How Many Hours in a Working Month A UK Payroll Guide

Posted by Robin on 06 Feb, 2026 in

Right, let's get straight to it. When people ask how many hours are in a working month, they’re usually looking for a quick, reliable number for planning or budgeting.

The short answer is that a typical full-time employee in the UK works somewhere between 158 and 173 hours per month.

That figure is a solid starting point. It’s calculated by taking a standard working week—like 37.5 or 40 hours—and multiplying it by 4.333, which is the average number of weeks in a month. It gives you a great ballpark figure, but it’s not the whole story.

Your Quick Answer to Monthly Working Hours

While the 158 to 173 hours range is a useful estimate, the reality is that the exact number changes from one month to the next. Some months are longer, some have more bank holidays, and so on.

Think of this guide as your roadmap from that quick estimate to total accuracy—the kind you need for spot-on payroll and resource planning. We'll dig into why this number fluctuates, how to calculate it precisely, and the best ways to handle holidays and leave.

To kick things off, here’s a handy table that breaks down the average monthly hours for common UK employment contracts.

Monthly Working Hours At a Glance for Common UK Contracts

This table gives you a snapshot of the average hours based on typical full-time and part-time weekly contracts, using that magic number of 4.333 weeks per month.

| Weekly Contracted Hours | Calculation (Hours × 4.333) | Average Monthly Hours |

|---|---|---|

| 40 hours | 40 × 4.333 | 173.32 hours |

| 37.5 hours | 37.5 × 4.333 | 162.49 hours |

| 35 hours | 35 × 4.333 | 151.66 hours |

| 20 hours | 20 × 4.333 | 86.66 hours |

These numbers provide a solid foundation. But remember, they are averages. For things like payroll where every hour counts, you'll need to go a step further and look at the specific number of workdays in any given month. We cover this in more detail in our guide to the average number of working days in a month.

Understanding the UK Average

So where do these contract hours come from? It helps to look at the official data.

According to the Office for National Statistics (ONS), full-time workers in the UK clocked in an average of 36.5 hours per week in the third quarter of 2025. This figure has held pretty steady since late 2024, after the significant disruptions seen back in 2020. If you’re interested in the trends, you can explore the latest UK working hours statistics.

For HR managers and business owners, this real-world benchmark confirms what we see on the ground: contracts around the 35 to 37.5-hour mark are very much the norm across the country.

Why a Working Month Is a Moving Target

Have you ever found yourself breezing through one month's payroll, only for the next one to feel like a complete headache? The reason is simpler than you might think: there’s no such thing as a standard "working month." It's an idea that ebbs and flows with every flip of the calendar page.

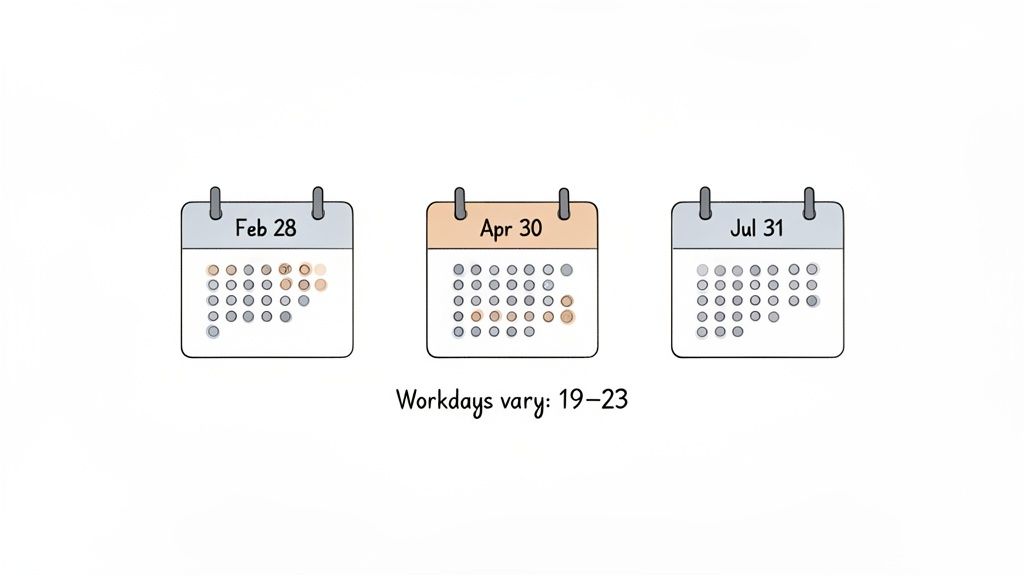

This is exactly why grabbing a single, one-size-fits-all number for monthly hours just doesn’t work for anything that needs real accuracy, like payroll. The number of days in a month bounces around, from 28 in a non-leap year February all the way up to 31 in months like March or August.

This calendar lottery has a direct knock-on effect on the number of available workdays.

The Real Impact of Calendar Variations

Take a short month like February. It might only have 19 or 20 working days. Compare that to a long month like October, which could easily pack in 23. That difference of three or four days might not sound like a big deal, but for a full-time employee, it adds up to a hefty swing in their working hours.

It's a bit like setting your monthly food budget. You wouldn’t budget the same amount for a 28-day month as you would for a 31-day one; your total spend would naturally change. The same logic applies directly to calculating how many hours are in a working month.

For anyone in HR or finance, accepting this fluctuation is the first step towards getting the numbers right. It’s the difference between a rough guess and a figure that will actually stand up to scrutiny, especially when you’re calculating pro-rata pay or overtime.

Treating every month as identical is a recipe for payroll errors, unhappy hourly staff, and a real mess for anyone managing team resources. Think about it: overpaying a new starter or underpaying a leaver can create compliance nightmares and seriously damage team morale.

This is why modern businesses can't afford to just rely on simple averages anymore. To manage your finances and your people fairly, you need methods that adapt to the unique shape of each month. Getting this right ensures everyone—from your newest hire to your most loyal team member—is paid correctly for their time, every single time. Precision isn't just about numbers; it's about fairness and running a tight ship.

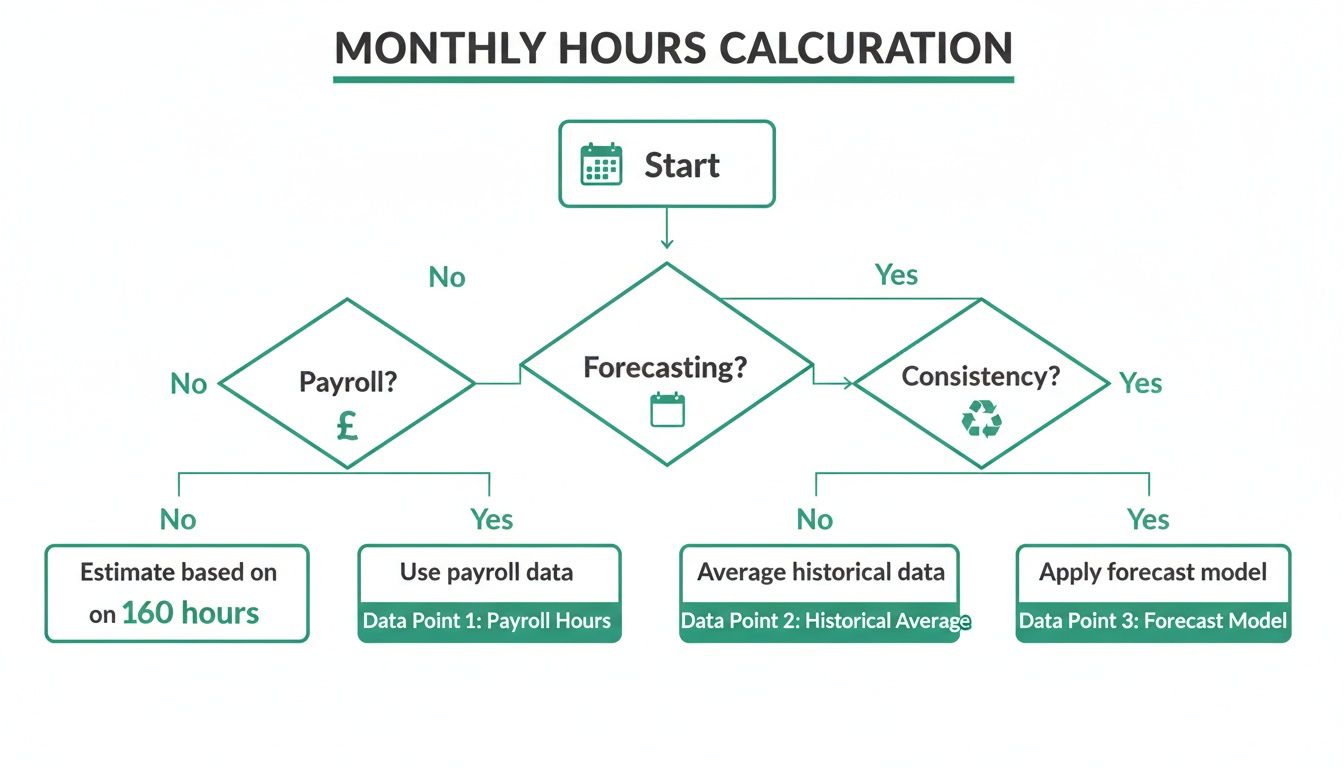

Three Simple Methods to Calculate Monthly Hours

Knowing that the number of hours in a working month is a moving target is one thing, but how do you actually calculate it? Whether you need a quick figure for long-term forecasting or a precise number for this month's payroll, there are specific methods for the job.

Let’s walk through three straightforward approaches, moving from a reliable average to pinpoint accuracy. Each serves a different purpose, ensuring you have the right tool for any HR or finance task that comes your way.

The Average Month Formula

This first method is your go-to for planning, budgeting, and forecasting. It smooths out the monthly variations to give you a consistent, reliable average. Because there are roughly 4.333 weeks in a month (that's 52 weeks ÷ 12 months), you can create a very dependable estimate.

The formula is simple and surprisingly effective for a high-level overview.

Weekly Contracted Hours × 4.333 = Average Monthly Hours

This calculation is perfect when you need to understand annual trends or set budgets without getting bogged down by the specific number of workdays in May versus June. It's the most common way to answer the general question, "how many hours are in a working month?".

The Specific Month Calculation

When it comes to payroll, especially for new starters, leavers, or hourly staff, averages just won't cut it. You need absolute precision. This is where the specific month calculation comes in, as it’s based on the exact number of working days in that particular calendar month.

The formula requires a quick look at the calendar but guarantees you get it right every time.

Working Days in the Month × Daily Hours = Actual Monthly Hours

For example, a full-time employee working 8 hours a day in a month with 22 working days will have 176 payable hours. In a shorter month with only 20 working days, that figure drops to 160 hours. This method is the gold standard for accurate wage calculations.

Automating this process can save a significant amount of time, as shown by tools like the Leavetrack holiday entitlement calculator.

As you can see, such tools handle complex pro-rata calculations instantly, removing the risk of manual error for non-standard work patterns.

The Annualised Hours Approach

A third method, popular in modern contracts for roles with fluctuating demand, is the annualised hours approach. This involves calculating the total hours for the entire year and then dividing that figure by 12 to create a consistent, predictable monthly number for both pay and planning.

Thinking about the whole year first is often a great starting point. In fact, before narrowing down to a month, it's useful to understand how many hours are in a work year.

The formula provides stability across the year.

(Weekly Hours × 52 Weeks) ÷ 12 Months = Consistent Monthly Hours

Using this approach helps manage resources effectively, especially in sectors with seasonal peaks. According to recent ONS data, the average UK full-time work week of 36.5 hours translates to about 158.2 hours per month using this method. However, this varies widely by sector, from 42.2 weekly hours in agriculture to just 26.3 in food services, highlighting the need for robust planning tools.

Real World Examples for Common UK Contracts

Theory is one thing, but seeing how these formulas play out in the real world is where it all clicks. Let's ground these calculations by applying the 'Average Month Method' to the most common full-time contracts you'll find across the UK.

This approach gives you a stable, predictable number that’s perfect for annual forecasting and general resource planning. Think of it as your quick-reference guide for establishing a baseline of how many hours are in a working month before you even start thinking about holidays or sick leave. We'll walk through the simple maths for each standard contract, step by step.

Calculating for a 40-Hour Week

The 40-hour week is a staple for many full-time roles. Using our trusty average of 4.333 weeks per month, the calculation is refreshingly simple and gives us the highest baseline figure of the common contract types.

- Formula: 40 hours × 4.333 weeks

- Result: 173.32 average hours per month

For many businesses, this number is the bedrock for budgeting labour costs or mapping out project capacity for the year ahead.

The decision on which calculation method to use often comes down to your primary goal—whether that's forecasting, payroll accuracy, or contractual consistency.

As the flowchart shows, when consistent annual planning is your top priority, the average month method we're using here is the most sensible path to take.

Calculating for a 37.5-Hour Week

Another incredibly common setup in the UK is the 37.5-hour week. This is often structured as an 8-hour day with a 30-minute unpaid lunch break. The calculation process is identical; we just plug in a slightly lower weekly number.

- Formula: 37.5 hours × 4.333 weeks

- Result: 162.49 average hours per month

Even this small drop in weekly hours makes a noticeable difference to the monthly total, which has a knock-on effect on everything from wage calculations to resource allocation. If you manage roles that require consistent month-to-month pay, you might be interested in learning what annualised hours are and how they work.

Calculating for a 35-Hour Week

Finally, we have the 35-hour week, often seen as a standard 7-hour working day, which still represents a significant slice of UK full-time employment. Applying our average month formula gives us the lowest baseline of the three.

Formula: 35 hours × 4.333 weeks = 151.66 average hours per month

These worked examples give you a solid, practical foundation to build on. Once you're comfortable with these simple calculations, you can confidently estimate monthly workloads and feel assured that your financial forecasting is built on solid ground.

How to Adjust for Holidays, Leave, and Absences

Getting your baseline monthly hours figured out is a great start, but it's really only half the story. The real world of work isn't that neat. It’s filled with bank holidays, much-needed annual leave, and the odd unexpected sick day. These are the variables that mean your initial calculation needs a bit of fine-tuning to get your payroll spot-on.

For your salaried staff, their monthly paycheque usually stays the same regardless of these absences. But for hourly workers, it's a different game entirely – every hour of leave directly hits their final wages. Not accounting for these deductions is one of the quickest ways to end up with payroll errors and unhappy team members.

Refining Your Monthly Hours Calculation

To arrive at a truly accurate figure for payroll, especially for your hourly people, you need a simple adjustment formula. This little equation turns your general estimate into the precise number of hours an employee actually needs to be paid for.

Total Monthly Hours - Hours for Leave/Holidays = Actual Payable Hours

Let's make that real. Say you have an employee on a 40-hour contract, which averages out to 173.32 hours a month. If they take one full day of unpaid leave (8 hours), their payable hours for that month drop to 165.32. This simple tweak is absolutely vital for keeping your financial records fair and accurate.

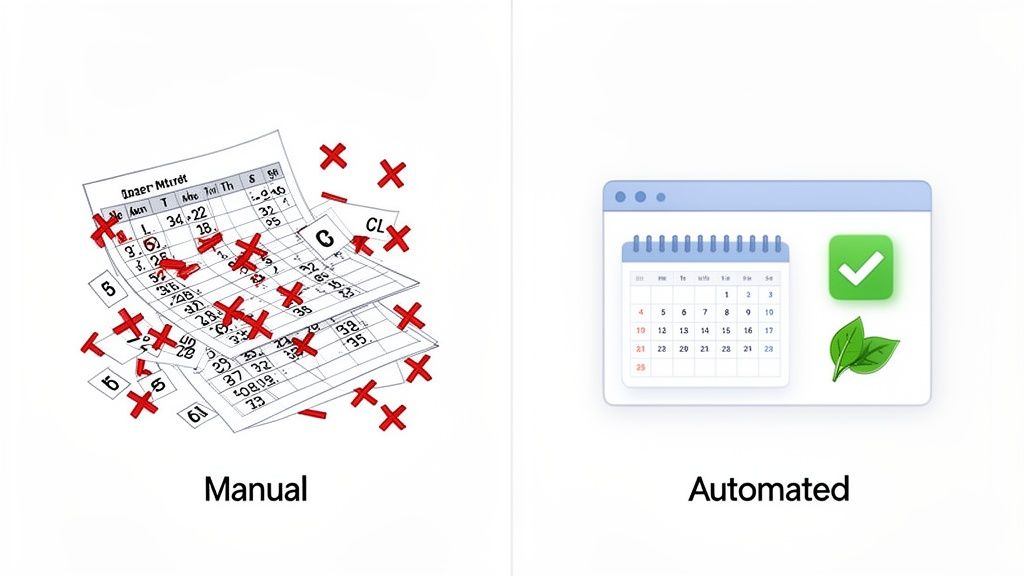

The Headache of Manual Tracking

Trying to track all these moving parts manually across a team can quickly become an administrative nightmare. Juggling spreadsheets, paper forms, and a flood of email requests just to see who's off and when isn't just a time sink; it's a high-risk activity.

A single missed entry or a tiny miscalculation can snowball into an incorrect payslip. That's not just a number on a page – it can damage trust and create a whole lot of unnecessary stress for everyone involved. This is a common pain point for so many businesses, and it really shines a light on the value of automating the process.

Let's look at the bigger picture in the UK. The latest 2025 data shows that the average annual working hours for full-time employees is 1,867. If you break that down, it comes to roughly 155.6 hours per month. This figure is based on a 35.9-hour average week and neatly illustrates how statutory holidays and leave entitlements already shape the national working calendar. You can explore more UK work hour trends on Clockify.me if you want to dig deeper.

What this average shows is that even at a national level, time off is already baked into the numbers. For any business, tracking these deductions accurately month-by-month is essential. It's how you align with these real-world work patterns and make sure every employee is paid correctly for the hours they've actually put in.

From Manual Calculations to Automated Clarity

Are you tired of wrestling with spreadsheets just to figure out how many hours are in a working month? It’s a familiar struggle for many HR and finance teams. Juggling formulas, cross-referencing holiday requests, and manually adjusting for sick leave isn’t just time-consuming—it’s a recipe for errors that can easily lead to payroll disputes and frustrated staff.

This old-school manual approach is incredibly fragile. It relies on perfect data entry every single time, which, let's be honest, is rarely the case. One wrong formula or a forgotten absence can throw everything off.

Moving from these error-prone methods to an automated system is a game-changer. Instead of spending hours chasing down information and double-checking calculations, you get a clear, real-time overview of your team's availability and working hours. The guesswork is completely eliminated.

Empower Your HR and Finance Teams

An automated tool like Leavetrack is designed to handle all this complexity for you. It turns a tedious, monthly headache into a seamless, background process.

- Automatic Leave Accrual: The system tracks holiday entitlement as it’s earned, preventing accidental over-booking and giving employees a clear picture of their balance.

- Integrated Calendars: Everyone gets instant visibility into who is off and when. This makes resource planning and project management a whole lot simpler.

- Simple Reporting: You can generate accurate reports for payroll in just a few clicks, saving hours of administrative work and ensuring everyone gets paid correctly.

This kind of dashboard view provides an immediate, clear summary of team leave, replacing cluttered spreadsheets with insights you can actually use. For a deeper dive into the benefits, check out our guide to online leave management systems.

To really understand the difference, let's compare the two approaches side-by-side.

Manual Spreadsheets vs Leavetrack for Managing Working Hours

| Feature | Manual Spreadsheet | Leavetrack System |

|---|---|---|

| Data Entry | Fully manual; high risk of human error. | Automated requests and approvals; minimal manual input. |

| Accuracy | Prone to formula errors and inconsistencies. | Calculations are automated and consistently accurate. |

| Visibility | Limited; often requires sharing outdated files. | Real-time, central calendar visible to the whole team. |

| Reporting | Time-consuming and requires manual data consolidation. | Instant, customisable reports for payroll and planning. |

| Compliance | Difficult to track and ensure fairness consistently. | Policies are applied automatically, ensuring consistency. |

| Time Investment | Hours of administrative work each month. | Minutes to review and approve; system does the heavy lifting. |

The table makes it clear: while spreadsheets might seem free, the hidden costs in time, errors, and frustration are significant.

The core benefit is shifting your focus from tedious data entry to strategic oversight. An automated system provides reliable data, ensuring fairness for employees and giving managers the confidence to make informed decisions without second-guessing their spreadsheets.

Ultimately, automation simplifies complex payroll adjustments and ensures consistency across the board. To fully streamline how you calculate working hours and integrate them into your payroll, exploring services from payment specialists like those at payments-experts.com can add another layer of efficiency. This move provides the reliable oversight needed to manage a modern workforce effectively.

Got Questions? We’ve Got Answers

Even with the right formulas in your toolkit, a few practical questions almost always pop up when you start applying these calculations to real people. It’s one thing to know the theory, but another to handle the nuances of part-time contracts or bank holidays.

Let's walk through some of the most common queries that land in our inbox.

How Do I Calculate Hours for a Part-Time Employee?

This is much simpler than you might think. You use the exact same logic and formulas as you would for a full-time employee. The only thing that changes is the number of weekly contracted hours you start with.

So, if you're using the average month method for your resource planning:

- Full-time staff (40 hours): 40 hours × 4.333 = 173.32 hours

- Part-time staff (20 hours): 20 hours × 4.333 = 86.66 hours

Keeping this approach consistent is a lifesaver. It’s also absolutely essential for getting their pro-rata holiday entitlement right, ensuring everyone gets the correct amount of leave relative to the hours they actually work.

Are UK Public Holidays Included in a Monthly Salary?

This is a classic point of confusion, and the answer really hinges on the employment contract.

For the vast majority of salaried employees, the answer is a simple yes. Their monthly pay is a consistent slice of their total annual salary, divided by 12. A bank holiday doesn't shrink their paycheque because their pay isn't tied to the exact number of days worked that month.

It’s a different story for hourly workers. They are typically only paid for the hours they physically work. While some contracts might offer paid bank holidays as a perk, it's not a statutory requirement in the UK, so it always comes down to what's written in their agreement.

What Is the Legal Maximum of Working Hours in a Month?

You won't find a hard legal cap on monthly hours in UK law. Instead, the rules are governed by the Working Time Regulations, which set the limit at an average of 48 hours per week.

The key word here is average. This is usually calculated over a 17-week "reference period." This means an employee can absolutely work more than 48 hours in some weeks, as long as their average over that 17-week window doesn't tip over the limit. This works out to roughly 208 hours a month, but it’s a guideline, not a strict monthly cap. It's also worth remembering that employees can voluntarily sign an "opt-out" agreement if they wish to work more hours.

Tired of juggling manual calculations and messy spreadsheets? Leavetrack offers a clear, automated way to manage working hours, holidays, and all types of leave, making sure your records and payroll are always spot on.

Discover how Leavetrack can simplify your absence management.