Think of it this way: your eligibility is assessed separately for each job you hold.

As long as you meet all the criteria for each role individually—including that all-important Lower Earnings Limit—you can receive SSP from each employer.

What About Workers on Zero-Hour Contracts? Do They Qualify?

Absolutely. People on zero-hour contracts have a legal right to SSP, just like any other employee. The key thing is that they have to meet all the usual eligibility rules.

The main hurdle is usually the earnings requirement. They need to have earned, on average, at least the Lower Earnings Limit over the eight weeks before they fell ill.

What Exactly Are 'Waiting Days' and How Do They Work?

This is a really common point of confusion. The first three days you’re off sick, which you would have normally worked, are called 'waiting days.'

SSP isn't paid for these first three days. Your payments will only kick in from the fourth 'qualifying day' of your sickness absence.

Juggling sick pay and leave for a part-time team can quickly become a headache. Leavetrack takes the pain out of it by automating calculations, tracking every absence, and keeping you compliant without the guesswork. Find a simpler way to manage your team's time off at https://leavetrackapp.com.