How to Work Out Your Holiday Entitlement a Complete UK Guide

Posted by Robin on 07 Jan, 2026 in

Getting to grips with holiday entitlement always starts with one simple fact: almost every worker in the UK is legally entitled to 5.6 weeks of paid annual leave.

For a typical employee working a five-day week, this works out to a straightforward 28 days per year. This figure, which can include bank holidays, is the absolute legal minimum – it's the foundation for everything else.

Understanding Your Core Holiday Entitlement

Before you start plugging numbers into a calculator, you need to understand the two different types of annual leave. The distinction between what the law demands and what your company actually offers is the first hurdle in managing holidays accurately. These two concepts are the bedrock of every calculation that follows.

The two key pillars of annual leave are:

- Statutory Entitlement: This is the non-negotiable legal minimum. The law is there to protect a worker's right to paid time off, and this is the baseline figure.

- Contractual Entitlement: This is any extra leave an employer decides to offer on top of the statutory minimum. It’s a key part of an employment contract and often a major employee benefit.

The Legal Baseline: Statutory Leave

In the UK, the starting point for almost everyone is 5.6 weeks' paid holiday per year. This legal baseline, set out in the Working Time Regulations, applies to nearly all workers, including agency staff, those on zero-hours contracts, and part-year employees. You can find the official guidance on holiday entitlement rights on the GOV.UK website.

For part-time staff, the entitlement is simply pro-rated. So, someone working three days a week gets 16.8 days (3 days x 5.6 weeks).

It’s important to know that this figure is capped at 28 days. This means an employee working six days a week doesn’t get more; they are still only entitled to the statutory maximum of 28 days.

A common point of confusion is how bank holidays fit into all this. Employers are perfectly within their rights to include the eight bank holidays (in England and Wales) as part of the 28-day statutory entitlement. But, and it's a big but, this must be clearly stated in the employment contract.

To make this easier to visualise, here’s a quick breakdown of the statutory minimums.

Statutory Minimum Holiday Entitlement At A Glance

| Days Worked Per Week | Statutory Entitlement (Weeks) | Statutory Entitlement (Days) |

|---|---|---|

| 1 | 5.6 | 5.6 |

| 2 | 5.6 | 11.2 |

| 3 | 5.6 | 16.8 |

| 4 | 5.6 | 22.4 |

| 5 | 5.6 | 28 |

| 6 | 5.6 | 28 (capped) |

| 7 | 5.6 | 28 (capped) |

As you can see, the 5.6-week rule is constant, but the number of days changes based on the work pattern, up to that 28-day cap.

Going Above and Beyond: Contractual Leave

Many companies choose to offer more than the legal minimum as a competitive perk. This is what we call contractual leave. You might see an offer of 25 days of holiday plus bank holidays, giving an employee a much more generous total of 33 days off.

The rules around this extra, contractual leave are governed entirely by the employment contract. This document should spell out things like:

- How much notice an employee needs to give to book time off.

- Whether any unused days can be carried over to the next holiday year.

- What happens to untaken contractual leave when an employee leaves the company.

It is absolutely crucial that your policies on this are crystal clear and documented. Any grey areas can quickly lead to disputes down the line, especially during an employee's exit. When it comes to any leave offered beyond the legal 5.6-week requirement, the contract is king.

Figuring Out Leave for Full-Time and Part-Time Staff

Once you’ve got your head around statutory vs. contractual leave, it’s time to apply that to your team. This is where the numbers meet reality for your most common types of employees. And while calculating leave for full-timers is usually a doddle, it's the part-time calculations where things can get messy, fast—leading to payroll headaches and unhappy staff.

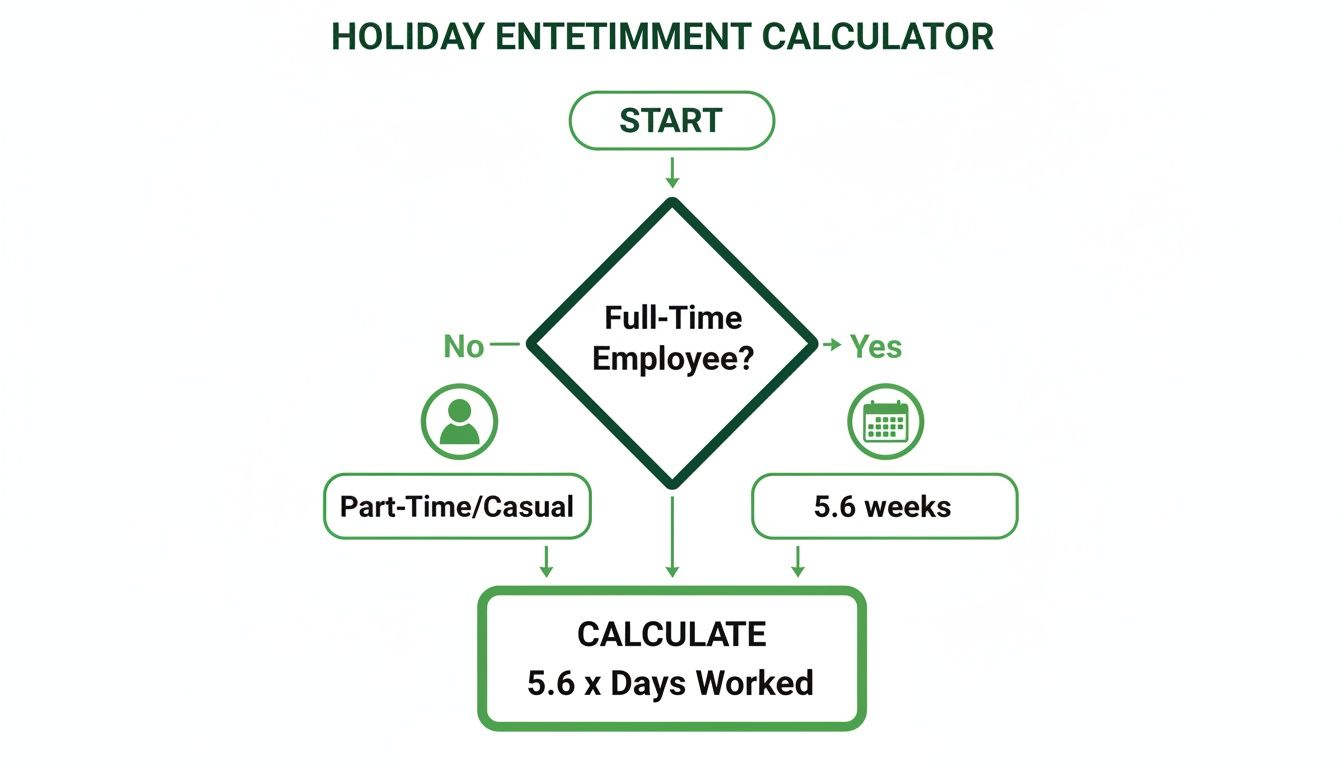

For a full-time employee on a standard five-day week, the calculation couldn't be simpler. They're entitled to the full 28 days of statutory annual leave. This comes from 5.6 weeks multiplied by their 5 working days. It’s the figure most of us know and serves as a solid baseline.

But the modern workplace isn't so rigid. More and more businesses rely on part-timers who work fewer days, and it's absolutely vital their holiday is calculated fairly on a pro-rata basis.

The Core Formula for Part-Time Workers

The trick here is to stop thinking in days and start thinking in weeks. The statutory entitlement is always 5.6 weeks, no matter how many days someone works. Keeping that constant in your mind is your secret weapon for getting it right across different work patterns.

The simple but powerful formula is this:

Number of days worked per week x 5.6 weeks = Total holiday days per year

This ensures every part-time employee gets the same proportional holiday allowance as their full-time colleagues, which isn't just fair—it's a legal requirement.

Here's a crucial tip from experience: never round down. If a calculation spits out a fraction, like 16.8 days, you must give them at least that. It’s common practice and great for morale to round up to the nearest half or full day (so, 17 days), but rounding down to 16 is a big no-no.

Real-World Scenarios and Examples

Let’s run this formula through a few real-world scenarios to see how it works in practice for different part-time setups.

Scenario 1: The Three-Day Week Employee

Sarah works in your accounts team every Monday, Tuesday, and Wednesday. That's a straight 3 days a week.- Calculation: 3 days × 5.6 weeks = 16.8 days of annual leave.

Scenario 2: The Compressed Hours Employee

David works full-time hours but squashes them into a four-day week, taking every Friday off. He works 4 days a week.- Calculation: 4 days × 5.6 weeks = 22.4 days of annual leave.

It's really important to remember that even though David works 'full-time hours', his holiday is based on the number of days he works. Why? Because a 'day' of his holiday is longer than a standard day for someone on a five-day week.

Handling Fixed but Non-Standard Patterns

What about when an employee works a fixed number of days, but they aren't the same each week? Maybe they're on a two-week rotating shift pattern, for instance. As long as the average number of days worked per week is consistent, the calculation is just as straightforward.

Let's take Maria, who works a repeating two-week pattern:

- Week 1: She works 4 days (Monday, Tuesday, Thursday, Friday).

- Week 2: She works 2 days (Wednesday, Thursday).

Over two weeks, she works a total of 6 days. To find her weekly average, just divide the total days by the number of weeks in her pattern: 6 days ÷ 2 weeks = 3 days per week on average.

So, her holiday entitlement is based on that average:

- Calculation: 3 days × 5.6 weeks = 16.8 days of annual leave.

Juggling these different calculations in a spreadsheet can get complicated, especially as your team grows. For more advanced conditional logic—like varying leave based on length of service—getting good with Excel IF statement examples can be a lifesaver.

However, this is also where automated systems like Leavetrack really shine. They handle these pro-rata calculations automatically, wiping out the risk of human error and making sure every single team member gets the exact time off they're entitled to.

Handling Complex Calculations for Variable Hour Workers

While sorting out holiday for your full-time and part-time staff with fixed hours is usually straightforward, the real challenge kicks in with variable hour workers.

Anyone on a zero-hour contract, seasonal staff, or employees with erratic shift patterns can cause massive headaches for HR and payroll teams. You can forget about fixed formulas; the only fair and legal way forward is to calculate holiday based on what they've actually worked. This ensures every hour an employee puts in contributes directly to the time off they've earned.

The Percentage Accrual Method Explained

For workers with no set hours, holiday entitlement builds up as they work. The standard method for this uses a very specific figure: 12.07%. This isn't just a number plucked out of thin air; it comes directly from the statutory holiday rules.

Here's the logic behind it:

- A standard working year has 52 weeks.

- The statutory paid holiday entitlement is 5.6 weeks.

- This means employees are only working for 46.4 weeks of the year (52 - 5.6).

- To find the percentage, you divide the holiday weeks by the working weeks: (5.6 ÷ 46.4) x 100 = 12.07%.

This means that for every single hour an employee works, they earn 12.07% of that hour as paid holiday. It's a simple, powerful way to keep their entitlement proportional to the work they do.

A Practical Example for a Retail Worker

Let's say you manage a retail store and have a student, Alex, who works different hours each week depending on the rota. Last month, Alex worked a total of 80 hours.

To work out the holiday he's accrued, you just apply the percentage:

80 hours worked × 12.07% = 9.656 hours of paid holiday earned.

It's common practice to round this to the nearest quarter or half-hour, so you’d credit Alex with 9.75 hours of holiday for that month. You’ll need to run this calculation for each pay period to maintain an accurate running total of his available leave.

Remember, this is the legally recognised way to handle holiday for irregular and zero-hour workers. It directly links their entitlement to their contribution, which is the fairest approach possible. Sticking rigidly to this calculation prevents disputes and ensures you're always on the right side of the law.

This visual decision tree helps break down the first few steps when you're trying to figure out which calculation approach to use based on an employee's work pattern.

As the flowchart shows, once you’ve identified that a worker doesn't have a fixed schedule, you need to switch over to a different method, like the percentage accrual system we've just covered.

The Pitfalls of Rolled-Up Holiday Pay

You might have come across ‘rolled-up’ holiday pay. This is where an employer adds an extra amount to an employee’s hourly rate—usually 12.07%—instead of paying them when they actually take time off. For a long time, many saw this as a convenient shortcut for casual workers.

Be warned: the legal standing of this practice is shaky at best. The courts have repeatedly ruled that it can discourage workers from taking their statutory time off, which completely undermines the Working Time Regulations. It is now widely considered unlawful for most situations.

The only safe and recommended practice is to calculate and pay for holiday when it is taken. This holiday pay should be based on their average pay over the previous 52 weeks. Simply adding an uplift to their regular wage is a major compliance risk that most businesses should steer well clear of. Calculating holiday for these contract types requires careful attention; our comprehensive guide to zero-hour contract holiday entitlement explains these nuances in greater detail.

This is where automated absence management systems become invaluable. A tool like Leavetrack can automatically perform these percentage-based accrual calculations every month, giving both managers and employees a clear, up-to-date view of available leave without any manual sums or risk of error.

Managing Holiday Entitlement for Starters and Leavers

People joining and leaving your company is a natural part of the business cycle, but it brings a small but crucial bit of admin: holiday calculations. Getting this wrong can cause payroll headaches and sour the relationship at a really important time.

The good news is that the process is pretty straightforward. It all boils down to pro-rating an employee's entitlement based on how much of the holiday year they’ve actually worked. They're only entitled to the leave they've earned up to their start or end date.

Calculating Entitlement for New Starters

When a new team member comes on board, you need to figure out their holiday allowance from their first day until the end of your company's leave year. This makes sure they get a fair slice of annual leave for the portion of the year they're with you.

The simplest way to work this out is to think of it as monthly accrual.

- Take the full annual entitlement (e.g., 28 days) and divide it by 12 to get the monthly figure (2.33 days).

- Then, just multiply this by the number of full months they'll be working in the current leave year.

Let’s walk through a real-world example. Imagine your holiday year runs from January to December. A new full-time employee, Chloe, starts on the 1st of April, and she's entitled to the statutory 28 days a year.

- From April to December, Chloe will be with you for 9 months of the leave year.

- Her pro-rata entitlement is 2.33 days per month x 9 months = 20.97 days.

In this situation, it’s always best practice to round the final figure up to the nearest half or full day. So, you’d give Chloe 21 days of holiday for the rest of the year. You should never round down, as that would dip below her statutory minimum.

Handling Calculations for Leavers

The process for someone leaving is much the same, but you’re calculating what they've accrued up to their final day. This is a critical step because it directly impacts their final pay packet.

First, you need to work out how much of the holiday year has passed. If an employee with a 28-day allowance leaves exactly six months into the year, they’d have accrued half their total entitlement: 14 days. Simple enough.

Next, you compare that accrued figure to the amount of holiday they’ve actually taken.

- Untaken Holiday: If they've taken less leave than they've earned, you owe them for the difference. This must be paid out in their final payslip and is often called 'payment in lieu of holiday'.

- Overtaken Holiday: What if they’ve used more holiday than they’ve accrued? You might be able to deduct the excess from their final salary, but—and this is a big one—you can only do this if there's a specific clause in their employment contract allowing it. Without that clause, you have no legal footing to reclaim the money.

Figuring out the exact holiday entitlement when leaving a job can get tricky, especially if you offer more than the statutory minimum, so having clear, written policies is absolutely essential.

This is another one of those areas where an absence management system really proves its worth. Leavetrack handles all these pro-rata calculations for starters and leavers automatically, wiping out the risk of manual error and guaranteeing every final payslip is spot on.

Getting Bank Holidays, Carry-Over, and Holiday Pay Right

Calculating the basic allowance is just the start. The real test of managing holiday entitlement well comes down to three areas that often trip employers up: bank holidays, carry-over rules, and how you calculate holiday pay.

Getting these details wrong isn't just a minor admin error. It can lead to underpaid staff, legal headaches, and a serious dent in team morale. A clear, well-communicated policy isn't just good practice; it's fundamental to running a fair and compliant workplace. Let's break down each part so you can handle them like a pro.

Dealing with Bank Holidays

One of the most frequent questions I hear is how bank holidays fit into the statutory 28 days of leave. The short answer is: it depends on your contract.

An employer can legally count bank holidays as part of an employee’s 5.6-week entitlement. But, and this is a big but, the employment contract must be crystal clear about this. If a contract just says "28 days holiday," the assumption is that bank holidays are included in that total.

On the other hand, if it states "20 days holiday plus bank holidays," you've created a contractual right for the employee to take their 20 days plus any public holidays that fall on their usual working days.

You also need to keep a close eye on the calendar. England and Wales usually have eight bank holidays a year, but the way they fall can create problems. For example, a leave year might end up with fewer public holidays than expected, which could mean a "20 days plus bank holidays" policy accidentally drops an employee's total leave below the legal minimum of 28 days. As one legal analysis highlights, this kind of oversight could easily lead to claims of unlawful deductions from wages.

Understanding Carry-Over Rules

So, what happens to any leftover leave at the end of the year? While the default position is often "use it or lose it," the law builds in some important flexibility.

Legally, employees have a right to carry over a portion of their leave if they couldn't take it for specific reasons, such as:

- Being on long-term sick leave.

- Taking statutory family leave (like maternity or adoption leave).

- The employer failed to give them a reasonable opportunity to take their leave.

Anything beyond these legal must-haves is down to your company policy. Many businesses choose to offer a contractual right to carry over a few days—often up to five—into the next leave year. It’s a popular perk that adds a welcome touch of flexibility for employees.

The crucial point to remember is that the first four weeks of statutory leave (the equivalent of 20 days for a full-timer) generally can't be carried over unless for the specific legal reasons mentioned. The remaining 1.6 weeks can be carried over if you have a formal agreement in place.

How to Calculate Holiday Pay Correctly

Calculating holiday pay seems straightforward for salaried staff, but it gets a lot trickier when an employee's pay packet changes from month to month.

The law is clear: a worker’s holiday pay must reflect what they would have earned if they'd been at work. This means you can't just fall back on their basic rate if their normal income includes other regular payments.

For anyone with variable pay, you have to use a 52-week reference period to work out their holiday pay. This means looking back over the last 52 weeks where they actually received pay and calculating their average weekly earnings. Weeks where they weren't paid at all are skipped, and you go back further until you have 52 paid weeks.

When you're calculating this average, you need to be sure you're including the right components. It’s not just about their basic salary. You also need to look at payments that are intrinsically linked to the job they do.

Here is a quick reference guide to help.

Holiday Pay Calculation Reference Period

| Pay Component | Include in Holiday Pay? | Notes |

|---|---|---|

| Basic Salary | Yes | The foundation of the calculation. |

| Commission | Yes | If it's a regular part of their earnings. |

| Overtime | Yes | This includes compulsory and regular voluntary overtime. |

| Bonuses | Yes | Performance-related bonuses that are not discretionary. |

| Shift Allowances | Yes | Regular payments for working specific patterns. |

| Travel Allowances | No | Payments that are purely expense reimbursements. |

This ensures that employees aren't financially penalised for taking the time off they're legally entitled to. Getting this calculation right is one of the absolute cornerstones of fair and lawful holiday management.

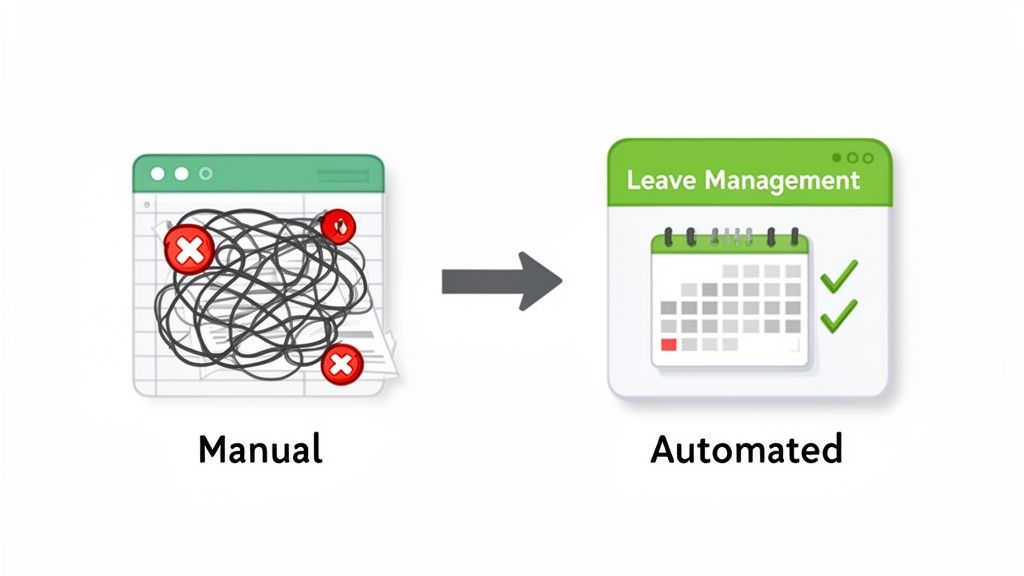

Time to Ditch the Holiday Tracking Spreadsheet?

If you're still wrestling with spreadsheets to track holidays, you’re not just wasting time—you’re creating risks you probably haven't even thought about yet. What starts as a simple tracking sheet quickly becomes a tangled mess of formulas, hidden errors, and zero real-time visibility as the business grows.

Let's be honest, this manual approach is a headache waiting to happen. A single typo in a formula can short-change an employee on their leave, leading to frustration and awkward conversations. At the same time, managers are left guessing about team availability, turning resource planning into a constant struggle.

The Real Cost of Sticking With Spreadsheets

The real pain point often arrives when you least expect it. Imagine a key team member leaves, and you suddenly discover their holiday record is a complete mess. Now you're faced with a legally sensitive final pay calculation that's far more complex than it needs to be.

Or think about the quiet productivity drain. How many hours do your managers lose cross-referencing calendars and spreadsheets instead of actually leading their teams? These aren't just hypotheticals; they are the everyday reality for businesses clinging to outdated methods.

There's also a bigger cultural shift to consider. Post-pandemic, UK workers are taking their holidays more seriously than ever. Unused annual leave per employee has plummeted 71%, from 18.5 days in 2019 to just 5.3 days recently, as people prioritise their wellbeing.

This shift means that any inaccuracies in your manual system are far more likely to be noticed and questioned by your staff. That heaps on the administrative burden and increases the potential for disputes.

The Automated Advantage

This is where modern leave management software comes in. By automating accruals, centralising requests, and integrating with team calendars, these systems get rid of the guesswork and human error that are baked into manual processes.

Here’s what you gain by making the switch:

- Error-Free Calculations: The software does the heavy lifting, automatically calculating pro-rata entitlements for new starters, leavers, and part-time staff with complete accuracy.

- One Source of Truth: A shared digital planner gives everyone an instant, clear view of who is off and when. Scheduling and project management just got a whole lot simpler.

- Painless Approvals: Managers can approve or deny requests in a single click, straight from their email or tools like Slack, freeing up their time for more important work.

Ultimately, getting a handle on a guide to employee holiday tracking is about more than just numbers; it’s about fairness, compliance, and efficiency. Adopting a dedicated system transforms this process from a risky administrative chore into a genuine strategic advantage. And you can see the benefits of moving beyond manual spreadsheets for tracking in other parts of the business too, showing just how much these digital tools can free up your team to focus on what really matters.

Common Holiday Entitlement Questions

Even with the rules laid out, you’re always going to run into those quirky, real-world scenarios that leave you scratching your head. It’s completely normal. Let's tackle a few of the most frequent questions that pop up when you're working out holiday entitlement.

Can I Round Up Holiday Entitlement?

Technically, there's no law forcing you to round up. But honestly, it’s just good practice and something I’d always recommend. For example, if a part-timer’s holiday calculation works out to 16.8 days, most employers will simply round it up to a clean 17 days. It keeps things simple and fair.

Whatever you do, you must never round down. Giving an employee less than their statutory minimum is against the law, no exceptions. The golden rule is to always round up to the nearest half or full day.

Holiday Accrual During Maternity Leave

This one is a definite yes. An employee’s holiday entitlement continues to build up (accrue) just as it normally would throughout their entire maternity leave. This covers both Ordinary and Additional Maternity Leave, and it applies to their full statutory and contractual allowance.

Because they obviously can't take annual leave while on maternity leave, it’s very common for them to take this accrued time either just before they go, or by tagging it onto the end of their leave before they officially return to work.

Changing Hours Mid-Year

What happens when someone’s contract changes part-way through the year? This is a classic HR puzzle. If an employee’s working hours change, you’ll need to do two separate calculations and then add them together to get the new total.

First, figure out their entitlement for the period they worked on their old pattern.

Then, calculate their entitlement for the rest of the holiday year based on their new working pattern.

Let’s imagine an employee moves from a five-day week to a three-day week exactly halfway through the year. For the first six months, they would have earned 14 days (half of their original 28 days). For the second six months, they would earn 8.4 days (half of their new pro-rata entitlement of 16.8 days). Add them together, and their total for the year is 22.4 days.

Stop wrestling with complex calculations and manual errors. Leavetrack automates holiday tracking, from accruals to approvals, ensuring every team member gets the exact leave they're entitled to. Discover a simpler way to manage absence at https://leavetrackapp.com.