How to work out holiday entitlement: A UK guide

Posted by Robin on 01 Jan, 2026 in

Before you can work out holiday entitlement for your team, you need to know the UK statutory baseline: 5.6 weeks of paid holiday per year. It's the magic number that everything else flows from.

For a typical employee working five days a week, this translates to 28 days of annual leave. Whether that includes bank holidays or not comes down to what's written in their contract.

Understanding UK Holiday Entitlement Rules

Navigating the rules around annual leave can feel a bit tangled, but the core principle is actually quite simple. The government sets a legal minimum to ensure every worker gets enough paid time off, no matter how they're scheduled to work. Getting this right is fundamental to staying compliant and, just as importantly, treating your people fairly.

The statutory minimum is set in stone at 5.6 weeks of paid annual leave each year. This rule, laid out in the Working Time Regulations, covers nearly everyone—from agency staff to those on zero-hours contracts. You can choose to include the usual eight bank holidays within that total, but the entitlement itself is non-negotiable. If you want to dive deeper, you can find more insights about UK annual leave entitlement to ensure your policies are watertight.

What this means in practice is that every worker is building up their right to paid leave as they work. The key is applying that 5.6-week rule proportionally to their specific schedule.

The Foundation of Fair Calculation

Once you've got your head around this baseline, you're halfway there. It's not a rigid, one-size-fits-all number but a flexible standard that adapts to different work patterns.

For example:

- Pro-rata Calculations: For your part-time staff, their entitlement is simply a proportion of the full-time equivalent.

- Accrual System: For those with irregular hours, leave is earned as they go, often calculated using a percentage method.

One of the most common mistakes I see is employers getting tripped up on bank holidays. There's no automatic legal right for an employee to have bank holidays off; it all comes down to what's in their employment contract. How you word this clause can make a big difference to their total leave.

To give you a clearer picture, here’s a quick-reference table that breaks down the statutory minimum entitlement based on common work patterns. It shows exactly how the 5.6-week rule plays out in the real world.

UK Statutory Holiday Entitlement at a Glance

This table provides a quick reference for the minimum legal holiday entitlement based on the number of days worked per week.

| Days Worked per Week | Calculation (Days x 5.6 Weeks) | Minimum Holiday Days per Year |

|---|---|---|

| 5 Days | 5 x 5.6 | 28 Days |

| 4 Days | 4 x 5.6 | 22.4 Days |

| 3 Days | 3 x 5.6 | 16.8 Days |

| 2 Days | 2 x 5.6 | 11.2 Days |

| 1 Day | 1 x 5.6 | 5.6 Days |

As you can see, the calculation is straightforward. The complexity comes when dealing with different contract types and hours, which we'll dive into next.

Figuring Out Holiday for Your Full-Time and Part-Time People

Let's get down to the brass tacks of holiday calculations for your most common types of staff. Getting this right is about being fair, consistent, and—most importantly—legally compliant, whether someone is full-time or only works a couple of days a week.

While the calculation for a full-timer is pretty straightforward, it's the part-time maths that often trips businesses up. Nailing these figures from the start is the best way to prevent disputes and make sure everyone gets the time off they're legally entitled to.

The Full-Time Employee Calculation

For a full-time team member working a standard five-day week, the calculation is thankfully simple. You just multiply the number of days they work each week by the statutory entitlement of 5.6 weeks.

- Calculation: 5 days × 5.6 weeks = 28 days of paid holiday per year.

This 28-day figure is the statutory maximum, so you don't need to cap it. It effectively serves as the baseline from which all other pro-rata calculations are built.

Working Out Part-Time Holiday Entitlement

This is where things can feel a bit more complex, but the core principle is exactly the same. A part-time employee is entitled to a proportional slice of the full-time allowance, which is known as pro-rata holiday entitlement.

You use the very same formula—just swap in the number of days the part-time person works.

Let's walk through a common scenario. Imagine you have an employee, Sarah, who works a consistent schedule of three days every week.

- Calculation: 3 days × 5.6 weeks = 16.8 days of paid holiday per year.

Now, this is where a critical rule kicks in: you must always round partial day entitlements up to the nearest half or full day. You can never, ever round them down.

For Sarah, her 16.8 days of leave must be rounded up to 17 days. Rounding down to 16.5 or even 16 would leave your business non-compliant and short-change your employee.

This isn't just good practice; it's a non-negotiable part of UK employment law. If you want to dig deeper into the specifics, our comprehensive guide on how to calculate pro-rata holiday entitlement has more examples and clarifies best practices.

Shifting from Days to Hours for More Flexibility

What happens when your part-timer works varied hours each day? Calculating their leave in "days" can quickly become messy and unfair. If their day off falls on a long shift, they use one day of leave for more hours than if it fell on a short one. It just doesn't add up.

The solution is to switch gears and convert their annual entitlement from days into hours. This brings total fairness to the table, as leave is simply deducted based on the exact duration of the absence.

First, work out their total holiday entitlement in days just like we did before. Let's take another team member, David, who works four days a week but with different hours each day.

- Calculate Annual Leave in Days: 4 days × 5.6 weeks = 22.4 days.

- Round It Up: This becomes 22.5 days, as we have to round up to the next half day.

- Find the Average Day Length: Let's say David is contracted to work 30 hours a week over his four days. His average working day is therefore 7.5 hours (30 hours ÷ 4 days).

- Convert Days to Hours: Now, multiply his entitlement in days by his average day length.

- Calculation: 22.5 days × 7.5 hours = 168.75 hours of paid holiday per year.

By calculating in hours, it suddenly doesn't matter if David takes off a four-hour shift or a ten-hour one. The correct amount is just deducted from his hourly balance. This approach gives you the accuracy you need for anyone not working a classic 9-to-5 pattern.

Handling Complex Calculations for Irregular Hours

This is where things can get a bit fiddly. Dealing with zero-hours contracts and staff on variable schedules is where most businesses find working out holiday entitlement becomes genuinely complex. For people whose hours change from one week to the next, a fixed allowance in days or hours just doesn't cut it. Their holiday entitlement has to be earned—or accrued—as they work.

This is where the percentage method comes in. It’s a fair, legally compliant way to manage leave for your most flexible team members. While it might sound technical, the logic behind it is pretty straightforward. It ensures everyone gets their fair share of paid time off, directly proportional to the hours they’ve actually worked.

The 12.07 Percent Accrual Method Explained

For workers with irregular hours, the standard way to calculate their holiday entitlement is at a rate of 12.07% of the hours they’ve worked. That figure isn’t just plucked out of thin air; it’s derived directly from the statutory 5.6 weeks of leave.

Here’s the simple maths behind it:

- There are 52 weeks in a year.

- Statutory holiday is 5.6 weeks, which leaves 46.4 working weeks (52 - 5.6).

- To find the percentage, you just divide the holiday weeks by the working weeks: (5.6 ÷ 46.4) x 100 = 12.07%.

This means for every hour an employee works, they earn just over seven minutes of paid leave. It’s a continuous accrual system that keeps everything proportional and above board.

Let’s see it in action. Imagine someone on a zero-hours contract works a total of 80 hours in a month. To figure out their accrued holiday, you simply apply the percentage.

- Calculation: 80 hours worked × 12.07% = 9.656 hours of holiday accrued.

As with all holiday calculations, it’s best practice to round this up. So, in this case, the employee has earned 9.66 hours of paid leave for that period, which can be added to their running total. This method removes the guesswork and keeps you compliant. If you need more examples, our guide to using a UK holiday calculator breaks these kinds of calculations down further.

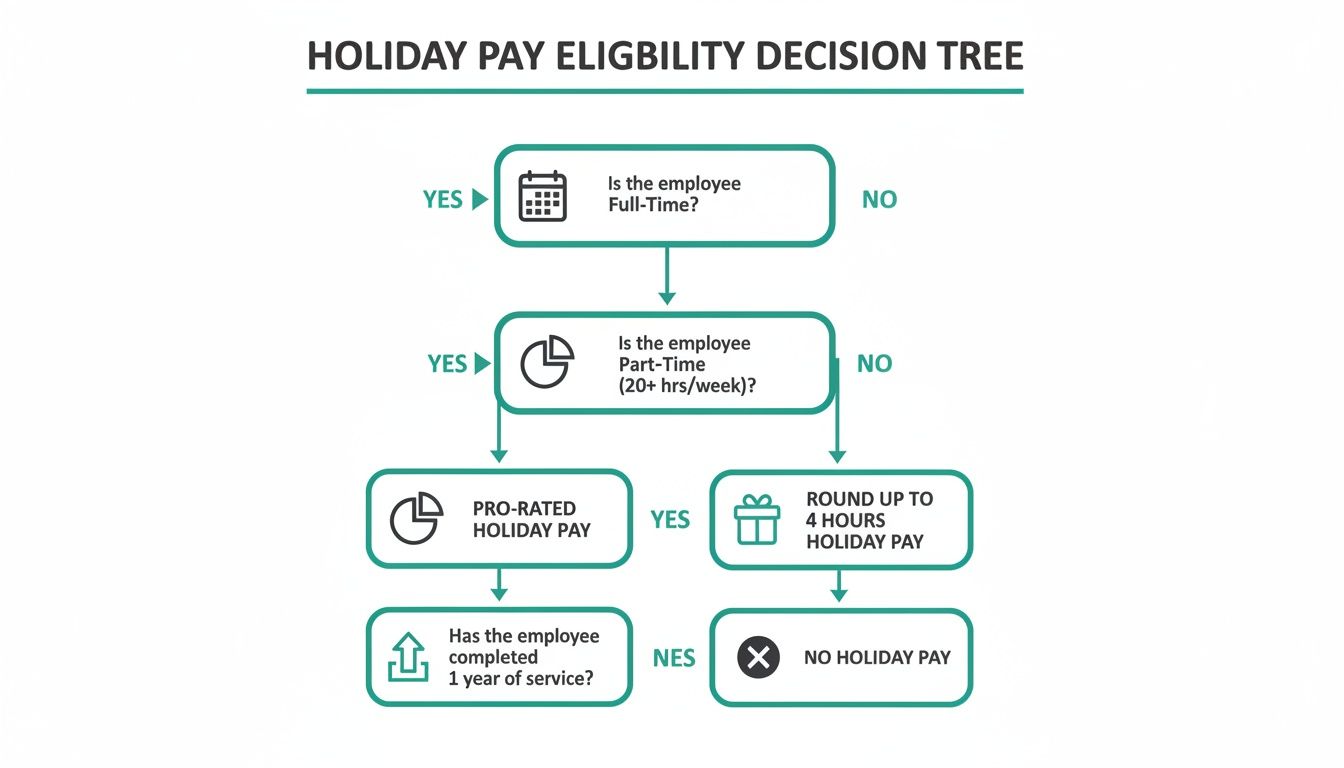

This decision tree gives you a simplified flow for determining how to approach holiday calculations based on different work patterns.

As the visual shows, the calculation method depends entirely on the employee's work schedule. It really reinforces the need for different approaches for fixed versus variable hours.

When to Use the 52-Week Reference Period

While the 12.07% method is perfect for calculating how much holiday is accrued, you need a different approach to work out how much to pay an employee for that time off. This is especially true for workers whose pay varies from week to week.

For this, the government specifies using a 52-week reference period. The whole point is to calculate an average weekly pay based on the last 52 weeks in which the employee actually earned money.

It's a crucial distinction: the 12.07% accrual method determines the amount of time off an employee earns, whereas the 52-week reference period determines the rate of pay for that time off. Confusing the two is a common pitfall.

To calculate their holiday pay, you need to:

- Look back over the previous 52 weeks from the date the holiday starts.

- Completely ignore any weeks where the employee didn't receive any pay.

- If you have to discount some weeks, you must go back further to find a total of 52 weeks of pay data (up to a maximum of 104 weeks).

- Once you have 52 weeks of pay data, calculate the average weekly pay. This average figure is what you pay them for a week of their holiday.

This system ensures their holiday pay accurately reflects what they typically earn, including any overtime or commission. It stops them from being financially disadvantaged just for taking time off. Properly applying both the accrual and payment calculation methods is essential for managing your flexible workforce fairly and staying on the right side of the law.

Managing Holiday for New Starters and Leavers

Handling employee transitions, whether it's a new face joining the team or a familiar one moving on, demands some careful maths to keep everything fair and legally watertight. When you’re working out holiday entitlement for starters and leavers, getting it spot on is crucial to avoid payroll headaches and potential disputes down the line. It's a fundamental part of both good onboarding and a smooth offboarding process.

For new starters, clearly explaining their holiday entitlement is a key part of making them feel welcome. This is one of those early interactions that sets the tone, and getting the calculations right from day one shows you're organised and fair. Some companies are even using tools like an AI for employee onboarding to deliver this kind of essential information consistently.

Calculating Holiday for New Employees

When a new team member joins part-way through your company's leave year, their holiday entitlement needs to be calculated on a pro-rata basis. It’s pretty simple – they get a proportion of the full annual leave allowance, based on how much of the year they'll actually be with you.

The calculation itself is straightforward. Just divide the total annual entitlement by 12, then multiply that number by how many months the new starter will work in that leave year.

Let’s take a common scenario. Imagine your leave year runs from January to December, and a new full-time employee starts on 1st April. They’ll be working for nine months of that year.

- Calculation: (28 days ÷ 12 months) × 9 months = 21 days of holiday.

This ensures they get the right amount of leave for their first year, with no confusion.

Final Holiday Calculations for Leavers

When an employee decides to move on, you need to do a similar pro-rata calculation to figure out their entitlement right up to their last day. This is essential for ensuring their final pay is accurate and covers any holiday they've earned but not taken.

First, work out what fraction of the leave year the employee has completed. For someone leaving on 30th June in a standard Jan-Dec leave year, they've worked six of the twelve months.

- Full-time leaver calculation: (28 days ÷ 12 months) × 6 months = 14 days accrued.

You then look at how much holiday they’ve already taken and subtract it from their accrued total. If they've taken 10 days, you owe them payment for the remaining 4 days in their final salary. This is often called payment in lieu of holiday.

What if They’ve Taken Too Much Holiday?

It happens. What if the employee in our example had taken 15 days of leave by the end of June? They've used one more day than they were actually entitled to.

This is where your employment contract is absolutely critical. You can only deduct the cost of this extra day from their final pay if there's a specific clause in their contract that allows you to do so. If that clause isn't there, you can't legally make the deduction.

Having a clear, unambiguous policy on deducting pay for over-taken holiday in your employment contract is non-negotiable. It protects the business and provides total transparency, preventing awkward and potentially costly arguments when someone leaves.

The Importance of Holiday Carry-Over Rules

Clear policies on carrying over unused leave are also vital, especially with working habits changing. The data is interesting here; UK workers are taking more of their holiday than before, with the average number of unused days dropping from 18.5 in 2019 to just 5.3 in 2024. But even so, 65% of employees still don't use their full allowance, often blaming heavy workloads. You can read more about the state of annual leave in the UK on Timetastic.co.uk.

The law is clear: employees must take at least four weeks of their statutory leave. You can't pay them in lieu for it unless they're leaving. The remaining 1.6 weeks can be carried over to the next leave year, but only if you have a written agreement in place. A well-communicated carry-over policy helps manage everyone's expectations and keeps things running smoothly from one year to the next.

Avoiding Common Bank Holiday and Contract Pitfalls

Bank holidays are one of the most persistent areas of confusion when it comes to calculating holiday entitlement. There's a widespread myth that employees have an automatic right to take these days off, but that’s simply not the case. The truth is far more nuanced and hinges entirely on the specific wording in an individual’s employment contract.

Getting this language wrong is an easy mistake to make, but it can lead to payroll errors, employee disputes, and even legal trouble. A vague or poorly phrased clause can create real headaches, especially when the calendar throws a curveball. That's why a quick audit of your contract templates is one of the smartest things you can do.

Contract Wording Makes All the Difference

The distinction between certain contractual phrases might seem trivial, but the legal and practical implications are huge. The two most common ways to phrase holiday entitlement can create very different outcomes for both the employee and the business.

Let's break down the key phrases you'll see:

- "28 days of annual leave, including bank holidays": This phrasing gives your business maximum flexibility. It means the employee's total entitlement is a fixed 28 days (or the pro-rata equivalent). You can require them to work on a bank holiday and, if they want it off, they book it from their 28-day allowance. Simple.

- "20 days of annual leave, plus bank holidays": This is much more restrictive. It locks you into giving employees all public bank holidays off in addition to their 20-day allowance. If a bank holiday falls on their normal working day, they are entitled to that day off with pay.

That second option can get particularly tricky with part-time staff. If a bank holiday lands on a day they don't normally work, you may still need to grant them a pro-rata entitlement for that day to avoid treating them less favourably than their full-time colleagues.

How Calendar Quirks Can Catch You Out

Vague contract wording can quickly escalate into a serious compliance issue when the number of bank holidays changes within your leave year. This isn't just a theoretical problem; it has caught plenty of businesses out.

A perfect example cropped up during the 2024-2025 leave year. For companies running an April-to-March holiday cycle, only seven bank holidays fell within that period because Easter Sunday landed on 20th April 2025, just outside the window. As a result, employees whose contracts stated "20 days plus all bank holidays" were only entitled to a total of 27 days' leave, falling short of the statutory minimum of 28 days. You can read more about how the 2025 leave year exposed this pitfall.

This scenario is a textbook case of why precision in your legal documents is so vital.

The lesson here is clear: your employment contracts must be built to withstand calendar anomalies. Relying on phrasing like 'plus bank holidays' without a fallback clause can inadvertently push your holiday provision below the legal floor, creating a compliance nightmare you didn't see coming.

To sidestep this trap, make sure your contracts are robust. A simple clause stating that the total annual leave entitlement, including any bank holidays, will never fall below the statutory minimum provides a crucial safety net. This protects both the business and the employee, guaranteeing you always meet your legal obligations, no matter how the dates fall. Reviewing and tightening up this language is a small task that prevents major headaches down the road.

How Absence Management Software Can Help

After wading through pro-rata percentages and 52-week reference periods, it’s painfully clear that trying to work out holiday entitlement using spreadsheets is fraught with risk. Manual calculations aren't just time-consuming; they’re a breeding ground for human error that can easily lead to non-compliance, payroll mistakes, and unhappy team members.

This is exactly where technology steps in to lift the administrative burden. Moving from a spreadsheet to a dedicated system is about more than just convenience—it’s about precision and efficiency. Absence management software automates all the tricky accruals and calculations we've discussed, from part-time pro-rata leave to the 12.07% rule for irregular hours. It completely eliminates the guesswork and ensures every calculation is accurate and legally sound.

Centralised and Automated Leave Management

The real game-changer is having a single source of truth for all things leave-related. Instead of juggling calendars and cross-referencing spreadsheets, a central dashboard gives complete, real-time visibility for everyone involved.

You can see below a typical dashboard view in a system like Leavetrack, which gives you an at-a-glance overview of leave balances and incoming requests.

This kind of clarity empowers both employees and managers, making the whole process transparent and refreshingly straightforward.

The system automatically handles entitlements for new starters and leavers, flags potential holiday clashes, and tracks accruals quietly in the background. A critical part of this is implementing efficient employee time off request forms, which are seamlessly built into these platforms. Managers can approve or deny requests in a single click, totally confident that the system has already crunched the numbers correctly.

By automating these complex calculations, you not only save countless administrative hours but also significantly reduce the risk of costly compliance errors. The software becomes your silent partner, ensuring fairness and accuracy across the board.

Ultimately, using a dedicated tool frees up valuable time for HR and managers to focus on more strategic work rather than getting bogged down in manual sums. For a deeper look into how these systems operate and help maintain compliance, our guide to how absence management software can streamline UK compliance provides more detailed insights. Adopting this technology solves the exact pain points discussed in this guide, ensuring your leave management is always accurate, fair, and compliant.

Common Questions on Holiday Entitlement

Okay, we've walked through the calculations, but what about those tricky 'what if' scenarios that always seem to crop up? Let's tackle some of the common questions I hear from managers and HR teams. Think of this as your quick-fire reference for handling those curveballs when an employee leaves.

What Happens if an Employee Is Sacked?

Even if an employee is dismissed, and yes, that includes for gross misconduct, they are still legally entitled to be paid for any untaken statutory holiday they have accrued up to their very last day. This isn't optional; that payment has to be included in their final payslip.

Do Employees Get Paid for Leave if They Quit Without Notice?

Absolutely. An employee is entitled to payment for any statutory leave they've earned but not taken, regardless of whether they serve out their notice period. The only thing they forfeit is pay for the unworked notice period itself.

It's a common misconception that abandoning a notice period forfeits all rights. The right to be paid for accrued statutory holiday is protected by law and applies no matter the circumstances of the departure.

Can We Deduct Pay if Someone Has Taken Too Much Holiday?

This is a classic headache. An employee leaves, and you realise they've taken more holiday than they'd actually accrued. You can only deduct the value of this excess holiday from their final pay if you have a clear, written clause in their employment contract that explicitly allows for it.

Without that specific contractual agreement in place before they even started, you can't legally make the deduction. It’s a detail that’s easily missed but crucial to get right.

What's the Difference Between Statutory and Contractual Holiday Pay on Leaving?

When an employee leaves your business, you are legally required to pay them for any unused portion of their 5.6 weeks statutory leave. That’s non-negotiable.

But what if you offer a more generous allowance on top of that? Any additional contractual holiday only needs to be paid out if it's explicitly stated in their employment contract. If the contract is silent on this point, you only have to pay out the statutory amount.

Stop drowning in spreadsheets and manual holiday calculations. Leavetrack automates everything from pro-rata entitlements to accruals, giving you accurate, compliant leave management with just a few clicks. See how it works at https://leavetrackapp.com.