How Many Working Hours in a Month A UK Guide

Posted by Robin on 21 Dec, 2025 in

On average, a full-time employee in the UK works somewhere between 158 and 173 hours a month.

This isn't a random guess; it's a straightforward calculation based on a standard working week. By multiplying the typical contracted hours (usually 37.5 or 40) by 4.33—the average number of weeks in a month—you get a solid baseline figure. It’s the kind of number every HR manager or team lead needs for accurate payroll and resource planning.

Your Quick Guide to UK Monthly Working Hours

Getting a handle on monthly working hours is fundamental. It's the bedrock of accurate payroll, fair project allocation, and staying on the right side of the law. While the basic maths is simple enough, the final number can shift depending on all sorts of factors, from public holidays to overtime.

Before you even start crunching the numbers, it's vital to be clear on what legally constitutes working time for minimum wage purposes. Getting this right from the outset ensures your calculations are built on a compliant, solid foundation.

The Standard Calculation Explained

So, where does that 4.33 figure come from? It's the industry-standard way to average out the weeks in a month (52 weeks / 12 months = 4.333...). Using this multiplier creates a consistent monthly figure for salaried staff whose pay doesn't change, whether a month has 20 working days or 23. That kind of consistency is a lifesaver for budgeting and financial forecasting.

In the UK, the average full-time employee puts in about 36.5 hours per week. Run that through our standard multiplier, and you land at roughly 158 hours per month. That's your starting point before you factor in deductions for annual leave or additions for overtime.

Key Takeaway: The 4.33 multiplier isn't just an arbitrary number; it's the key to turning weekly hours into a consistent monthly average. This simple trick smooths out the peaks and troughs between shorter months like February and longer ones like July, making payroll wonderfully predictable.

Quick Reference for Common Schedules

To make things even easier, here's a quick look at how different weekly contracts translate into average monthly hours. Think of this table as a handy cheat sheet for HR managers and team leads.

Average Monthly Working Hours by Weekly Schedule

This table provides a quick reference for calculating monthly working hours based on common weekly hour contracts in the UK, using the standard 4.33 weeks per month multiplier.

| Weekly Contracted Hours | Calculation (Hours x 4.33) | Average Monthly Hours |

|---|---|---|

| 40 Hours (Full-Time) | 40 x 4.33 | 173.2 |

| 37.5 Hours (Full-Time) | 37.5 x 4.33 | 162.4 |

| 30 Hours (Part-Time) | 30 x 4.33 | 129.9 |

| 20 Hours (Part-Time) | 20 x 4.33 | 86.6 |

Remember, these numbers represent the gross working hours. For the full picture, you also need to understand the number of workdays, which is a closely related but different metric. If you’re interested, we’ve put together a guide on how many working days are in a month in the UK.

Calculating Hours for Full-Time Employees

Getting a handle on your monthly hour calculations starts with establishing a solid baseline for your full-time staff. It sounds straightforward, but this is where payroll confusion often begins. While there's a standard formula, the devil is always in the detail of your employment contracts.

In the UK, the two most common full-time contracts you’ll see are for 40 hours and 37.5 hours a week. That small difference adds up. A 40-hour week averages out to 173.2 hours a month, while a 37.5-hour week comes in at 162.4 hours. That’s a gap of nearly 11 hours per employee, every single month—a perfect example of why nailing the contractual figure is so critical for accurate payroll and resource planning.

The Critical Role of Unpaid Breaks

One of the most common tripwires I see when it comes to calculating working hours is the mishandling of unpaid breaks. It’s an easy mistake to make. An employee might be on-site for 40 hours, but if they take a one-hour unpaid lunch break each day, you're only paying them for a 35-hour week. Your calculations must reflect paid, productive time only.

Here’s how to get it right every time:

- Go Back to the Contract: The employee’s contract is your single source of truth. It should spell out their total weekly hours and explicitly state whether breaks are paid or unpaid. Always start there.

- Deduct Breaks First: Before you even think about multiplying by 4.33, subtract any unpaid breaks from the weekly total. For someone on-site from 9 am to 5 pm (an 8-hour day), a 30-minute unpaid lunch makes it a 7.5-hour paid day. That’s a 37.5-hour week.

- Be Consistent: Apply the same logic across all your full-time staff. This isn’t just about compliance; it's about fairness and maintaining good employee morale. Inconsistencies will always cause friction.

Worked Examples for Clarity

Let’s put this into practice. Imagine you have two full-timers, Alex and Ben, both working Monday to Friday. Their contracts, however, are slightly different.

Alex's Contract (40 Hours)

- Weekly Hours: 40 paid hours per week.

- Monthly Calculation: 40 hours × 4.33 weeks = 173.2 average monthly hours.

- Scenario: Alex’s role might not have a fixed unpaid lunch, or perhaps their shorter breaks are paid as part of their contractual agreement.

Ben's Contract (37.5 Hours)

- Weekly Hours: 37.5 paid hours per week.

- Monthly Calculation: 37.5 hours × 4.33 weeks = 162.4 average monthly hours.

- Scenario: Ben has a classic 9:00 am to 5:30 pm schedule but takes a daily one-hour unpaid lunch break.

Payroll Insight: The distinction between on-site time and paid working time is absolutely fundamental. If you don't exclude unpaid breaks from your calculations, you risk overpaying staff, inflating your wage bill, and creating compliance headaches down the line.

Getting this baseline calculation spot-on for your full-time team is the foundation. Once you have this number locked in, you can move on to accurately adjusting for variables like annual leave, bank holidays, and overtime.

Navigating Part-Time and Variable Hour Calculations

The standard full-time calculation is a tidy baseline, but let's be honest, the modern workforce is far more complex. For many businesses, part-time staff, zero-hour contracts, and fluctuating rotas are the norm. This is where things get a bit more detailed.

Calculating monthly working hours suddenly shifts from simple multiplication to a more nuanced process that demands real attention to detail. Getting this right isn't just about running payroll; it's a matter of legal compliance and, just as importantly, employee trust. Miscalculate hours for someone on a variable contract, and you're looking at incorrect pay, damaged morale, and the potential for messy disputes.

The key is to ditch the one-size-fits-all approach. You need methods that are tailored to each specific working arrangement.

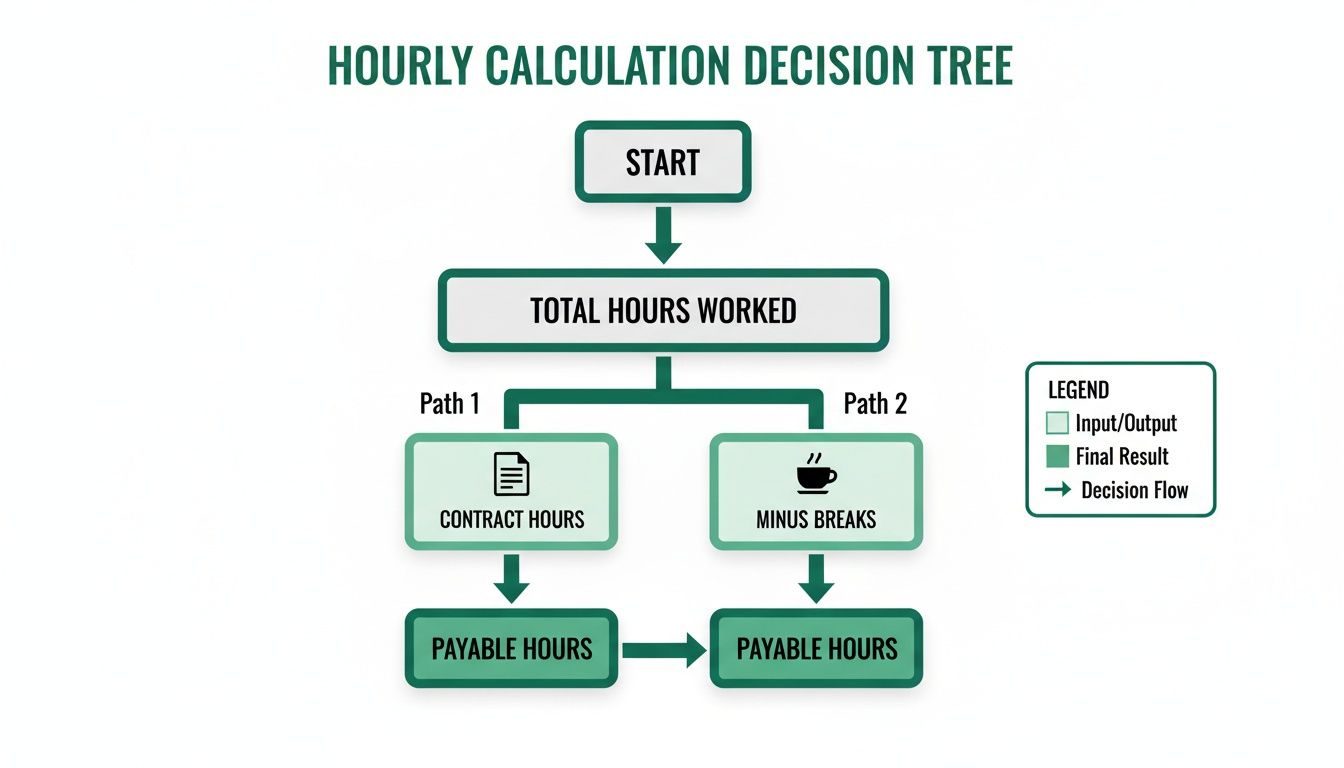

This decision tree shows a simple way to approach hour calculations, starting with the contract and making sure breaks are correctly deducted.

As the visual shows, the employment contract is always your starting point. From there, the crucial step is subtracting any unpaid breaks to land on the correct number of payable hours.

Tackling Part-Time Schedules

For part-time employees on a fixed schedule—say, someone who works three set days a week—the calculation is a straightforward twist on the full-time method. Instead of a 40-hour week, you might be working with a 24-hour week (3 days x 8 hours).

The formula itself stays the same:

24 hours per week × 4.33 weeks = 103.92 average monthly hours

This gives you a reliable figure for salaried part-time staff, ensuring their pay is consistent each month, no matter how many days are actually in it.

Managing Zero-Hour and Fluctuating Contracts

Zero-hour contracts and variable rotas are a different beast entirely. Since there are no guaranteed hours, the whole idea of a monthly "average" becomes pretty much redundant for payroll purposes. For these employees, you have to move from forecasting to a purely retrospective calculation.

Crucial Distinction: For variable-hour employees, payroll must be based on the actual hours worked in a specific pay period. The focus shifts from calculating an average to meticulously tracking and summing up every single hour clocked.

This makes a robust time-tracking system absolutely essential, as you're no longer relying on a contractual number. The calculation becomes a simple addition exercise at the end of the month:

- Week 1: 18 hours worked

- Week 2: 25 hours worked

- Week 3: 12 hours worked

- Week 4: 21 hours worked

In this scenario, the total payable hours for that month would be 76. This method ensures pay is directly and transparently linked to the work performed, which is a legal requirement for these types of contracts. Accuracy here is completely non-negotiable.

Adjusting for Annual Leave and Public Holidays

Simply calculating hours from a contract is only half the story. The reality on the ground is that an employee’s actual working time is always shifting, thanks to annual leave, sick days, and bank holidays. These aren't just minor details to gloss over; they are vital pieces of the puzzle for accurate payroll and sensible resource planning.

A standard month’s hours can drop significantly, especially during peak holiday seasons. Just think about August, when half the team seems to be on a beach, or December, with its string of bank holidays and festive time off. If you ignore these deductions, you’re setting yourself up for overpaying staff and completely misjudging your team's capacity.

Deducting Leave and Public Holidays

Adjusting for absences really just boils down to simple subtraction. The first thing you need is the employee's daily working hours. For someone on a standard 37.5-hour week, that’s usually 7.5 hours per day (37.5 hours ÷ 5 days).

Let's walk through a common scenario. Say an employee takes five days of annual leave in a month that has 22 working days.

- Standard Monthly Hours: 22 days × 7.5 hours/day = 165 hours

- Leave Deduction: 5 days × 7.5 hours/day = 37.5 hours

- Adjusted Monthly Hours: 165 hours - 37.5 hours = 127.5 hours

You need to apply this same logic for every kind of absence, whether it’s a pre-booked holiday, an unexpected sick day, or a public holiday. Looking at the bigger picture, UK full-time employees work an average of 1,867 hours a year. That works out to roughly 155.6 hours per month. Understanding how leave chips away at this average is key for accurate forecasting all year round.

Pro-Rata Calculations for Part-Time Staff

Things get a little more complex with part-time employees, especially when it comes to bank holidays. Most of them fall on a Monday, which isn't fair to a part-timer who doesn't work Mondays. To keep things equitable, their entire holiday entitlement, including bank holidays, is calculated on a pro-rata basis.

For instance, an employee working three days a week is entitled to 60% of the full-time holiday allowance. This total pot of leave is then used to cover any bank holidays that fall on their usual working days, as well as any other annual leave they decide to take.

HR Tip: Always calculate a part-time employee's total annual leave entitlement first (including their pro-rata bank holiday allowance). From there, you can deduct hours for any leave or public holidays from their monthly total. It's the only way to ensure fairness and stay compliant.

Juggling these entitlements can feel complicated, but it's a legal must-do. For a proper deep dive into the rules, our ultimate guide to UK statutory holiday allowance has all the detailed explanations you'll need. Making precise deductions for all types of leave isn't just good practice—it's non-negotiable for accurate payroll and keeping your employees' trust.

Factoring in Overtime and Its Payroll Impact

Your employee's contract hours are the baseline, but let's be honest—overtime is the wildcard that can really skew the total hours worked in a month. It’s a reality in many industries, but it’s also one of the most common causes of payroll headaches.

Getting overtime wrong isn't just about miscalculating pay. It can quickly spiral into compliance nightmares and seriously damage team morale.

Not all overtime is the same, either. The first step to getting your calculations right is knowing exactly what you’re dealing with.

- Paid Overtime: This is the most common arrangement. Any hours worked beyond the contract are paid, usually at an enhanced rate like time-and-a-half or even double time.

- Unpaid Overtime: While you might see this in some salaried roles, there's an expectation that extra hours might be needed without extra pay. Be careful here, though—this must always comply with minimum wage laws.

- Time Off in Lieu (TOIL): Instead of cash, employees get their overtime hours back as paid time off to use later. It’s a popular option for balancing workloads without inflating the wage bill.

Pinning down these monthly working hours is the foundation of effective payroll management. Every extra minute needs to be accounted for and compensated correctly.

Calculating Overtime Pay

Let’s walk through a real-world example. Say you have an employee, Sarah, who works a standard 37.5-hour week and earns £15 per hour. This month, a big project required her to put in an extra 10 hours. Her contract states overtime is paid at time-and-a-half, which works out to £22.50 per hour.

Here’s how you’d break it down:

- Standard Monthly Hours: 37.5 hours/week × 4.33 weeks = 162.4 hours

- Total Hours Worked: 162.4 standard hours + 10 overtime hours = 172.4 hours

- Standard Pay: 162.4 hours × £15/hour = £2,436

- Overtime Pay: 10 hours × £22.50/hour = £225

- Total Gross Pay for the Month: £2,436 + £225 = £2,661

This careful approach makes sure Sarah is rewarded fairly for going the extra mile, and your payroll records stay clean and accurate.

Staying Compliant with UK Regulations

Overtime is a useful lever for managing busy periods, but it comes with strict rules attached. In the UK, the Working Time Regulations 1998 generally limit the average working week to 48 hours, calculated over a 17-week reference period.

An employee can choose to sign an opt-out agreement to work more, but you can never make this a condition of their employment.

The Office for National Statistics pegs average actual weekly hours for full-time UK workers at 36.6 hours for August-October 2025. This yields about 158.5 monthly hours using the 4.33-week factor. While the 48-hour cap is law, a 13% opt-out rate pushes some employees' totals higher.

That's why meticulous tracking of all hours—including every bit of overtime—isn't just good practice for accurate payroll. It's a legal must-have to keep you on the right side of these important regulations.

How HR Software Can Streamline Your Calculations

Let's be honest: wrestling with spreadsheets to calculate working hours is a recipe for disaster. It's not just slow; it’s an open invitation for costly mistakes. A single typo in a formula or a misplaced number can throw off an entire payroll run, leading to incorrect pay, compliance headaches, and seriously frustrated employees. That administrative headache is time your team could be spending on strategic work that actually moves the needle.

This is where shifting to modern HR software can be a complete game-changer. These tools are built from the ground up to handle all the fiddly complexities of calculating working hours automatically.

As you can see, a clean, simple dashboard gives you an instant and accurate overview of monthly hours—no manual number-crunching required. This kind of visual clarity makes it so much easier to spot trends and manage your team's capacity.

Key Benefits of Automation

Instead of getting bogged down in spreadsheets, think about what the right software brings to the table:

- Improved Accuracy: Automated systems pull data directly from employee records and digital timesheets. This eliminates human error and ensures every single calculation is spot-on.

- Time Savings: What used to take hours of painstaking manual work can now be done in minutes. That’s precious time your HR team gets back for higher-value activities.

- Seamless Integration: Most modern HR tools are designed to talk to your payroll software, making the entire process from tracking hours to paying your team incredibly smooth and error-free.

By automating these calculations, you're not just saving time—you're building a more reliable and transparent system. That accuracy is absolutely fundamental for maintaining employee trust and making sure your business stays compliant with UK working time regulations.

Tools like a dedicated employee leave management system are a perfect example. They automatically adjust monthly totals for any approved absence, taking yet another manual step off your plate.

Common Questions About Calculating Working Hours

Even with the formulas laid out, it’s completely normal to have a few questions lingering. When you’re dealing with something as critical as payroll, getting it right is everything—it’s always better to clear up any confusion before it spirals into a bigger issue.

Let’s run through some of the most common queries we hear from HR professionals and team managers. These are the little details that often trip people up, but nailing them ensures your process is fair, compliant, and transparent for everyone involved.

Salaried Versus Hourly Calculations

One of the first questions that always comes up is how the maths differs for salaried versus hourly staff. It's a fundamental split in how you approach payroll.

For a salaried employee, you’ll typically lean on the 4.33 weeks per month average. This simple trick keeps their pay consistent, regardless of whether a month has 28 or 31 days. It’s all about smoothing out the payroll process for easier budgeting and predictability.

It's a different story for an hourly employee. You must pay them for every single hour they've worked, period. Their monthly total is a straightforward sum of the hours they clocked in that specific pay period. The idea of an "average" month doesn't really apply here; their pay is a direct reflection of their actual time on the job.

Key Takeaway: The fundamental difference is consistency versus reality. Salaried pay is based on a consistent average for predictability, while hourly pay is based on the precise reality of hours worked in that specific month.

How Do Leap Years Affect Annual Hours?

Another great question we get is about leap years. It might feel like a tiny detail, but that extra day every four years definitely adds up and affects the annual total. A standard year has 365 days, but a leap year has 366.

That extra day adds roughly 8 working hours to the annual total for a full-time employee. While it won't drastically alter your average monthly hours calculation, it's a key factor for precise annual salary figures and resource planning, especially if you're in a project-based industry where every hour counts.

Best Practices for Communicating Hours

Calculating hours correctly is only half the battle; communicating them clearly is just as vital. You need to make sure your employment contracts are crystal clear from the start.

Always ensure the contract explicitly states:

- The total number of contracted weekly hours.

- Whether break times are paid or unpaid (a common point of confusion!).

- The company's policy on overtime and how it is compensated.

This kind of transparency heads off disputes before they can even start. It makes sure everyone understands exactly what's expected of them and helps build a relationship based on trust and clarity right from day one.

Ready to stop wrestling with spreadsheets and endless manual calculations? Leavetrack automates your entire absence management process, from holiday requests to sickness tracking, ensuring your monthly working hour data is always accurate and up-to-date. Discover a simpler way to manage leave at https://leavetrackapp.com.