UK Holiday Pay Calculator Made Simple

Posted by Robin on 10 Nov, 2025 in

A holiday pay calculator is a lifesaver for figuring out leave entitlement, especially when you're juggling part-time or irregular-hours staff. It's a simple tool that helps you stay on the right side of UK law by turning complex work patterns into the correct amount of paid leave.

Decoding Your UK Holiday Pay Entitlement

Before you start plugging numbers into formulas or a digital calculator, it’s crucial to get a firm grip on the legal basics of holiday entitlement in the UK. Nailing this from the start not only keeps you compliant but also shows your team they're valued and treated fairly. The core idea is simple enough, but how it applies can change a lot depending on your employment contracts.

At the heart of UK employment law is the statutory minimum holiday entitlement. This gives almost all workers—including agency staff, those with irregular hours, and people on zero-hours contracts—5.6 weeks of paid holiday each year. This is the baseline designed to ensure everyone gets a proper rest, no matter how they work.

For a full-time employee on a standard five-day week, the maths is easy: 28 days of paid leave (5.6 weeks x 5 days). But most businesses aren't that simple. They often have a mix of full-time, part-time, and casual staff, and that’s where you need to pay closer attention to the calculations.

Pro-Rata Entitlement for Part-Time Staff

For your part-time team members, that 5.6-week rule still stands, but their final entitlement is worked out on a pro-rata basis. This is just a fair way of giving them a proportional amount of leave based on the days or hours they actually work.

Let’s look at a couple of common, real-world examples:

- An employee who works three days a week gets 16.8 days of holiday (5.6 weeks x 3 days).

- Someone working four days a week is entitled to 22.4 days (5.6 weeks x 4 days).

This pro-rata system keeps things fair and consistent across your entire workforce. The 5.6 weeks per year is a cornerstone of UK employment law that covers nearly everyone. If you want to get deeper into the specifics, you can find more insights about UK holiday entitlement rules right from the source.

Understanding Bank Holidays

One of the most common questions I hear is about bank holidays and how they fit in. As an employer, you’ve got some flexibility here. You can either include the bank holidays as part of the statutory 28 days or offer them as extra paid days off on top of the minimum.

Your employment contract should make your policy on bank holidays crystal clear. If a part-timer's usual workday falls on a bank holiday, they are entitled to that day off with pay. If they don't normally work that day, they don't automatically get another day off in lieu—unless, of course, their contract says they do.

Calculating Pay for Fixed-Hours Staff

Figuring out holiday pay for your staff on fixed, regular hours should be pretty straightforward, but getting it right down to the penny is crucial. For both your full-time and part-time salaried team members, it all starts with one key number: their weekly pay. This figure is the bedrock for making sure they're paid correctly for any time they take off.

First things first, you need to calculate a week's pay. For anyone on a salary, it’s a simple case of taking their annual salary and dividing it by 52. That gives you the gross weekly amount they earn, and it's exactly what they should get for a full week's holiday.

Let’s take an example. Say you have an employee earning £31,200 a year. Their weekly pay comes out to £600 (£31,200 / 52). If they work a standard five-day week, their pay for one day of holiday would be £120 (£600 / 5). This basic formula is the starting point for any holiday pay calculator dealing with fixed-hours staff.

Handling Part-Time Arrangements

The same logic applies to your part-time staff, but the calculation has to be based on their specific work pattern. Consistency is what keeps things fair and compliant, whether they work the same set days each week or a fixed number of hours spread differently.

Think about these common part-time scenarios:

- Employee A works three set days per week (e.g., Monday, Tuesday, Wednesday). Their holiday pay for one of their usual workdays is simply their standard daily rate. Easy.

- Employee B works 20 hours per week, but their days change. Here, their holiday pay is based on their weekly pay. If they take a day off, you'll need to work out the value of that specific day based on their total weekly earnings.

The core principle is simple: an employee should never be financially worse off for taking holiday. Their pay must reflect what they would have earned if they'd been at work.

Adjusting for Salary Changes

Here’s a common curveball: an employee gets a pay rise halfway through the year. When this happens, you must use their new, higher rate to calculate any holiday pay from that point on. You can't just average out their old and new salaries.

Imagine an employee’s salary goes up on 1st July. Any holiday they take after that date has to be paid at their new weekly rate. Using the old rate would mean you’re underpaying them, which could easily lead to a dispute or even a legal challenge. This is exactly where a solid process, or a reliable holiday pay calculator, becomes worth its weight in gold. Getting these adjustments right keeps your payroll compliant and ensures your team feels properly valued for their well-deserved time off.

Holiday Pay for Irregular and Zero-Hours Workers

Calculating holiday pay for people on irregular or zero-hours contracts is often where things get a bit tricky. Unlike your salaried staff, their pay can go up and down week by week, so the law requires a different, fairer method to work out what they're owed. This approach makes sure their holiday pay genuinely reflects what they normally earn.

The secret ingredient here is the 52-week reference period. Instead of just looking at one week's pay, you calculate an average based on the last 52 weeks in which the person was actually paid. This method smooths out all the peaks and troughs of a variable work schedule and gives you a much more accurate figure.

The 52-Week Reference Period Explained

This method isn't as complicated as it might sound. The basic idea is to find the average weekly pay over the last 52 paid weeks. It's crucial that you only count the weeks where your employee actually earned some money.

If an employee had a week with no work and therefore zero pay, you just skip that week and look at the one before it. You keep going back like this, as far as 104 weeks if you need to, until you've gathered 52 weeks of pay data.

This process ensures that quiet periods or weeks off don't unfairly drag down their average earnings. This has been the standard since 6 April 2020, when UK holiday pay law was updated from a 12-week to a 52-week reference period. It’s a much better way to protect workers with fluctuating incomes.

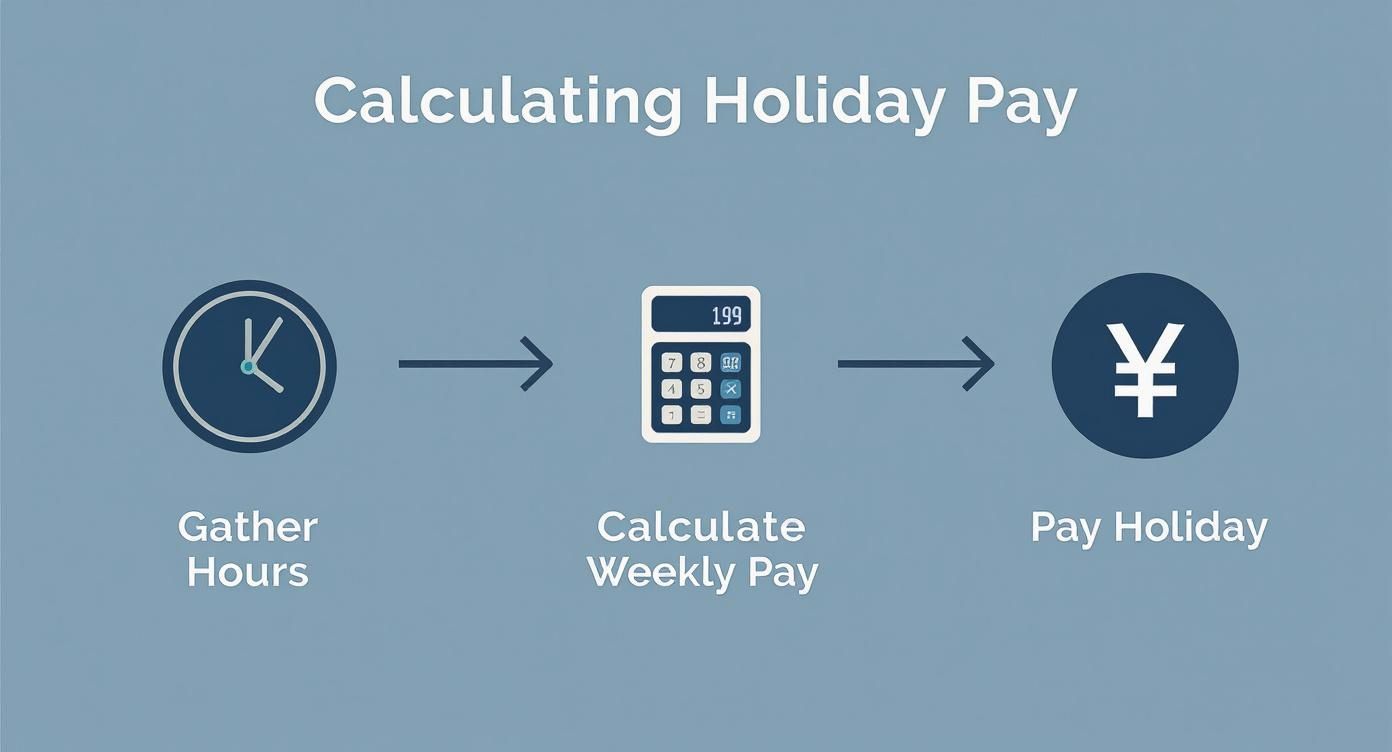

Here's a simple flowchart to help you visualise how it all comes together, from gathering the hours to making the final payment.

This visual guide breaks down the essential stages, making sure you gather the right earnings data and average it correctly before issuing payment.

Putting It into Practice: A Worked Example

Let's walk through a real-world scenario. Imagine you have a zero-hours worker, Alex, who wants to take a week of paid holiday. Alex has been with your company for over a year, so you have plenty of pay history.

To calculate Alex's holiday pay, you would:

- Gather the Pay Data: Pull together the payslips from the last 52 weeks where Alex received payment. Let's say the total gross pay over these 52 weeks adds up to £13,000.

- Exclude Unpaid Weeks: You notice that during this period, there were four weeks where Alex didn't work and wasn't paid. You need to ignore these "zero" weeks and go back an extra four weeks to get a full 52 paid weeks of data.

- Calculate the Average: Now, just divide the total earnings by the number of paid weeks.

- Calculation: £13,000 ÷ 52 weeks = £250

So, in this case, Alex’s holiday pay for one week of leave is £250. This figure represents their true average weekly earnings, making it a fair payment for their time off.

The whole point of the 52-week reference period is fairness. It ensures that a worker's holiday pay isn't artificially low just because they happened to book a holiday after a quiet couple of weeks.

What If an Employee Has Less Than 52 Weeks of Service?

This is a really common situation, especially with new starters or seasonal workers. Don't worry, the principle is the same. If someone has been with you for fewer than 52 weeks, you simply use the number of full weeks they have worked to calculate the average.

For instance, if a new team member has been on your payroll for 20 weeks, you'd add up their total earnings over those 20 weeks and divide by 20 to find their average weekly pay. This ensures they still get holiday pay that's proportional to what they've earned so far. To get a better handle on their rights, have a look at our complete guide on holiday entitlement on a zero-hour contract.

To make things even clearer, here's a quick reference table showing the right calculation method for different types of workers.

Holiday Pay Calculation Methods by Worker Type

| Worker Type | Primary Calculation Method | Key Considerations |

|---|---|---|

| Full-Time (Fixed Hours) | Standard weekly wage | Straightforward. Pay for a week of holiday is the same as a normal week's pay. |

| Part-Time (Fixed Hours) | Standard weekly wage | Calculated based on their fixed part-time hours, not full-time equivalent. |

| Shift/Variable Hours | 52-week reference period | Average pay over the last 52 paid weeks. Exclude any weeks with zero pay. |

| Irregular/Zero-Hours | 52-week reference period | Crucial for fairness. Look back up to 104 weeks if needed to find 52 paid weeks. |

| New Starter (<52 Weeks) | Average over weeks worked | Use the total number of weeks they have been paid to calculate the average. |

This table should help you quickly identify the correct approach, ensuring your payroll calculations are always accurate and compliant.

Navigating Complex Holiday Pay Scenarios

The standard holiday pay formulas cover most of your team, most of the time. But let's be honest, employment isn't always that straightforward. You'll inevitably run into trickier situations like people leaving, long-term absences, or even outdated payment habits that can throw a spanner in the works.

Getting these edge cases right isn't just about ticking a compliance box—it's about treating your people fairly.

One of the most common complexities is handling leave when an employee moves on. As part of their final pay, you've got to calculate and pay out any holiday they've accrued but haven't had a chance to take.

This means working out their pro-rata entitlement up to their last day and then knocking off any leave they've already used during the holiday year. For a full breakdown of the rules, you can read our detailed guide on handling holiday pay when an employee leaves.

Leave Accrual During Sickness and Parental Leave

Here’s a question that trips up a lot of managers: what happens to holiday accrual when someone is off on long-term sick leave or parental leave?

It’s simple, but critical to get right: their statutory holiday entitlement continues to accrue as if they were still at their desk. You can't just press 'pause' on their leave while they're away. When they come back, they’ll have built up a bank of holiday time that they're entitled to take.

- Long-Term Sickness: If an employee couldn't take their holiday because they were ill, they are allowed to carry over up to four weeks of statutory leave into the next holiday year.

- Parental Leave: The full 5.6 weeks of statutory leave keeps building up. A good practice is to encourage your team member to take this accrued holiday either just before their parental leave starts or tack it onto the end.

Failing to track this properly is a big risk. It can easily lead to a nasty surprise in the form of underpayments and even a potential legal claim. Using a solid system to automatically manage this for you is a lifesaver here.

Understanding Rolled-Up Holiday Pay

You might have come across the term "rolled-up holiday pay." It was an old-school method where instead of paying someone when they were actually on holiday, employers would just add a bit extra—usually 12.07%—to their hourly pay packet.

While it might have seemed like a simple workaround, this practice is now unlawful for the vast majority of workers. The European Court of Justice ruled against it because it actively discourages people from taking the rest they need—after all, they wouldn't see any separate payment when they took a day off.

The only real exception is for certain workers on irregular-hours or part-year contracts, following new rules introduced in April 2024. For everyone else, though, holiday pay must be paid when the holiday is taken. If you’re still using a rolled-up system, you need to switch gears and update your payroll process immediately to stay compliant.

Using a Holiday Pay Calculator to Ensure Accuracy

Let's be honest, manual holiday pay calculations—especially with the 52-week reference period—are a headache waiting to happen. It's far too easy for a simple slip of a decimal point or a miscounted week to lead to underpayments. This doesn't just create a legal minefield; it erodes the trust you have with your team.

This is exactly where technology offers a much smarter, more reliable way forward.

Using a dedicated holiday pay calculator takes all the guesswork out of the equation. These tools are built to handle the fiddly details of UK employment law, from working out pro-rata entitlements for part-timers to the complex averaging needed for staff on zero-hours contracts. It gives you a clear, repeatable process that ensures everyone is paid correctly and consistently.

What’s more, this kind of automation provides a crucial audit trail. Having a digital record of every calculation is solid proof of your compliance, which is invaluable if you're ever facing an internal review or an external inspection. It’s all about building a robust system that protects your business and looks after your employees.

How the GOV.UK Calculator Works

For many, the official GOV.UK calculator is the go-to starting point. Its popularity speaks for itself—in 2023, the tool was used over 1.2 million times, a clear sign of how valuable it is for untangling complex pay rules.

The process is refreshingly straightforward. The tool walks you through a series of simple questions to figure out the correct entitlement and pay. To get an accurate result, you'll need a few key details to hand.

- Employment Start and End Dates: This is vital for calculating accrued leave, particularly for new starters or when someone is leaving the company.

- Contract Type: You’ll need to select how the employee is paid—for example, hourly, daily, by salary, or on irregular hours.

- Work Pattern: This covers the number of days or hours worked each week.

- Pay Details: For anyone on irregular hours, you'll need the total pay earned over the relevant reference period.

Here’s a quick look at the kind of initial questions you’ll see on the government’s official calculator.

As the screenshot shows, the tool uses a clear, step-by-step approach to make sure you’re providing the right information from the very beginning.

By guiding you through these inputs, a good calculator effectively forces you to follow the correct legal process. It’s a fantastic safety net for your payroll operations and dramatically cuts the risk of accidental non-compliance.

While a specialist holiday pay calculator is essential, it's also useful to see how these figures slot into an employee's total earnings. For a wider view of how different deductions and earnings add up, a comprehensive UK payroll calculator guide can be helpful. For more direct guidance, you can also check out our own in-depth article on using a https://blog.leavetrackapp.com/articles/holiday-calculator-uk-%7C-your-guide-to-annual-leave.

Common Holiday Pay Questions Answered

Even when you feel you have a good handle on holiday pay, certain situations can pop up that leave you second-guessing. It’s completely normal to have questions, especially when you’re navigating the finer points of UK employment law. This section tackles some of the most common queries, helping you manage those tricky scenarios with total confidence.

One of the first questions I always get is about what exactly counts as 'pay' when you're working out holiday entitlement. It’s definitely not as simple as just using an employee's basic salary.

For an accurate calculation, 'a week's pay' needs to include:

- Guaranteed overtime that you're contractually obliged to offer.

- Commission payments that are directly tied to the work an employee does.

- Bonuses related to their performance.

Essentially, if a payment is a regular and expected part of their earnings, it has to be factored into their holiday pay. Getting this wrong is a common pitfall that can lead to underpayment and, frankly, headaches you just don't need.

Can We Pay in Lieu of Untaken Holiday?

This is another classic point of confusion. The short answer is no, you cannot pay an employee for their statutory minimum holiday entitlement (5.6 weeks) while they are still working for you. The whole point of the law is to make sure people actually take a break.

The only time you can pay an employee for untaken statutory holiday is when their employment comes to an end. At that point, you absolutely must calculate any accrued but unused leave and add it to their final payslip.

What About Carrying Holiday Over?

As a rule, employees have to use their statutory holiday entitlement within the current leave year. But, as with most things in employment law, there are a few exceptions where carrying leave over is permitted or even required.

An employee can carry over a maximum of 1.6 weeks of their statutory holiday into the next leave year, but only if you have a proper written agreement in place. Any leave carried over due to long-term sickness is a different story and has its own set of rules. Forgetting to get the carry-over agreement in writing is a simple mistake that can create payroll nightmares and compliance issues later on.

Do Part-Time Workers Get Bank Holidays Off?

Not automatically, no. A part-time worker's right to a bank holiday all comes down to their usual work schedule. If their normal working day happens to fall on a bank holiday, then they get that day off as paid leave.

But what if they don't usually work on the day a bank holiday falls (say, a Monday)? In that case, they aren't automatically entitled to a different day off in lieu. The crucial thing is to make sure their total holiday entitlement is calculated correctly on a pro-rata basis. This prevents any unfair treatment compared to your full-time staff.

Juggling all these details manually isn't just time-consuming; it’s risky. With Leavetrack, you can automate holiday accruals, track leave balances in real-time, and ensure every employee's entitlement is calculated correctly. It saves you time and gives you complete peace of mind. Streamline your entire leave management process by visiting https://leavetrackapp.com.