holiday entitlement uk: The Complete Guide for Employers

Posted by Robin on 30 Oct, 2025 in

At its heart, the law on UK holiday entitlement is refreshingly simple: almost every worker is legally entitled to 5.6 weeks of paid annual leave.

For someone working a typical five-day week, this works out to 28 days of paid time off each year. This isn’t a perk or a nice-to-have; it's the absolute minimum set in law to support employee wellbeing and a healthy work-life balance.

Decoding the Basics of Statutory Holiday Rights

Think of the UK's statutory holiday entitlement as a fundamental right built into the fabric of employment. It provides a legal baseline that every single employer must follow.

This entitlement is a cornerstone of UK employment law, guaranteeing all workers a minimum of 5.6 weeks of paid leave each year. This applies across the board, whether someone is a full-time employee, works part-time, or is on a zero-hours contract. You can find more detailed insights on the minimum holiday entitlement in the UK on LeaveWizard.com.

The core principle is that for every year an employee works, they get 5.6 weeks of paid time off. While the weeks stay the same for everyone, the actual number of days this translates to depends entirely on their individual work schedule.

The Full-Time Employee Benchmark

The easiest way to get your head around this is by looking at a standard full-time employee. Let’s take someone who works a classic Monday to Friday week.

- Weekly Work Pattern: 5 days per week

- Statutory Entitlement: 5.6 weeks

- Calculation: 5 days × 5.6 weeks = 28 days

This 28-day figure is what most people picture when they talk about UK holiday rights. It's crucial to remember that employers can choose to include the eight standard bank holidays within this total, or they can offer them on top. Either way, the legal floor remains 28 days of paid leave.

To help you see how this works at a glance, here's a quick breakdown.

Statutory Holiday Entitlement at a Glance

| Days Worked per Week | Calculation (5.6 weeks x days) | Minimum Paid Holiday Days |

|---|---|---|

| 1 day | 5.6 x 1 | 5.6 days |

| 2 days | 5.6 x 2 | 11.2 days |

| 3 days | 5.6 x 3 | 16.8 days |

| 4 days | 5.6 x 4 | 22.4 days |

| 5 days | 5.6 x 5 | 28.0 days |

| 6 days | 5.6 x 6 | 28.0 days (capped) |

Note: The statutory entitlement is capped at 28 days. Even if an employee works 6 days a week, their minimum paid holiday does not exceed this amount.

Scaling for Part-Time Workers

So, what happens when an employee works fewer than five days a week? The 5.6-week rule still applies, but the calculation is adjusted proportionally. This is commonly known as a 'pro-rata' calculation.

Imagine you have an employee who works three days a week. They are still entitled to 5.6 weeks of holiday, but their 'week' is simply shorter.

- Weekly Work Pattern: 3 days per week

- Statutory Entitlement: 5.6 weeks

- Calculation: 3 days × 5.6 weeks = 16.8 days

This system ensures fairness for everyone. The part-time employee receives the same amount of holiday relative to their working pattern. Grasping this simple multiplication is the first, most important step to mastering holiday entitlement calculations for any employee, setting the foundation for all other, more complex scenarios.

Calculating Leave for Different Work Patterns

Things get a bit more interesting when you move beyond the standard five-day work week. Not everyone fits into a neat Monday-to-Friday box, and you can't just apply a one-size-fits-all approach to holiday pay. Doing so can lead to dodgy calculations and unfairness.

The trick is to adapt that core 5.6-week principle to fit each person's unique working schedule. It's all about making sure every employee gets the right amount of leave relative to the time they actually work. This means getting to grips with pro-rata calculations for your part-timers and knowing how to handle trickier schedules with variable hours or shifts.

Calculating Part-Time Holiday Entitlement

The most common variation you'll come across is the part-time employee. As we touched on earlier, their entitlement is calculated on a pro-rata basis, which is just a fancy way of saying "in proportion."

Let's say you have someone who works a consistent two days every single week. The formula is the same one we've been using: the number of days they work per week multiplied by 5.6 weeks.

- Calculation: 2 days × 5.6 weeks = 11.2 days of paid holiday per year.

It really is that simple for fixed part-time schedules. But what happens if someone works a set number of hours spread unevenly across the week, rather than a fixed number of days? In that situation, it's often much easier and more accurate to calculate their holiday entitlement in hours instead.

For example, a full-timer working a 40-hour week (8 hours a day, 5 days a week) gets 224 hours of holiday (40 hours × 5.6 weeks). A part-time colleague working 20 hours a week would simply be entitled to half of that:

- Calculation: 20 hours × 5.6 weeks = 112 hours of paid holiday.

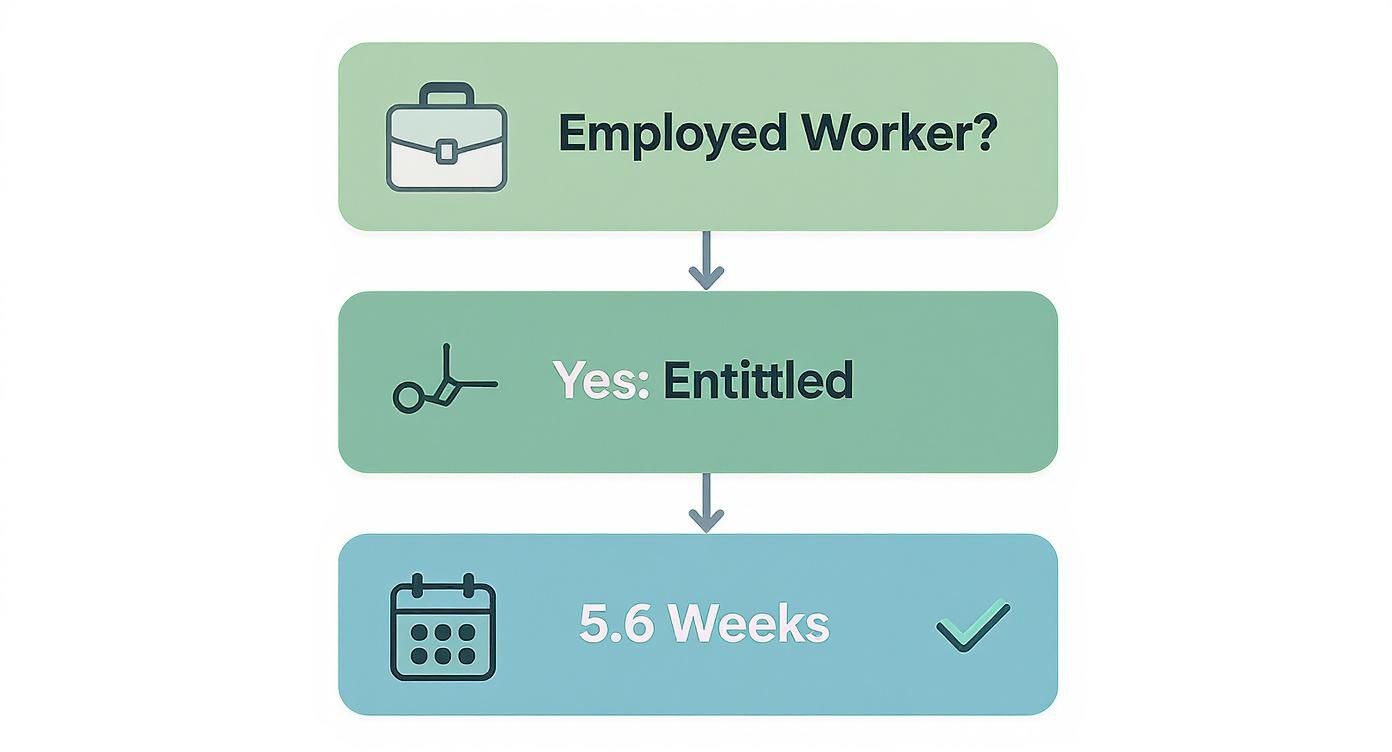

This decision tree gives you a clear visual of the basic entitlement path for most UK workers.

As you can see, the starting point for statutory holiday is being an employed worker, which unlocks that universal right to 5.6 weeks of paid leave. If you want to dive deeper into the nuts and bolts of this method, check out our full guide on https://blog.leavetrackapp.com/articles/how-to-calculate-pro-rata-holiday-a-uk-guide.

Dealing with Complex Shift Patterns

Shift work throws another spanner in the works because the whole concept of a "day" can get a bit blurry. Someone might work a 12-hour shift one day and then be off for the next three. Trying to calculate their leave in days just doesn't fly.

For these employees, you have to calculate their holiday based on their average working week over a full rota cycle. The first job is to figure out the average number of days or hours worked per week. A typical reference period for this is 17 weeks, but you should use whatever cycle length makes sense for your business.

Let's imagine an employee works a pattern of four 12-hour shifts on, followed by four days off. That's an 8-day cycle.

- Days worked in the cycle: 4 days

- Average days per week: (4 days ÷ 8 days in cycle) × 7 days in a week = 3.5 days

- Annual holiday in days: 3.5 days × 5.6 weeks = 19.6 days

This calculation makes sure that even with a complicated rota, the employee gets their fair and legal holiday entitlement. It effectively translates their unconventional schedule into a weekly average that you can plug straight into the statutory formula.

Annualised and Term-Time Workers

The same logic applies to other irregular work patterns, like term-time only contracts or annualised hours. For these roles, you still need to work out the average hours or days they work across the year to calculate their 5.6-week entitlement fairly.

The focus is always on proportionality. An employee who only works during school terms, for instance, has their holiday calculated based only on the weeks they actually work, ensuring they get their statutory leave on a pro-rata basis.

To help with the practical side of these calculations, especially for different work patterns, you might find a PTO calculator useful. It can take the headache out of the maths and give you confidence that your figures are spot on.

Getting Holiday Pay Calculations Right

Calculating an employee's holiday pay should be simple, but it’s an area where businesses often trip up. The guiding principle is actually quite straightforward: an employee taking a holiday shouldn't be financially worse off than if they were at work. This means their holiday pay has to reflect what they normally earn, not just their basic contracted salary.

Think of it like this: if an employee regularly boosts their income with overtime or commission, that extra cash is part of their normal earnings. Paying them only their basic salary while they're on leave would be like asking a guitarist to perform without their guitar—it just doesn't reflect their true contribution.

This core idea is central to the holiday entitlement UK rules. Failing to include these additional payments is one of the most common payroll mistakes, and it can easily lead to disputes or even employment tribunals. So, it's vital to get your head around what actually counts as 'normal pay'.

What to Include in Holiday Pay

So, what exactly needs to go into the pot when you're working out holiday pay? The law is pretty clear that any payments "intrinsically linked" to the performance of their job should be included.

This list covers the usual suspects you need to consider:

- Regular Overtime: This covers both compulsory and voluntary overtime, as long as it's worked often enough to be considered a normal part of their pay.

- Commission Payments: If an employee’s income includes commission, you must factor this into their holiday pay calculations.

- Performance-Related Bonuses: Bonuses that are directly tied to the work an employee does should be part of the calculation.

- Shift Allowances: Extra payments for working unsociable hours or specific shift patterns definitely count as normal pay.

Basically, any payment that forms a regular and settled part of someone's earnings must be accounted for. The whole point is to calculate a 'week's pay' that gives a true picture of their average income.

Calculating a Week's Pay for Different Scenarios

How you calculate this 'week's pay' depends on whether the employee has fixed hours and pay, or if their earnings fluctuate. Let's walk through a couple of examples to see how this plays out in the real world.

Scenario 1: The Employee with Fixed Hours

Let's say you have an employee who works a standard 40-hour week but consistently puts in an extra five hours of paid overtime. Their contract says 40 hours, but their normal working week is really 45 hours. In this situation, their holiday pay must be based on their average earnings for those 45 hours, not just the contracted 40.

Scenario 2: The Employee with Variable Pay

Now, picture a sales consultant. Their hours are consistent, but their pay packet changes each month because of their commission structure. For this person, and for any other worker without a fixed pattern of pay, the law sets out a different method. You have to calculate their holiday pay based on their average earnings over their last 52 paid weeks. You can find more insights on how normal earnings are reflected in the UK system and other useful statistics on Timetastic.co.uk. This reference period helps to smooth out the inevitable peaks and troughs in their income.

To do this, you need to look back over the previous 52 weeks in which the employee actually received pay, skipping any weeks where they weren't paid at all. You then calculate the average weekly pay from this period, and that's the rate you use for their holiday pay.

This 52-week reference period is the legal standard for ensuring fairness for people with irregular pay. It ensures the holiday entitlement UK laws protect every type of worker, preventing them from being penalised for taking their well-earned time off. Nailing this calculation isn't just about compliance; it's fundamental to building a transparent and fair relationship with your team.

Managing Leave for Irregular Hours and Zero-Hours Workers

Calculating holiday entitlement for workers on zero-hours contracts or with unpredictable schedules can feel like trying to hit a moving target. These flexible arrangements are becoming more and more common, but they add a serious layer of complexity to getting paid leave right. For years, many employers used a tempting shortcut, but the rules have since been tightened up to create a much fairer system.

The key thing to remember is this: every single worker, no matter their contract type, is entitled to 5.6 weeks of paid holiday. The real challenge isn't the entitlement itself, but figuring out how to translate those weeks into days or hours and, crucially, how to calculate the correct pay when their work pattern is all over the place. This is where dropping outdated methods and using the proper legal framework becomes absolutely essential.

The Problem with the 12.07% Method

For a long time, the go-to approach for casual workers was the "12.07% method." The logic seemed sound – 5.6 weeks of holiday is 12.07% of the remaining 46.4 working weeks in a year. Simple, right?

Unfortunately, a series of court rulings found this approach could be inaccurate and unfair, particularly for workers who had gaps in their employment throughout the year. As a result, this method is no longer legally compliant for most workers. Sticking with it could mean you're underpaying holiday pay, leaving your business wide open to employment tribunal claims. The correct approach now focuses on a look-back period to figure out a worker’s average pay.

The shift away from the 12.07% accrual calculation represents a significant change in how holiday entitlement UK law is applied to the modern flexible workforce. The focus is now firmly on ensuring holiday pay accurately reflects a worker's actual, recent earnings.

If you need a really deep dive into the specifics for these workers, our complete guide on holiday entitlement on a zero-hour contract breaks it down with clear, practical examples.

To see just how different the old and new methods are, let's compare them side-by-side.

Holiday Calculation Methods Past vs Present

| Aspect | Outdated 12.07% Method | Current 52-Week Average Method |

|---|---|---|

| Basis of Calculation | A fixed percentage (12.07%) of hours worked. | Average pay over the last 52 paid weeks. |

| Fairness | Can be inaccurate, often underpaying workers with inconsistent hours. | Accurately reflects actual recent earnings, including overtime and variable pay. |

| Legal Status | Unlawful for most workers following recent court rulings. | Legally compliant and the required standard. |

| Complexity | Seems simple, but its application is legally flawed. | Requires careful record-keeping but ensures fair and legal payment. |

| Practical Impact | Discourages taking leave and can lead to tribunal claims. | Ensures workers receive fair pay for their time off, reducing legal risk. |

The table makes it clear: the 52-week average isn't just a suggestion, it's the legally required standard for ensuring fairness and compliance.

The Correct Method: The 52-Week Reference Period

So, what's the legally sound way to calculate holiday pay for workers with irregular hours? You need to use a 52-week reference period. It’s the same principle we touched on for employees with variable pay, but for anyone without fixed hours or salary, it’s the default method.

Here’s how it works in practice:

- Look Back 52 Weeks: You need to review the last 52 weeks in which the employee actually earned money.

- Ignore Non-Working Weeks: Any weeks where the employee didn’t work and received no pay are skipped. You can look back up to 104 weeks if you need to find 52 paid weeks.

- Calculate the Average: Add up the total pay from those 52 weeks and divide it by 52. This gives you their average weekly pay.

- Pay the Holiday: When the worker takes a week of leave, they are paid this calculated average amount.

This process ensures their holiday pay is a true reflection of what they would normally earn, capturing all the natural ups and downs of their work schedule.

Understanding Rolled-Up Holiday Pay

There's one more practice you absolutely must avoid: "rolled-up" holiday pay. This is where an employer simply adds a bit extra to a worker's hourly rate—supposedly to cover their holiday pay—instead of paying them when they actually take time off.

Let's be clear: this practice is unlawful. The whole point of paid holiday is to let people rest and recharge without worrying about their income. Rolling the pay into their hourly rate actively discourages them from taking that essential break. Employers must manage and pay for leave as it's taken, not as a top-up to their wages. Proper tracking of hours and accrued leave is the only way to stay on the right side of the law.

What About Holiday During Sickness and Family Leave?

Life happens. People get sick long-term, or they start a family, and it’s natural to wonder how these big events affect things like holiday pay. It’s a common source of confusion for managers and staff alike, but the rule is actually quite straightforward.

Under UK law, an employee's statutory holiday entitlement continues to build up, even when they’re off work for sickness or family-related leave like maternity or paternity. Their rights don't just get put on pause.

Think of it as a benefit that keeps ticking along in the background. Someone on sick leave for six months won't come back to find their holiday allowance has vanished. They’ll have accrued half their annual entitlement during that time, ready for them when they return. This ensures people aren't penalised for taking essential time away from work.

The real challenge isn't whether the holiday builds up—it’s how you manage it, especially when someone can't possibly take their leave within the usual holiday year. This is where specific carry-over rules provide a crucial safety net.

Sickness and Holiday Accrual

When an employee is on sick leave, their holiday entitlement carries on accruing as normal. Simple as that. If they’re unwell for so long that they can't use their holiday during the leave year, they have a right to carry it over.

This protection is pretty solid. An employee can carry over up to four weeks (or 20 days for a full-timer) of their statutory leave into the next holiday year if they were physically unable to take it due to illness.

There are a couple of important details to keep in your back pocket:

- The carry-over limit: This automatic right applies to the first four weeks of statutory leave, which comes from the EU's Working Time Directive. The extra 1.6 weeks of UK-specific leave might be subject to your company's standard carry-over policy.

- The time limit: This carried-over leave must be used within 18 months from the end of the leave year in which it was accrued.

It's a common myth that an employee has to pick between sick pay and holiday pay. If someone falls ill just before or during a pre-booked holiday, they can choose to class that time as sick leave instead. They can then re-book their holiday for a later date, making sure they still get a proper break.

Family Leave and Carrying Over Holiday

The rules for statutory family leave—maternity, paternity, adoption, or shared parental leave—are just as clear-cut. An employee continues to build up their full contractual holiday entitlement throughout their entire leave period.

For example, an employee on maternity leave for a full year will return to work with a full year's holiday entitlement waiting for them. Since it's often impossible for them to use this leave within the standard year, they are legally entitled to carry over all of their untaken statutory holiday to the next leave year.

This ensures new parents aren't put at a disadvantage. It allows them to take their full paid leave, and many choose to add it to the end of their family leave to extend their time at home before returning to work.

Managing this accrued leave properly is vital. It all comes down to clear communication before, during, and after their leave. When you're planning their return, you should always sit down and discuss how and when they plan to use their accrued holiday. It makes for a much smoother and more compliant transition back into the team.

Creating a Fair and Effective Holiday Policy

Knowing the law is one thing, but putting it into practice is where a good employer really makes their mark. A clear, fair, and well-thought-out holiday policy is the bridge between simply complying with the rules and building a positive, trusting workplace. It takes the abstract legal requirements for holiday entitlement UK and turns them into a practical system that everyone in the company can actually use.

Think of your holiday policy as the user manual for time off. Without one, you're inviting chaos—confusion over how to book leave, arguments about who gets the popular Christmas week off, and a lingering feeling that the whole process is unfair. A solid policy cuts through that ambiguity, setting crystal-clear expectations for both your team and your managers.

This isn't just about ticking boxes to avoid legal trouble; it's about fostering trust. When your staff see a transparent process that’s applied consistently to everyone, they know the system is fair. That simple fact is fundamental to creating an environment where people feel valued.

Key Components of a Strong Holiday Policy

A robust holiday policy doesn’t need to be an epic, multi-volume saga. It just needs to be clear, cover the important bases, and be easy for everyone to find and understand. Its main job is to answer the most common questions before they even get asked, making life smoother for everyone.

At a minimum, your policy should clearly explain:

- Booking Procedures: How do people actually request time off? Is there an online system to use? Crucially, how much notice do they need to give? A common rule of thumb is asking for notice that's at least twice the length of the holiday they want to take.

- The Approval Process: Who has the final say on holiday requests? What’s the backup plan if a person's direct manager is away? Clarifying this chain of command stops requests from getting stuck in limbo.

- Handling Peak Seasons: How will you manage the inevitable rush for popular times like the summer holidays or Christmas? You could use a first-come, first-served system, a fair rota, or even a ballot. Whatever you choose, make it clear.

- Carry-Over Rules: Can people carry unused leave into the next holiday year? If so, you need to specify how much they can carry over and the deadline for using it. Clear limits are essential to prevent a massive backlog of leave from building up.

Of course, holiday policies are just one piece of the puzzle. Many businesses find that structured frameworks for other areas are just as important. For instance, a clear modern corporate travel policy template can bring the same level of clarity to business trips. For a head start on your own system, you can learn how to simplify leave management with our template annual leave policy, which covers all these essential points.

Fostering a Culture That Values Rest

Let's be honest, a policy is just a document. What really matters is the culture you build around it. Worryingly, recent data shows that UK employees are taking less of their holiday allowance than they used to. In 2023, the average employee took just 33.9 days off, a steep drop from 38 days back in 2020. You can dig into more of the data in the UK annual leave report from PeopleHR.

This trend points to a serious problem: the growing risk of employee burnout. A great holiday policy needs to be backed up by a culture that genuinely encourages people to switch off and recharge their batteries.

When leaders and managers actively push their teams to take their full holiday entitlement, they send a powerful message: we care more about your wellbeing than short-term output. This builds loyalty, cuts down on stress, and ultimately creates a more productive and engaged workforce.

Encouraging proper rest isn't just a nice thing to do; it has real business benefits. Well-rested employees are more focused, more creative, and more resilient. By championing the use of annual leave, you’re not only meeting your legal obligations but also making a direct investment in the health and performance of your team. It’s a proactive way to prevent burnout, boost morale, and hold on to your best people.

Your Questions Answered

When it comes to holiday entitlement in the UK, a few common questions pop up time and time again. Let's tackle some of the most frequent queries we see from both employers and employees, so you can handle these situations with confidence.

Can We Tell Staff When to Take Their Holiday?

Yes, you absolutely can. It's quite common for businesses to require staff to take leave on specific dates, especially for things like a company-wide shutdown over the Christmas period.

The key thing to remember is that you have to give them proper notice. The rule of thumb is simple: you must provide notice that is at least double the length of the holiday you're asking them to take. So, if you need everyone to take one week off, you'll have to let them know at least two weeks beforehand.

What Happens to Holiday When an Employee Leaves?

When someone's time with your company comes to an end, you need to settle up their remaining holiday. They are legally entitled to be paid for any statutory holiday they've accrued but haven't used, calculated on a pro-rata basis right up to their last day.

On the flip side, what if they've taken more holiday than they've actually earned? You might be able to deduct the value of that excess leave from their final pay packet. However, you can only do this if you have a crystal-clear clause in their employment contract that explicitly allows for it.

A watertight clause in the employment contract is non-negotiable if you ever want to reclaim pay for unaccrued leave. Without it, you simply have no legal standing to make the deduction. It’s a critical detail for every employer.

Do Bank Holidays Count Towards the 5.6 Weeks?

This is a big one, and it often causes confusion. There’s no automatic legal right for employees to have bank holidays off. As an employer, you can choose to include the UK's bank holidays as part of the minimum 5.6 weeks of statutory leave.

The crucial part is making this clear in your employment contract. It needs to spell out whether bank holidays are counted within the total entitlement or if they are given in addition to it. If you need an employee to work on a bank holiday, it's standard practice to offer them another day off in lieu.

Tired of wrestling with spreadsheets and endless email chains to manage leave? Leavetrack gives you a simple, central hub to track requests, monitor holiday accruals, and make sure your policy is applied fairly to everyone. See how Leavetrack can make your life easier.