How to Calculate Pro Rata Holiday A UK Guide

Posted by Robin on 09 Oct, 2025 in

Figuring out pro rata holiday doesn't need to be a headache. The basic formula is surprisingly simple: just multiply the number of days an employee works each week by 5.6 weeks. That’s the UK's statutory annual leave entitlement, and this calculation ensures your part-time team members get a holiday allowance that’s perfectly proportional to the hours they put in.

Understanding Pro Rata Holiday in the UK

Before we jump into the maths, it’s worth understanding why these calculations are such a big deal in the UK. The whole system is built on a cornerstone principle: fairness. An employee’s holiday entitlement should directly mirror the time they work. This isn’t just good HR practice; it’s a legal requirement under the Working Time Regulations 1998.

Those regulations set the statutory minimum at 5.6 weeks of paid holiday per year for all workers. That includes anyone working part-time, on a term-time basis, or even on a zero-hour contract. They are all legally entitled to a proportional slice of paid time off. Getting this wrong can quickly land you in hot water, leading to compliance issues and messy employee disputes.

Statutory vs Contractual Holiday

It’s also crucial to get your head around the two types of leave, as it affects your calculations.

- Statutory Holiday: This is the non-negotiable legal minimum of 5.6 weeks that every UK employer has to provide. For a standard full-time employee working five days a week, this works out to 28 days.

- Contractual Holiday: This is any extra holiday you offer on top of the statutory minimum. If your company has a more generous allowance, you must apply the pro rata principle to the entire amount, not just the legal baseline.

The statutory minimum of 5.6 weeks (or 28 days for a five-day week) is actually one of the more generous allowances in Europe. For part-time workers, the law is clear: you must calculate their entitlement on a pro rata basis. For example, someone working three days a week is entitled to 16.8 days (3 × 5.6). To learn more about the specifics, you can check out our ultimate guide to UK statutory holiday allowance.

The fundamental rule is simple: never round holiday entitlement down. If a calculation results in a fraction of a day, you must round it up to the next half or full day to remain compliant.

So, in the example above, 16.8 days would be rounded up to 17 days.

This approach ensures that as flexible working becomes more common, every employee receives the benefits they've earned. Nailing these pro rata calculations is an essential skill for any manager or HR professional looking to keep things fair and compliant.

Calculating Holiday for Part-Time Staff with Fixed Days

This is probably the most common scenario you'll come across, and thankfully, it's also the simplest to get right. When you have an employee who works the same number of days each week, you can figure out their pro rata holiday entitlement with one reliable formula. No need for complex spreadsheets—this gives you a clear and legally sound answer every time.

The whole calculation hinges on the UK statutory minimum of 5.6 weeks of paid leave. All you need to do is multiply the number of days your team member works each week by this figure.

The Formula: (Number of days worked per week) x 5.6 = Annual holiday entitlement in days.

Putting the Formula into Practice

Let's see how this plays out in the real world. Imagine you have a couple of part-time team members on different schedules.

Scenario 1: Maria works three days per week. Her calculation would be: 3 days x 5.6 = 16.8 days of holiday per year.

Scenario 2: David works two days per week. His calculation is: 2 days x 5.6 = 11.2 days of holiday per year.

It’s a straightforward multiplication that gives you the exact entitlement. But wait, there's one more crucial step that often gets missed, and it's absolutely vital for staying on the right side of UK employment law.

The Golden Rule of Rounding Up

You can’t actually give an employee a fraction of a day's holiday. UK law is very specific here: you must always round up to the next half or full day. You can never, ever round down.

Let's apply this rule to our examples:

- Maria’s 16.8 days must be rounded up to 17 days.

- David’s 11.2 days must be rounded up to 11.5 days.

This isn't just a courtesy; it's a legal requirement. Rounding down, even by a tiny fraction, means you're not giving the employee their full statutory minimum entitlement, which can easily lead to a dispute.

To save you grabbing a calculator every time, we've put together a handy reference table. It shows the correct, rounded-up holiday entitlement for the most common part-time work patterns.

Quick Reference Pro Rata Holiday Entitlement

This table gives you a simple guide to the statutory minimum holiday entitlement in days for part-time staff, based on the fixed number of days they work each week.

| Days Worked Per Week | Calculation (Days x 5.6) | Statutory Holiday Days (Rounded Up) |

|---|---|---|

| 1 Day | 1 x 5.6 = 5.6 days | 6 Days |

| 2 Days | 2 x 5.6 = 11.2 days | 11.5 Days |

| 3 Days | 3 x 5.6 = 16.8 days | 17 Days |

| 4 Days | 4 x 5.6 = 22.4 days | 22.5 Days |

| 5 Days | 5 x 5.6 = 28 days | 28 Days |

This method is the foundation of how to calculate pro rata holiday fairly and accurately. By sticking to this simple formula and always remembering the rounding-up rule, you can make sure every team member gets their correct allowance, keeping your processes transparent and compliant.

Navigating Bank Holidays for Part-Time Employees

Bank holidays can feel like a bit of a puzzle when you're managing part-time staff. It’s a common myth that everyone has an automatic right to a paid day off, but the reality is much simpler: it all comes down to what’s in the employee's contract.

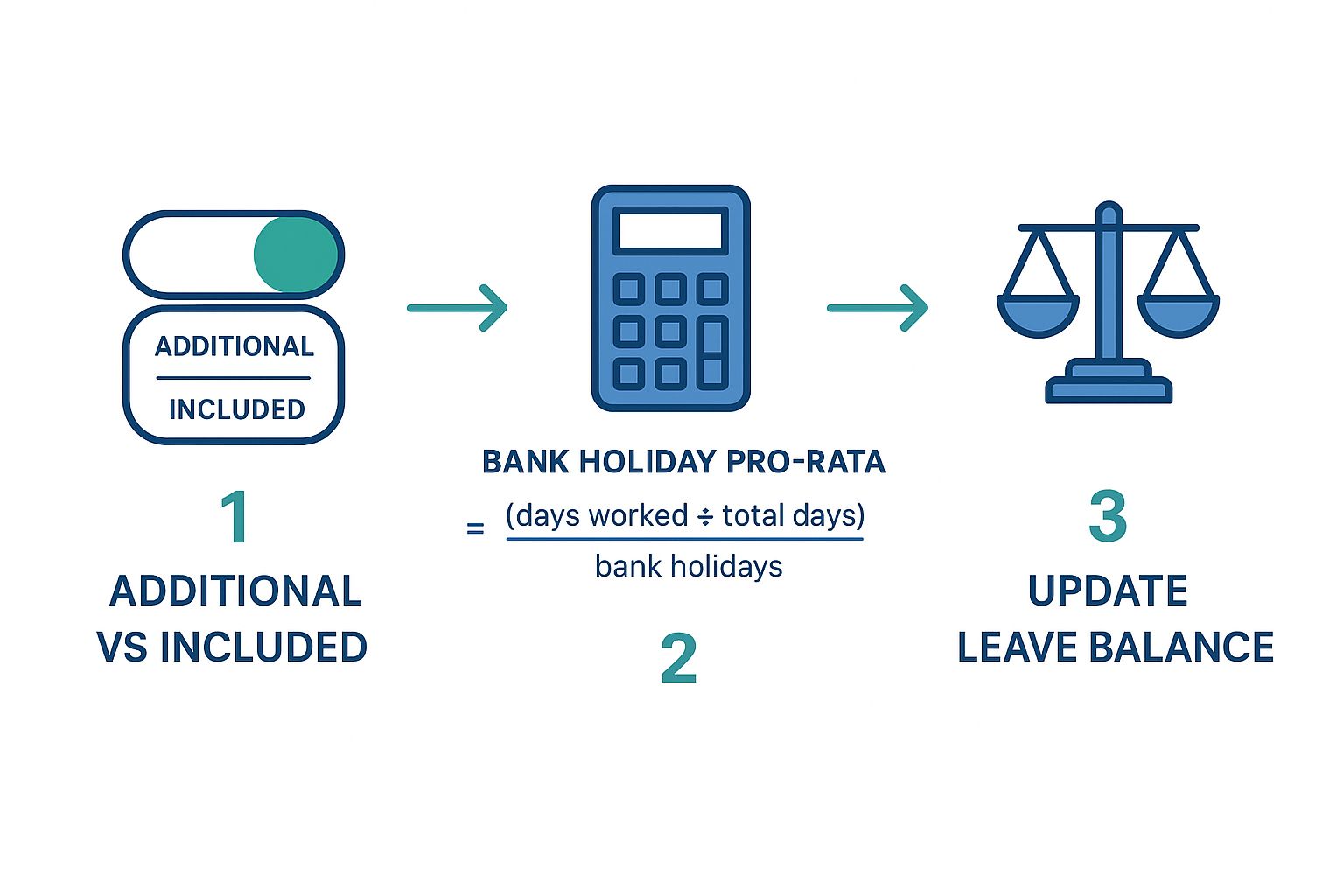

This flexibility generally leads employers down one of two paths. Some companies grant bank holidays in addition to the statutory 5.6 weeks of annual leave. Others, and this is more common, include the bank holidays within that total entitlement. Neither way is wrong, but consistency and clarity in your contracts are non-negotiable. The goal is always to make sure part-timers get a fair, proportional share of public holidays, no matter which days of the week they happen to work.

Calculating a Fair Share of Bank Holidays

To keep things fair, you need to calculate a pro rata entitlement for your part-time team members. This stops the unfair scenario where an employee who always works Mondays gets all the bank holidays off with pay, while someone working Wednesday to Friday gets none.

Thankfully, the calculation is pretty straightforward.

First, figure out the baseline for a full-time employee. In England and Wales, we typically have 8 bank holidays a year. A full-timer working 5 days a week gets all 8.

For a part-time employee, the formula is simple: (Number of days worked per week ÷ 5) x Number of bank holidays in the leave year

Let's take a real-world example. Imagine Chloe works three days a week. Her entitlement would be calculated like this:

(3 ÷ 5) x 8 = 4.8 bank holidays.

This infographic breaks down the process visually, from setting your policy to updating leave balances.

Following this flow ensures you’re being consistent and fair every single time, which is exactly what you want.

Putting It All Together in a Real-World Scenario

Once you have that pro rata figure, managing their leave becomes much clearer. When a bank holiday falls on one of Chloe's normal working days (let’s say a Monday), one day is simply deducted from her 4.8-day bank holiday pot. If a bank holiday lands on a day she doesn't usually work, her allowance is untouched.

What happens at the end of the year? If any of her 4.8 days are left over, she can take them as extra annual leave. On the flip side, if more bank holidays happened to fall on her working days than she had in her allowance (say, 6 of them), the difference is just deducted from her main holiday pot.

UK law is particularly clear on this: while employers can include bank holidays within the 28-day statutory minimum, they don't have to. For a part-timer working three days a week, their total entitlement would be 16.8 days. This could be made up of their 4.8 pro rata bank holidays, leaving 12 days of ‘ordinary’ leave. You can discover more insights on UK holiday allowances and how they compare.

This method guarantees no one is penalised or gets an unfair advantage because of their work schedule. It's a cornerstone of calculating pro rata holiday fairly and is absolutely essential for keeping your leave policies transparent and legally sound for the whole team.

Calculating Leave for Irregular Hours and Variable Shifts

Things get a bit more complicated when an employee’s hours change from week to week. For casual staff, zero-hour contract workers, or anyone on a variable shift pattern, you can't just use a fixed-day calculation. The law requires a different approach to make sure their holiday entitlement is fair and proportional to the time they’ve actually put in.

The go-to method here is to work out their holiday entitlement as a percentage of the hours they've worked. The magic number you need to remember is 12.07%. It might look a bit random, but there’s a solid reason behind it.

Where Does 12.07% Come From?

This figure comes directly from the statutory holiday entitlement. A standard working year is 52 weeks, but UK law grants everyone 5.6 weeks of paid holiday. That means the average person actually works for 46.4 weeks of the year (52 - 5.6 = 46.4).

To get the percentage, you just divide the holiday weeks by the working weeks:

(5.6 holiday weeks ÷ 46.4 working weeks) x 100 = 12.07%

Using this percentage ensures that for every single hour someone works, they accrue the correct slice of holiday time. It's a tried-and-tested method, but it’s always worth understanding the full specifics of holiday entitlement on a zero-hour contract to get the complete picture.

Putting the Percentage Method into Practice

Let's walk through a real-world example. Imagine you have a casual team member, Alex, who sends you a timesheet at the end of every month.

- In May, Alex worked a total of 75 hours.

- To figure out his accrued holiday, you multiply his hours by the percentage: 75 hours x 12.07% = 9.05 hours of holiday earned.

You simply repeat this calculation for each pay period. When Alex wants to take a day off, you just deduct the number of hours he would have worked that day from his running total.

It's absolutely crucial to track these hours meticulously. Keeping a running total of accrued holiday is the only way to accurately manage leave for workers on irregular patterns and stay fully compliant.

A Quick Note on Rolled-Up Holiday Pay

You might have come across the term "rolled-up" holiday pay. This is where an employer adds an extra 12.07% onto a worker's hourly pay instead of paying them when they actually take time off. For a long time, this was unlawful because it could discourage people from taking the rest they're entitled to.

However, things have recently changed. For leave years starting on or after 1st April 2024, rolled-up holiday pay is now allowed for irregular-hour and part-year workers. If you decide to go this route, you must:

- Show the holiday pay portion as a completely separate item on their payslip.

- Make sure the rate is the correct 12.07%.

Even though it’s now legal in these specific cases, the standard accrual method is still what we’d recommend for most employers. It does a much better job of encouraging a healthy work-life balance by ensuring your team actually takes their paid time off to rest and recharge.

Handling Calculations for New Starters and Leavers

It’s pretty rare for an employee’s start or end date to line up perfectly with your holiday year. This is where pro rata calculations become an everyday task, and getting them right is key to being fair, compliant, and starting or ending things on the right foot.

The logic is simple: an employee’s holiday entitlement should match the proportion of the holiday year they’ve actually worked for you. This stops a new joiner from getting a full year's holiday for just a few months of work, and it makes sure leavers are paid for any time off they’ve earned but haven’t used.

Calculating Entitlement for New Starters

When someone joins your team part-way through the leave year, you need to figure out their holiday allowance from their first day until the year wraps up.

The formula is pretty straightforward and is based on months of service:

(Full annual entitlement ÷ 12) x Number of months remaining in the holiday year

Let’s run through a quick example. Say your company's holiday year is January to December. A new full-time employee, who gets 28 days a year, starts on 1st October. That leaves three months in the year: October, November, and December.

Here's the calculation:

(28 days ÷ 12) x 3 months = 7 days

Simple as that. Your new starter is entitled to 7 days of holiday for the rest of that year.

Managing Holiday for Leavers

The process for someone leaving is much the same, but instead of looking forward, you’re looking back at the time they've already worked. You need to calculate the holiday they've accrued right up to their last day.

The formula is a mirror image of the one for starters:

(Full annual entitlement ÷ 12) x Number of months worked in the holiday year

Picture this: a full-time employee hands in their notice and their last day is 31st March. They've worked three full months of the holiday year.

Their accrued holiday would be:

(28 days ÷ 12) x 3 months = 7 days

This number is crucial for their final paycheque. If this person has taken less than their accrued 7 days, you owe them payment for the untaken leave. If they’ve taken more, you can usually deduct the excess from their final salary—but only if this is clearly spelled out in their employment contract.

Sorting these exit calculations correctly is vital for a smooth offboarding process. If you want to dig deeper into the specific rules and what employees are entitled to, check out our detailed guide on holiday entitlement when leaving a job. It’s a great way to sidestep payroll headaches and potential disputes down the line.

Your Pro Rata Holiday Questions Answered

Even when you've got the formulas down, a few tricky situations always seem to pop up. It’s one thing to know the maths, but applying it to real-world scenarios is where things can get complicated.

Over the years, I've seen the same questions come up time and again from both managers and their teams. Here are the most common ones, with some clear, straightforward answers to help you handle any situation with confidence.

Do We Have to Round Up Holiday Entitlement?

Yes, you absolutely do. This is a non-negotiable part of UK employment law. You must always round holiday entitlement up to the next half or full day. Rounding down is never an option.

For instance, if your calculation spits out a number like 16.8 days of annual leave, that employee is legally entitled to 17 days. If it's 11.2 days, you need to round it up to 11.5 days. This is a hard and fast rule designed to make sure everyone receives their full statutory minimum leave, and getting it wrong can easily lead to disputes.

What Happens if an Employee Changes Their Working Pattern?

This is a classic one. If an employee’s hours or days change part-way through the year—maybe due to a promotion or a flexible working request—you'll need to recalculate their holiday entitlement. A common mistake is just applying the new pro rata calculation to the entire year, but that won't give you an accurate figure.

The right way to handle this is with a two-part calculation:

- First, work out the holiday they earned on their old contract, up to the date of the change.

- Then, calculate the holiday they'll earn for the rest of the year on their new contract.

Add those two numbers together, and you've got their new, correct total for the year. It's crucial to document this change and let the employee know what their updated entitlement is. A quick email confirming the new figure can prevent a lot of confusion down the line.

This approach ensures that the employee’s holiday for the year is a true reflection of the hours they’ve actually worked. It’s the fairest way to handle promotions, role changes, or requests for more flexible working arrangements.

How Is Pro Rata Holiday Calculated for Term-Time Workers?

Term-time workers often cause a bit of head-scratching, but they are still entitled to the full 5.6 weeks of statutory paid holiday like any other employee. The main difference is that they have to take this leave during school holidays or other non-term periods.

Their holiday pay is worked out based on the number of weeks they're contracted to work. You calculate their total pay for the working weeks, then add the holiday pay (for the 5.6 weeks) on top. This total amount is often spread out into 12 equal monthly payments. This gives them a consistent salary throughout the year, even when they aren't working.

Managing these calculations manually can be a real headache, especially when things change. It's time-consuming and far too easy for errors to creep in. Leavetrack automates the entire process for you, from accruals for new starters to complex recalculations for changing work patterns. See how much time you could save by visiting https://leavetrackapp.com.