A Guide to the Zero Hours Contract Holiday Pay Calculator

Posted by Robin on 17 Jan, 2026 in

Figuring out holiday pay for people on zero-hours contracts is one of those headaches that seems to trip up even the most organised UK businesses. It's a common source of confusion, and frankly, a real compliance risk if you get it wrong. The heart of the problem is simple: their hours and pay can be all over the place, making the standard calculation methods totally impractical.

This guide is here to cut through the noise and show you the legally approved ways to get it right every time.

The Real Challenge of Zero Hours Holiday Pay

A flexible workforce is a huge asset, but it comes with its fair share of admin, especially when it comes to statutory holiday pay. For anyone in HR or running a small business, relying on a spreadsheet to track this manually is a high-wire act. One small slip-up can lead to underpayments, which not only erodes trust with your team but can land you in legal trouble.

And this isn't a niche problem anymore. The number of people on these contracts has ballooned, hitting 1.2 million as of November 2025 – the second-highest figure on record. It’s a huge trend among younger workers in particular, with a record 508,000 individuals aged 16-24 now on zero-hours contracts, according to ONS data. You can dig into the full Work Foundation analysis of these figures to see just how significant this shift is.

Why Getting It Right Is Critical

This is about more than just ticking a compliance box; it’s about treating your people fairly and keeping your operations running smoothly. Botching the numbers can cause some serious fallout:

- Legal Penalties: Employment tribunals don't mess around. They can, and will, issue fines for failing to pay the correct statutory holiday entitlement.

- Damaged Morale: Nothing kills trust faster than inconsistent or incorrect pay. This can easily lead to higher staff turnover, which is a costly problem for any business.

- Administrative Overload: The time you spend fixing payroll errors and dealing with disputes is time you can’t get back—time that could be invested in growing the business.

The real trick is turning those sporadic work patterns into a fair and legally sound holiday pay figure. Without a solid system, you're essentially guessing, and that's a dangerous game to play with UK employment law.

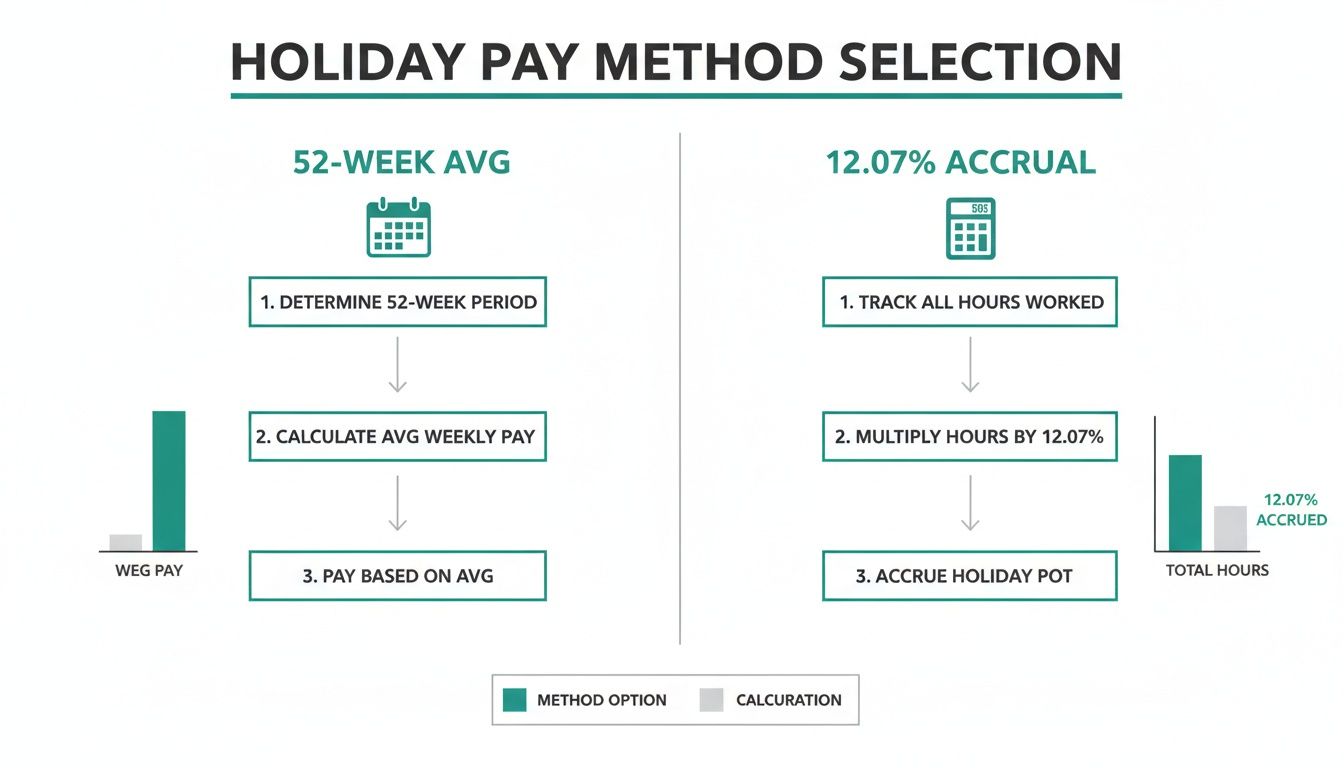

To get a handle on this, UK law gives us two main methods. The first is the 52-week rolling average, which uses a worker's past earnings to work out their average pay for a week's holiday. The second option is the 12.07% accrual method, which is a straightforward calculation based on the hours they've worked.

If you want a more detailed breakdown of the regulations, our complete guide on holiday entitlement on a zero hour contract has you covered. Knowing which method to use, and when, is the first real step to mastering this tricky task.

Choosing the Right Calculation Method

Getting holiday pay right is the bedrock of staying compliant and being fair to your team. For workers on zero-hours contracts, UK employment law offers two distinct ways to calculate what they're owed. Picking the correct one for your situation is the critical first step, long before you even touch a zero hours contract holiday pay calculator.

The two legally recognised methods are the 52-week rolling average and the 12.07% accrual method. Each is built for different working patterns, and believe me, using the wrong one can lead to some serious headaches and potential legal challenges down the road.

The 52-Week Rolling Average Method

The 52-week reference period is the standard, statutory method for anyone with variable hours. It’s designed to give a fair reflection of what a worker typically earns over a long stretch, smoothing out the natural peaks and troughs of irregular work.

In a nutshell, you look back over the last 52 weeks in which the employee actually got paid to figure out their average weekly earnings. That average figure then becomes the amount they are paid for one week of holiday.

Here's the crucial bit: you have to ignore any weeks where the worker earned nothing. If someone had a few weeks with zero pay, you must look further back to find 52 weeks of earnings. The law gives you a window of up to 104 weeks to find this data. If you still don't have 52 weeks of pay information within that two-year period, you just average the pay across the number of weeks you do have.

This method is based on a simple principle: a worker's holiday pay shouldn't leave them financially worse off than if they were working. By averaging a full year of earnings, you get a figure that truly represents their "normal" pay.

The 12.07% Accrual Method

For certain types of workers, a more direct approach is now the legal go-to. The 12.07% accrual method is specifically for employees classified as 'irregular-hour workers' or 'part-year workers' for any leave years starting on or after 1 April 2024.

That 12.07% figure isn't just plucked out of thin air. It’s derived directly from the statutory holiday entitlement of 5.6 weeks. The maths works like this: you take the 52 weeks in a year, subtract the 5.6 weeks of holiday, which leaves 46.4 working weeks. Then, 5.6 divided by 46.4 gives you 12.07%.

With this method, a worker builds up holiday entitlement as they work. For every hour they're paid for, they accrue holiday time at a rate of 12.07%. So, if someone works 100 hours in a month, they’d bank 12.07 hours of paid leave.

This makes it a perfect fit for staff whose working patterns are so sporadic that trying to find a 'normal' week's pay using the 52-week average would be nearly impossible. It creates a clear, transparent link between the hours worked and the holiday earned.

Comparing Holiday Pay Calculation Methods

Deciding between these methods isn't about personal preference; it's about applying the correct legal framework to your workforce. A side-by-side look can make the distinction much clearer.

Here's a direct comparison to help you choose the right one for your staff.

| Feature | 52-Week Rolling Average | 12.07% of Hours Worked |

|---|---|---|

| Who It's For | Workers with variable hours who are not classified as 'irregular-hour' or 'part-year'. | Officially for 'irregular-hour' and 'part-year' workers (for leave years from 1 Apr 2024). |

| Calculation Basis | Based on average weekly pay over the last 52 paid weeks. | Holiday entitlement is accrued at 12.07% of the total hours worked. |

| Data Requirement | Requires up to 104 weeks of historical payroll data. | Needs accurate, real-time tracking of all hours worked by the employee. |

| Main Advantage | Accurately reflects a worker's typical long-term earnings, including seasonal variations. | Simple to calculate and provides a direct link between work performed and leave earned. |

| Potential Challenge | Can be administratively complex, especially when needing to look back over 104 weeks of data. | Requires precise classification of workers to ensure it's legally appropriate to use. |

Getting this right from the start saves a world of trouble. The key is correctly identifying the worker's employment pattern first, which then dictates the legally required calculation method.

Putting It Into Practice

Let’s make this real. Imagine you run a small events company.

- You have a worker, Alex, who helps with events most weekends. While the hours fluctuate, the work is pretty consistent throughout the year. Alex would almost certainly fall under the 52-week average method.

- You also hire Ben, a student who only works during the summer holidays and the busy Christmas period. Ben is a classic 'part-year worker'. For him, the 12.07% method is the correct and legally required approach.

Applying the right method is non-negotiable. Using the 12.07% calculation for someone like Alex, who should be on the 52-week average, could result in an incorrect payment and a compliance breach. Always start by correctly classifying your workers before you run any numbers.

Right, let's get into the nitty-gritty of actually calculating holiday pay. The theory is one thing, but running the numbers is where you really get to grips with it. While a good zero-hours contract holiday pay calculator is a lifesaver, it's crucial to understand how it works behind the scenes.

We'll walk through a real-world scenario with a hospitality worker named Chloe, whose hours and pay change from month to month. This is an incredibly common setup, especially in sectors like food and accommodation where a whopping 32.2% of the workforce are on these kinds of arrangements. It's easy to see how tracking this manually becomes a minefield for errors.

Applying the 52-Week Average Method

First up, the standard statutory method. Let’s say Chloe has been with a catering company for over a year, and her hours are all over the place depending on the season. To figure out her pay for one week of holiday, we need her average weekly pay over the last 52 weeks she actually got paid.

You'll need to pull the right data from your payroll records.

- Find the 52-week reference period: This is the 52-week block ending just before the holiday starts.

- Skip any unpaid weeks: This is a big one. You have to ignore any weeks where Chloe earned nothing. If she had two unpaid weeks, for instance, you’d need to look back 54 weeks to get 52 weeks of pay data.

- Total up the pay: Add up the total gross pay Chloe received across those 52 paid weeks. Don't forget to include things like overtime, commission, and most bonuses.

- Work out the average: Just divide the total pay by 52. That final figure is what Chloe should be paid for one week of her annual leave.

Chloe's Example

Let's imagine that over the last 54 weeks (which includes two weeks she didn't work), Chloe earned a total of £10,400.

The calculation is pretty straightforward:£10,400 (Total Pay) ÷ 52 (Paid Weeks) = £200

So, Chloe gets £200 for one week of holiday. This method is designed to give a fair reflection of her typical earnings, smoothing out the peaks and troughs of her work schedule.

Using the 12.07% Accrual Method

Now, for leave years starting on or after 1 April 2024, there's a different approach for workers classified as 'irregular-hour' or 'part-year'. This is where the 12.07% accrual method comes in. It's now the legally required way to handle holiday pay for these workers, calculating entitlement as they go.

Instead of looking back, this method is all about accruing holiday in real-time.

- Track all hours worked: You need a precise log of every single hour Chloe works.

- Calculate holiday hours earned: Multiply the total hours worked in a pay period by 12.07% (or 0.1207). This tells you how many hours of leave she's banked.

- Work out the payment: When Chloe wants to take that accrued time, you pay her for those hours at her average hourly rate.

Chloe's Example (Accrual)

Let's say last month, Chloe put in a total of 80 hours.

Her holiday accrual for that month is:80 hours × 0.1207 = 9.656 hours

She has now earned 9.656 hours of paid leave. When she decides to take this time off, you'll need to pay her for it. If her average hourly rate (based on the 52-week reference period) was £12.50, the pay for this accrued time would be:

9.656 hours × £12.50 = £120.70

The beauty of the 12.07% method is that it creates a direct, transparent link between the work someone does and the holiday they earn. It’s perfect for seasonal or genuinely sporadic work where defining a 'normal' week is next to impossible.

To make things even easier, you can check out our guide on how a UK holiday pay calculator made simple can break these formulas down for you.

This flowchart is a great way to visualise which calculation method to use.

The key takeaway is that the right method depends entirely on the worker's contract type and working pattern, not what's most convenient for the employer.

What Counts as 'Pay'

One of the most common places people get tripped up is figuring out what to actually include in the "average weekly pay" for the 52-week method. It’s not just their basic rate.

You almost always need to include:

- Commission payments that are directly linked to the work they've done.

- Overtime payments, whether that overtime was guaranteed or not.

- Performance-related bonuses that are a regular part of their pay packet.

Things you typically wouldn't include are discretionary bonuses (like a one-off Christmas bonus that isn't tied to performance) or expenses. Getting this right is absolutely fundamental to staying compliant with UK employment law. For businesses moving away from spreadsheets, a dedicated system like Leavetrack can handle this automatically, ensuring every relevant pay component is factored in correctly, every single time.

Getting It Wrong: Common Holiday Pay Mistakes and How to Fix Them

Let's be honest, getting zero-hours contract holiday pay right can feel like navigating a minefield. Even with the best intentions, a seemingly small miscalculation can quickly snowball into a major compliance headache, leaving you with underpaid staff and the risk of a legal challenge.

But here’s the good news: knowing the common pitfalls is half the battle.

Many businesses stumble when working out what counts as 'a week's pay' for the 52-week average. A frequent slip-up is failing to exclude weeks where an employee didn't work at all. This simple error can drag down their average earnings, meaning they get short-changed when they take time off. Another classic mistake is misapplying the 12.07% method. It's the go-to for genuinely irregular hours, but using it for someone with a more consistent (though still variable) work pattern can land you in hot water. Classifying your workers correctly from day one is fundamental.

The Big One: Rolled-Up Holiday Pay

Of all the potential mistakes, the most serious is the practice of rolled-up holiday pay. This is where you add a little extra to a worker's hourly rate—supposedly to cover their holiday pay—instead of paying them when they actually take leave.

It might seem like an easy admin fix, but it's completely unlawful. UK employment law is crystal clear: workers must be able to take paid time off to rest. Giving them a bit extra in their pay packet actively discourages them from taking that essential leave.

Key Legal Takeaway: A 2006 European Court of Justice ruling confirmed that rolled-up holiday pay is unlawful. Employers must pay for holidays when the time is taken, not as an ongoing top-up to their wages.

If this sounds like your current system, you need to stop immediately. The first step is to switch to a compliant method, like the 52-week average, and be upfront with your staff about the change.

Give Your Process a Quick Health Check

Taking a few minutes to review your current setup can save you a world of pain down the line. A quick internal audit will help you spot issues before they escalate. Building robust, compliant systems is non-negotiable, and a comprehensive guide to error-free small business payroll can provide a solid foundation.

Here’s a simple checklist to get you started:

- Check Your Maths: When using the 52-week average, are you definitely ignoring any weeks with zero pay?

- Verify Worker Status: Have you correctly identified who is an 'irregular-hour' or 'part-year' worker?

- Review Pay Elements: Does your calculation for 'a week's pay' include all the right components, like overtime, commission, and relevant bonuses?

- Ditch Rolled-Up Pay: Can you confirm you're not using rolled-up pay and are paying for leave when it's actually taken?

- Keep Good Records: Are your records of hours worked and holidays taken accurate and easy to access for every single worker?

Don't Underestimate Clear Communication

Beyond the spreadsheets and calculations, one of the biggest failings is simply a lack of communication. Your team members on zero-hours contracts need to understand exactly how their holiday pay is calculated, how much they’ve built up, and how they can book time off.

This level of transparency builds trust and nips potential disputes in the bud. Provide them with regular, clear updates on their accrued holiday, either on their payslip or through an online portal. A system like Leavetrack can handle this automatically, giving employees a real-time view of their leave balance and making the whole request and approval process painless. It turns a potential point of conflict into a straightforward, fair, and easy-to-manage procedure for everyone.

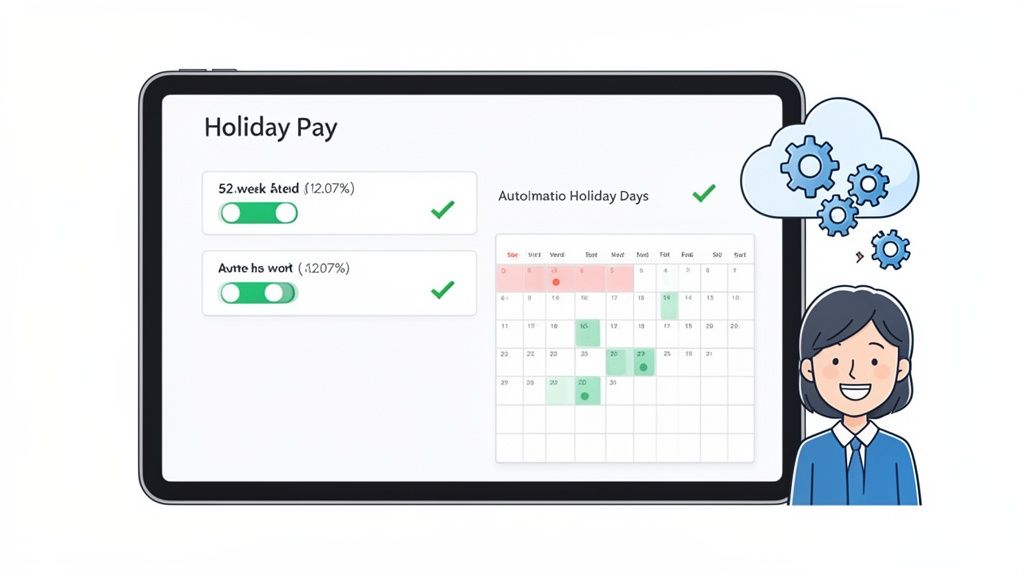

Why You Should Automate Holiday Pay Calculations

After wading through the formulas and potential pitfalls, the strain of doing this manually becomes pretty clear. Trying to manage zero-hours holiday pay with a spreadsheet isn't just a headache; it's a huge compliance risk that can lead to expensive mistakes and unhappy staff. The obvious way forward is to ditch the manual process and let technology handle it.

Systems like Leavetrack are built specifically to take this administrative weight off your shoulders. When you automate the whole thing, you remove the guesswork and the chance of human error. The platform can be set to accrue holiday pay based on hours logged, applying either the 52-week average or the 12.07% formula correctly, every single time.

This isn't just about saving a bit of time—it's a complete change in how you manage compliance. With over 1 million UK workers on zero-hours contracts as of late 2024, this is a massive challenge, affecting roughly 3% of the entire workforce. For businesses in hospitality and retail, where these contracts are everywhere, getting this right is non-negotiable.

Eradicate Errors and Boost Transparency

Automation cuts right to the heart of the problems with manual tracking. Instead of spending hours matching up payroll data, an integrated system does all the heavy lifting, making sure every calculation is accurate and easy to justify. That kind of reliability gives peace of mind to everyone in HR, finance, and operations.

- Automated Accruals: The system calculates and updates holiday entitlement as your team logs their hours, so you always have an accurate, live figure.

- Real-Time Reporting: Pull up-to-the-minute liability reports to see exactly what you owe in accrued leave, helping you budget properly.

- Clear Staff Visibility: Team members can check their own holiday balance whenever they want, which builds trust and cuts down on the constant queries to HR.

Switching from manual spreadsheets to an automated system isn't just buying a piece of software. You're putting a solid compliance framework in place that protects your business and guarantees your staff are treated fairly.

More Than Just a Calculator

A proper platform gives you so much more than a simple zero-hours contract holiday pay calculator. A tool like Leavetrack builds these calculations into a complete leave management system. Have a look at our detailed guide on employee leave management systems to see how everything fits together.

Features like a real-time digital staffing planner solve the tricky operational puzzle of organising cover for a flexible workforce. Managers get an instant overview, so they can approve or deny leave requests knowing exactly who's available. This turns leave management from a reactive chore into a proactive, strategic part of the business.

Beyond just pay, you can also explore how AI tools for reviewing employment contracts can help ensure compliance across the board. Ultimately, automation frees up your valuable time, slashes your risk, and gives you the clarity you need to manage a modern, flexible team effectively.

Frequently Asked Questions

Once you get your head around the main calculation methods, it’s only natural that more specific, fiddly questions start to pop up. Zero-hours contracts are notorious for throwing up unique situations that aren't always covered in a standard guide. Here are some clear, straightforward answers to the queries we see most often from business owners and HR managers.

What Happens If a Worker Has Gaps in Their Employment?

This is a classic query, and a really important one when you're using the 52-week reference period. If a worker has weeks where they weren't offered any work and therefore earned nothing, you absolutely must ignore those weeks. The law is clear: you need to find 52 weeks of actual pay data to work out a fair average.

To make this possible, the law allows you to look back up to 104 weeks (that’s two years) to piece together those 52 paid weeks.

- If you can find 52 paid weeks within that 104-week window, brilliant. You use them to calculate the average.

- But what if you look back a full 104 weeks and still don't have 52 weeks of pay data? In that case, you simply average the pay across the number of weeks you do have.

This rule exists for a very good reason—it stops a worker’s holiday pay from being unfairly watered down by periods when they had no earnings.

When Should I Use the 12.07 Percent Method?

The rules around the 12.07% method have finally been clarified, which is a relief for many. For any leave years starting on or after 1 April 2024, this is the legally required method for calculating holiday entitlement for staff who are properly classified as 'irregular-hour' or 'part-year' workers.

It was brought in to simplify holiday accrual for those with genuinely sporadic work patterns. The idea is that holiday is earned as a simple percentage of the hours they work, creating a direct and transparent link between work done and leave accrued.

Just be careful: for any of your zero-hours staff who actually end up working pretty consistent, regular hours, the standard 52-week average method is still the one to use. Getting the classification right from the start is absolutely key to staying compliant.

Do Zero-Hours Workers Get Paid for Bank Holidays?

This is a common point of confusion. There’s no statutory right for any worker, including those on zero-hours contracts, to be paid for bank holidays. A worker's total annual leave entitlement is 5.6 weeks, and this pot of leave can include the bank holidays.

How this works in practice really comes down to your company policy and the worker's schedule.

- If they are not scheduled to work on a bank holiday, they don't get paid for it automatically. They can, however, ask to use a day of their accrued holiday allowance to get paid for it.

- If they are scheduled to work on a bank holiday, they get paid their normal rate for the hours they work. That day isn't then deducted from their holiday balance because they’ve worked it.

It is vital to have a clear and consistent policy on bank holidays for all staff, especially those with variable hours. This transparency prevents confusion and ensures everyone is treated fairly.

How Is Final Holiday Pay Calculated When a Worker Leaves?

When a zero-hours worker's employment comes to an end, you are legally required to pay them for any statutory holiday they've accrued but not yet taken. This is non-negotiable.

The calculation is typically based on their accrued entitlement right up to their final day. You’d work out their total holiday allowance for the portion of the leave year they were with you, subtract any leave they’ve already taken, and pay out the remainder in their final payslip.

Using an accurate zero hours contract holiday pay calculator or an automated system makes sure this final figure is precise, helping you avoid any potential disputes long after they've left.

Stop wrestling with spreadsheets and eliminate compliance risks. Leavetrack automates holiday pay calculations, provides real-time visibility for your entire team, and ensures every employee is paid accurately and fairly. Discover how Leavetrack can simplify your leave management today.