Legal Holiday Allowance UK: legal holiday allowance uk entitlements

Posted by Robin on 23 Dec, 2025 in

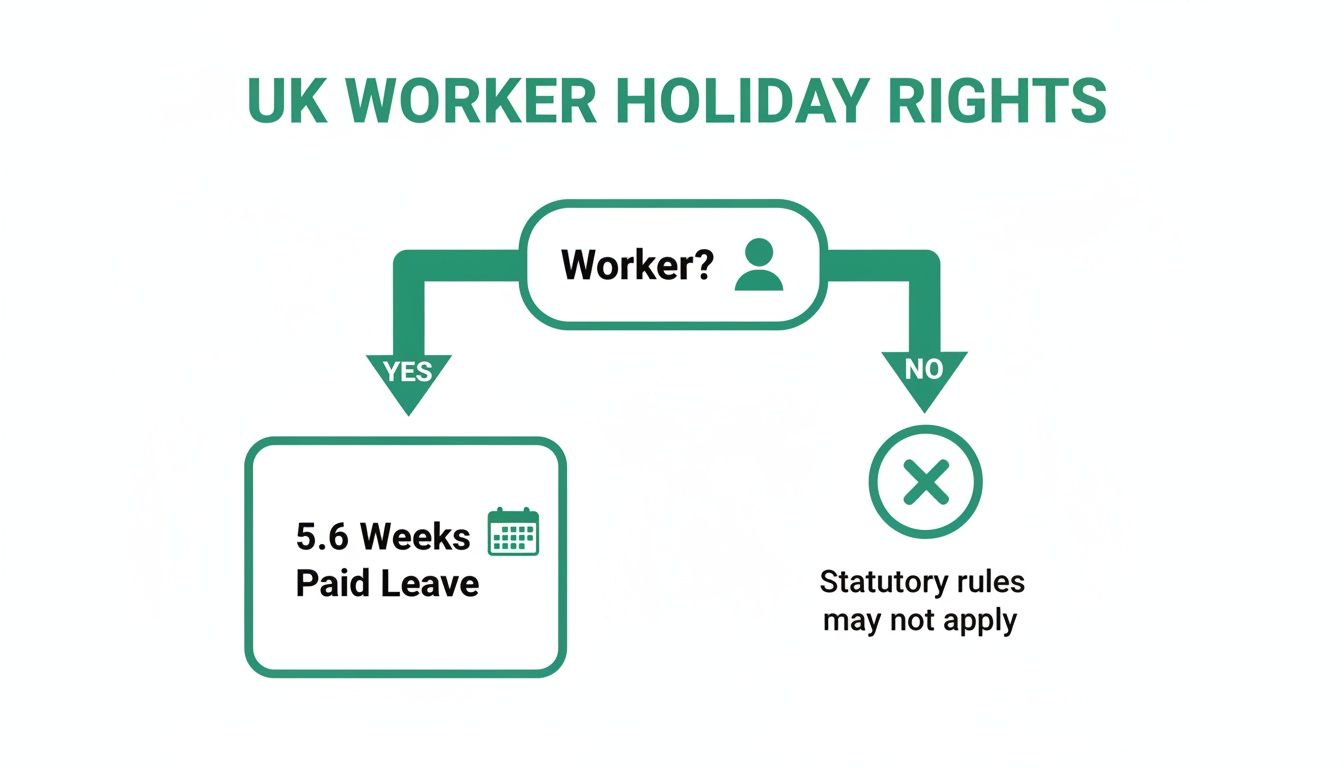

Let's get straight to the heart of UK holiday law. The absolute bedrock is a statutory minimum of 5.6 weeks of paid annual leave for nearly every worker. It’s not a perk; it’s a legal right.

For someone working a standard five-day week, this works out to 28 days of paid time off each year. This is the baseline, the non-negotiable minimum your business must provide.

Understanding Your Core Holiday Entitlement in the UK

Think of this 5.6-week allowance as a fundamental protection designed to ensure everyone gets proper rest and a break from work. This entitlement isn't just for your salaried, full-time staff either—it extends right across your entire workforce, and getting the calculations right is crucial.

This legal minimum covers almost everyone who is legally classified as a 'worker', which is a much broader category than 'employee'. This is a vital distinction for HR to get right, as it pulls in people on all sorts of different contract types.

Who Is Entitled to Paid Leave?

Knowing who qualifies is the first step towards compliant holiday management. The right to paid annual leave is surprisingly broad and includes:

- Full-time and part-time employees: Their entitlement is simply pro-rated based on their working pattern.

- Agency workers: They start accruing holiday rights from their very first day on an assignment.

- Workers on zero-hour contracts: Their leave builds up based on the hours they actually work.

- Part-year and term-time workers: Specific rules are now in place to make sure they get a fair, proportionate holiday allowance.

Getting this right from the outset prevents messy disputes down the line and keeps your organisation on the right side of the law. For a deeper look into the official rules, you can review our detailed guide to GOV.UK holiday entitlement.

To help translate the 5.6 weeks into practical days, here’s a quick reference table based on the number of days an employee works each week.

Statutory Holiday Entitlement at a Glance

| Days Worked per Week | Statutory Minimum Holiday Entitlement (Days) |

|---|---|

| 5 | 28 |

| 4 | 22.4 |

| 3 | 16.8 |

| 2 | 11.2 |

| 1 | 5.6 |

This table clearly shows how the 5.6 weeks statutory minimum is applied on a pro-rata basis, ensuring fairness for your part-time team members.

Demystifying Bank Holidays

Bank holidays are a classic source of confusion for both managers and employees. Here’s the key thing to remember: there is no automatic legal right for a worker to have paid time off on a bank holiday. It’s entirely up to you as the employer to decide how to handle them, as long as you state it clearly in the employment contract.

A very common approach is to include the standard eight bank holidays (in England and Wales) as part of the total 28-day allowance. You’ll often see this worded in contracts as "20 days annual leave plus bank holidays." While this is perfectly fine, the total must always meet that 5.6-week legal minimum.

If you require an employee to work on a bank holiday, that's also fine, but they must still receive their full statutory holiday entitlement to take at another time. You can't use bank holiday working to dip below the minimum 28 days (or pro-rata equivalent).

Calculating Holiday Allowance for Different Work Patterns

Once you've got your head around the core entitlement of 5.6 weeks, the next job is figuring out how to apply it to your entire workforce. It's one thing when you're dealing with a standard Monday-to-Friday employee, but a modern workforce is rarely that simple. Getting this right is absolutely fundamental to running a fair and compliant holiday policy.

This quick decision tree shows the basic principle in action.

As the flowchart shows, the starting line for everyone is the same: if someone is classified as a 'worker', they get 5.6 weeks of paid leave. Simple as that.

Full-Time Employees: The Simple Calculation

Let's start with the easiest one. For a full-time employee who works five days a week, the maths is straightforward. You just multiply the number of days they work each week by the statutory entitlement.

- Calculation: 5 days/week × 5.6 weeks = 28 days of paid annual leave.

This figure is the legal minimum and can include bank holidays. If your company offers more than 28 days, that's a fantastic contractual benefit, but this is the baseline you can't drop below.

Part-Time Employees: The Pro-Rata Principle

For part-time staff, fairness comes from using a pro-rata calculation. This ensures their holiday allowance is directly proportional to the time they work compared to a full-timer.

Take an employee who works three days a week. They're still entitled to 5.6 weeks of holiday, but their 'week' is just shorter.

- Calculation: 3 days/week × 5.6 weeks = 16.8 days of paid annual leave.

It's common practice to round this up to the nearest half or full day (so, 17 days in this case) to make administration easier. Just remember, you must never round down. For a more detailed walkthrough, check out our guide on how to calculate pro-rata holiday entitlement.

A Note on Fairness and Transparency

The pro-rata system is all about preventing discrimination against part-time workers. By making sure their leave is a direct reflection of their hours, you create a level playing field for your whole team – a cornerstone of good HR practice.

Irregular Hours and Zero-Hours Contracts

Working out holiday for staff with no set hours—like casual workers or those on zero-hours contracts—used to be a real headache. Thankfully, there’s now an established and compliant method to follow.

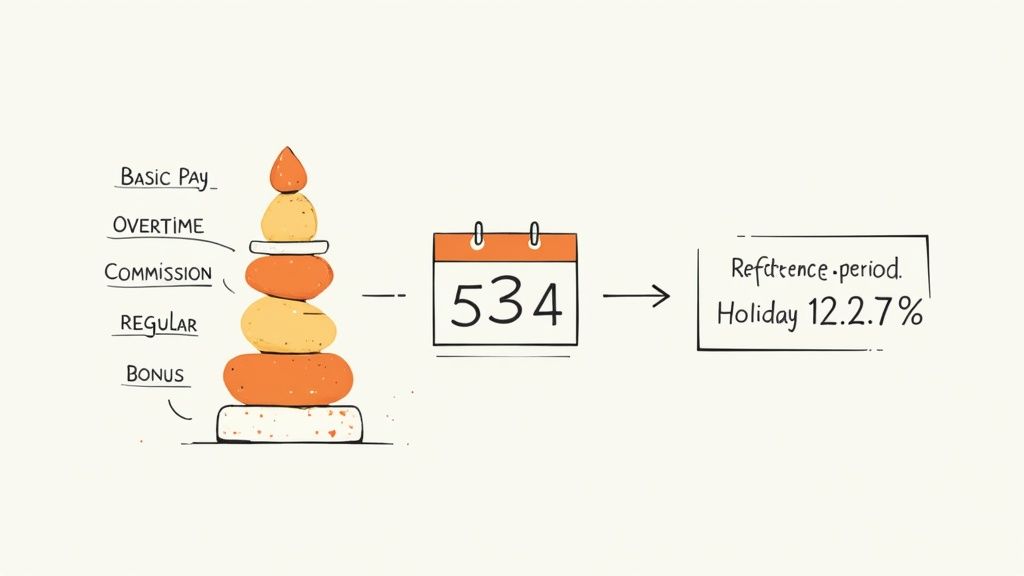

For these workers, holiday entitlement builds up as they work. The most common and government-endorsed approach is to calculate their holiday as 12.07% of the hours they've worked.

This percentage isn't just plucked from thin air. It’s derived from the statutory 5.6 weeks of leave, calculated as a percentage of the remaining 46.4 working weeks in a year (52 weeks - 5.6 weeks). It’s a systematic way to ensure that even your most flexible workers get the holiday they're entitled to.

Let's see this in action with a quick example.

Example Calculation

- An employee on a zero-hours contract works 80 hours in a month.

- To figure out their holiday accrual, you just multiply their hours by the percentage.

- Calculation: 80 hours × 12.07% = 9.656 hours of paid leave accrued.

This method directly links their holiday entitlement to their contribution—the more hours they put in, the more paid leave they earn. For HR and payroll, this means meticulous tracking is essential to keep the balance accurate. This is exactly where a system like Leavetrack can be a lifesaver, automating the calculations and removing the risk of human error.

Mastering Holiday Pay Rules and Calculation Methods

Figuring out an employee's holiday entitlement is only half the battle. You also have to get their holiday pay right, and that’s where things can get tricky. A classic mistake is just paying someone their basic salary when they take a day off. But the law is crystal clear: an employee's holiday pay has to reflect their 'normal' remuneration.

The whole point is to make sure people aren’t financially worse off for taking the annual leave they're entitled to. If someone regularly earns more than their basic pay because of overtime or commission, their holiday pay needs to reflect that higher, 'normal' amount. Getting this wrong can lead to some hefty underpayments and a potential trip to an employment tribunal.

What Counts as Normal Pay

So, what exactly goes into the 'normal pay' pot? This has been hammered out in court over the years, but the general rule is that it includes payments intrinsically linked to the job they do.

Here are the key components you need to include:

- Guaranteed and non-guaranteed overtime: If an employee has to work overtime, it counts. It doesn't matter if the amount varies from week to week.

- Commission payments: For a sales role where commission is a regular part of their earnings, it has to be factored in.

- Performance-related bonuses: Any bonus that's directly tied to the work an employee does should be part of the calculation.

- Regular allowances: Things like shift allowances or standby payments are also considered part of their normal pay.

Basically, if a payment is made regularly enough, it should probably be included. For a more detailed look, our guide on how to use a UK holiday pay calculator made simple breaks it down with more examples.

Using the 52-Week Reference Period

For staff with variable pay, you can't just grab a recent payslip and call it a day. The law requires you to use a 52-week reference period to work out a week's pay for holiday purposes.

This means you look back over the last 52 weeks where the employee actually got paid, skipping any weeks they didn't work or get paid (like during statutory sick leave). Then, you calculate the average weekly pay across those 52 weeks. If someone’s been with you for less than a year, you just use the number of full weeks they've worked.

Why 52 Weeks?

The 52-week reference period is designed to create a fair average. It smooths out the peaks and troughs in someone's pay—like a busy season with lots of overtime or a quiet one with less commission—to make sure the final holiday pay figure is a true reflection of what they normally earn.

Rolled-Up Holiday Pay for Irregular Hours Workers

For a long time, 'rolled-up holiday pay'—adding a bit extra to a worker's regular pay instead of them taking paid leave—was technically unlawful. However, the legal ground here has shifted quite a bit recently.

Since 1 April 2024, the rules have changed, giving employers more flexibility for workers with irregular or part-year hours. Now, you have the choice to either let them accrue a bank of leave or pay them rolled-up holiday pay. It’s a much more practical solution for certain types of work.

This is now a legally sound option, but only for two specific groups of workers:

- Irregular-hour workers: People whose paid hours are completely or mostly variable in each pay period.

- Part-year workers: Those who are only required to work for part of the year, with periods of at least a week where they aren't working and aren't paid.

For these workers, you can 'roll up' their holiday pay by adding a 12.07% uplift to their regular pay for the hours they work. This has to be clearly shown as a separate item on their payslip. While it simplifies the admin, it's vital you only use it for the right people to stay on the right side of the law.

Managing Public Holidays and Leave Carryover Policies

Sorting out the rules for public holidays and unused leave are two of the most frequent headaches for any manager. It’s a common minefield. Many employees just assume bank holidays are an automatic paid day off, while the regulations for carrying leave over from one year to the next can feel needlessly complicated.

Let's cut through the confusion and map out a clear, compliant path forward.

First, let's bust a widespread myth: employees do not have a statutory right to paid time off on bank holidays. It's simply not true. As an employer, you can absolutely require staff to work on a bank holiday, and there's no automatic legal right for them to get a higher pay rate for doing so.

The only real legal obligation is that an employee receives their full 5.6 weeks of statutory annual leave. How you decide to handle bank holidays within that total is entirely a matter for the employment contract.

Public Holiday Policy Traps to Avoid

One of the most common phrases you'll see in a contract is something like "20 days annual leave plus bank holidays." It seems simple enough, but this wording can quickly land you in hot water. For instance, in years with extra bank holidays for national events (like a Jubilee), this phrasing could mean you're unintentionally giving out more leave than you planned for.

On the flip side, some years have fewer bank holidays that fall on actual weekdays. If your contract just says "20 days plus bank holidays," an employee could end up with fewer than the legal minimum of 28 days, putting your business in direct breach of the law.

The Compliance Golden Rule

Your employment contracts should always guarantee the statutory minimum of 5.6 weeks (or 28 days for full-time staff) as the absolute baseline. Wording like "28 days annual leave, inclusive of bank holidays" is often the safest bet, as it keeps you compliant no matter how many bank holidays pop up in any given year.

Understanding Leave Carryover Rules

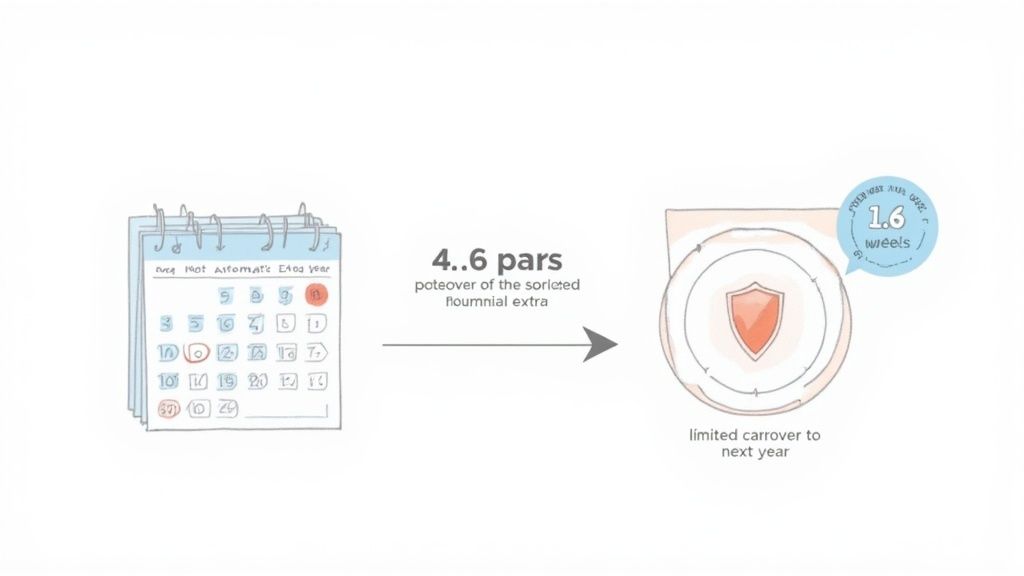

So, what happens when someone doesn’t use all their holiday entitlement by the end of your leave year? The rules for carrying over leave are quite specific and depend entirely on the type of leave we’re talking about. For this purpose, the statutory 5.6 weeks are split into two distinct pots.

- 4 Weeks (EU-derived leave): This is the core portion of leave. It generally cannot be carried over, sticking to a strict "use it or lose it" principle. The whole point of this leave is health and safety – making sure people actually take a proper break. The only real exceptions are when a worker is physically unable to take it due to long-term sickness or family-related leave like maternity.

- 1.6 Weeks (UK-derived leave): This extra bit of leave is more flexible. As an employer, you can agree in writing (via the contract or a clear company policy) to allow this portion to be carried over into the next leave year.

It’s crucial to remember that if you don’t have a written agreement in place, the default position is that none of this extra 1.6 weeks can be carried over.

Legally Protected Carryover Scenarios

While your company policy will dictate most carryover situations, there are a few scenarios where employees have a legal right to carry unused holiday forward. You need to know these inside out to avoid disputes.

The main situations are:

- Long-Term Sickness: If an employee is on long-term sick leave and simply cannot use their holiday, they are legally entitled to carry over up to 4 weeks of their statutory leave. This carried-over leave must then be used within 18 months from the end of the leave year in which it was accrued.

- Family-Related Leave: An employee on statutory leave such as maternity, paternity, or adoption leave must be allowed to carry over any untaken portion of their full 5.6-week entitlement into the next leave year.

Ultimately, creating a clear, written policy is the best way to manage everyone’s expectations. A modern leave management system like Leavetrack can automate these complex rules, ensuring carryover balances are calculated correctly and applied consistently. This removes the risk of human error and makes sure your policies are followed every single time.

How Annual Leave Interacts with Sickness and Termination

The relationship between annual leave, sickness, and an employee's departure can create some of the most complex admin headaches for HR teams. Getting these situations right isn't just about good practice; it’s about meeting your legal obligations, treating people fairly, and avoiding messy disputes down the line.

One of the most important principles to get your head around is that statutory holiday entitlement continues to build up, or accrue, even when an employee is off sick. Their absence doesn't hit a pause button on their right to paid holiday. This is a crucial detail, especially when you're managing long-term sickness absence.

Sickness During a Pre-Booked Holiday

So, what happens if an employee gets ill just before or during a holiday they've already booked? This is a classic point of confusion, but the legal position is crystal clear. An employee has the right to reclassify that time as sick leave.

This means the days they were unwell are treated as sickness absence, and the holiday days are effectively refunded to their leave balance. Simple as that. They can then re-book that holiday for another time, following your usual process.

To manage this properly, you should:

- Insist they follow your standard sickness reporting procedure, even if they're on a beach somewhere.

- Ask for a doctor's note or other evidence of their illness, just as you would for any other sick day.

This approach makes sure the employee doesn't lose out on the proper rest and recuperation that holiday is for – which is the entire point of the legal holiday allowance uk. When you're dealing with longer periods of sickness, resources like guidance on fitness to work assessments can be invaluable for managing those tricky health-related employment matters that cross over with annual leave.

Calculating Holiday Pay on Termination

When an employee leaves the business, you absolutely must calculate a final payment for any statutory holiday they've accrued but not taken. This is often called 'payment in lieu of holiday' and it's a non-negotiable legal requirement that has to be on their final payslip.

The calculation itself is pretty straightforward:

- Start with their total annual entitlement (e.g., 28 days).

- Work out how far into the leave year they are (e.g., 6 months is 50%).

- Calculate the pro-rata holiday they've earned for that period (e.g., 50% of 28 days = 14 days).

- Subtract any holiday they've already used.

- The number you're left with is what you owe them in their final pay.

Final Pay Example

An employee with a 28-day entitlement leaves exactly halfway through the leave year. They've earned 14 days but have only taken 8. You must pay them for the remaining 6 days of untaken leave.

Handling Excess Holiday Taken

But what about the flip side? What if someone leaves after taking more holiday than they've actually earned? Can you get that money back?

The short answer is yes, but only if you have the right clause in your employment contract.

Without a specific, clearly worded clause that gives you the right to deduct pay for excess holiday taken on termination, you legally can't touch their final salary. This small contractual detail is vital for protecting the business. It's a critical compliance action to review your employment contracts and make sure that clause is in there.

Common Questions About UK Holiday Allowance

Once you get past the basic calculations, you quickly run into the tricky, real-world situations that pop up day-to-day. Let's tackle some of the most common questions that HR managers and team leaders grapple with, so you can handle them with confidence.

Can We Make an Employee Take Their Holiday?

This one comes up a lot, especially around Christmas shutdowns or quiet periods. The short answer is yes, you absolutely can. An employer can tell staff when to take their leave.

The key is giving the proper notice. The rule is simple: you must give at least double the notice for the length of the holiday you want them to take. So, if you're closing for a week (5 working days), you need to tell your team at least 10 days in advance.

What Happens if Someone Works on a Bank Holiday?

There's a common misconception that working a bank holiday automatically means extra pay. This isn't true. An employee's right to premium pay (like time-and-a-half) depends entirely on what's written in their employment contract.

From a legal standpoint, the main thing is that they still receive their full 5.6 weeks of statutory leave over the course of the year. A bank holiday is just a normal working day unless the contract says otherwise.

Watch Out for This Common Contract Trap

Be very careful with contract wording like '20 days plus bank holidays'. While it seems straightforward, it can easily trip you up and lead to non-compliance.

For instance, some employers offer what looks like a generous '28 days annual leave plus bank holidays'. But what happens when the number of bank holidays changes, like for a Jubilee? Or, more commonly, what if it dips? In the 2024-25 holiday year, England and Wales only had seven bank holidays. An employee on that contract would have received just 27 days off, putting them one day short of the legal minimum. You can discover more insights about UK holiday entitlement to avoid these pitfalls.

Can We Refuse a Holiday Request?

Yes, you can. As long as you have a genuine business reason for the refusal (like ensuring departmental cover), you are well within your rights. The notice you have to give is at least the same length as the holiday requested. For example, if an employee requests two weeks off, you must let them know you're refusing it at least two weeks before their planned start date.

Juggling all these rules, contract clauses, and notice periods manually is a huge administrative headache and a serious compliance risk. A slip-up can be costly.

Tools like Leavetrack take the pressure off by automating all the calculations, tracking leave in real-time, and giving everyone a clear, central place to see requests and balances. It ensures your policies are applied fairly and correctly, every single time.