Legal Holiday Entitlement UK: legal holiday entitlement uk explained

Posted by Robin on 04 Feb, 2026 in

Let's get straight to it: UK law is crystal clear that every single worker is entitled to 5.6 weeks of paid annual leave.

For someone working a standard five-day week, that works out to a non-negotiable minimum of 28 days of paid holiday each year. This isn't a perk or something you earn over time; it's a fundamental right from the very first day on the job.

Understanding UK Statutory Holiday Entitlement

Think of this statutory entitlement as the foundation of your entire holiday policy. It's the legal floor—the absolute minimum you must provide. Nailing this basic concept is crucial before you even think about the more complex stuff, like calculating leave for part-timers or adding extra contractual days.

This universal 'leave allowance' is all about fairness. The 5.6-week rule ensures that everyone gets a proportional amount of holiday, no matter their working pattern. A part-time employee working three days a week gets 16.8 days (5.6 weeks x 3 days), while someone on a four-day week gets 22.4 days. It's a simple, scalable system. If you want to dive deeper, you can explore the government's guidance on minimum holiday entitlement rules in the UK.

What About Bank Holidays?

This is where things often get confused. A common myth is that employees have an automatic right to take bank holidays off. They don't. The law is surprisingly flexible here—there's no automatic legal right for an employee to have bank holidays off, paid or otherwise.

As an employer, you can choose to include the eight bank holidays (in England and Wales) as part of that statutory 28-day total.

For example: If your company shuts down on all eight bank holidays and you give these to staff as paid leave, you only need to provide another 20 days of annual leave to meet the 28-day minimum.

Of course, you could also offer the bank holidays in addition to the 28 days, but that's a contractual perk, not a legal requirement. The key takeaway is to be completely transparent about your approach in the employment contract to avoid any misunderstandings down the line.

Proportional Leave for Part-Time Workers

The beauty of the 5.6-week rule is how neatly it scales for part-time staff. To figure out their pro-rata entitlement, you just multiply 5.6 by the number of days they work each week. This ensures their holiday allowance is directly proportional to a full-time colleague's.

To give you a quick summary of how this works, we've put together a simple table.

Statutory Holiday Entitlement at a Glance

This table breaks down the minimum legal entitlement for employees based on the number of days they typically work per week.

| Days Worked Per Week | Calculation (5.6 Weeks x Days) | Minimum Annual Leave Days |

|---|---|---|

| 5 Days | 5.6 x 5 | 28 Days |

| 4 Days | 5.6 x 4 | 22.4 Days |

| 3 Days | 5.6 x 3 | 16.8 Days |

| 2 Days | 5.6 x 2 | 11.2 Days |

| 1 Day | 5.6 x 1 | 5.6 Days |

As you can see, the calculation is straightforward. This simple formula is the bedrock of fair and legally compliant holiday management for your entire team.

Calculating Holiday for Different Work Patterns

The standard 5.6-week rule is simple enough for full-time staff, but today's workforce is far more diverse. To stay fair and on the right side of the law, you need to know how to translate this entitlement for your part-time, fixed-term, and irregular-hours team members.

The guiding principle here is pro-rata. It’s a straightforward idea: you simply adjust the holiday allowance proportionally based on the hours or days someone actually works. For most non-full-time roles, it's a direct comparison to the full-time equivalent, ensuring everyone gets their fair share of paid time off.

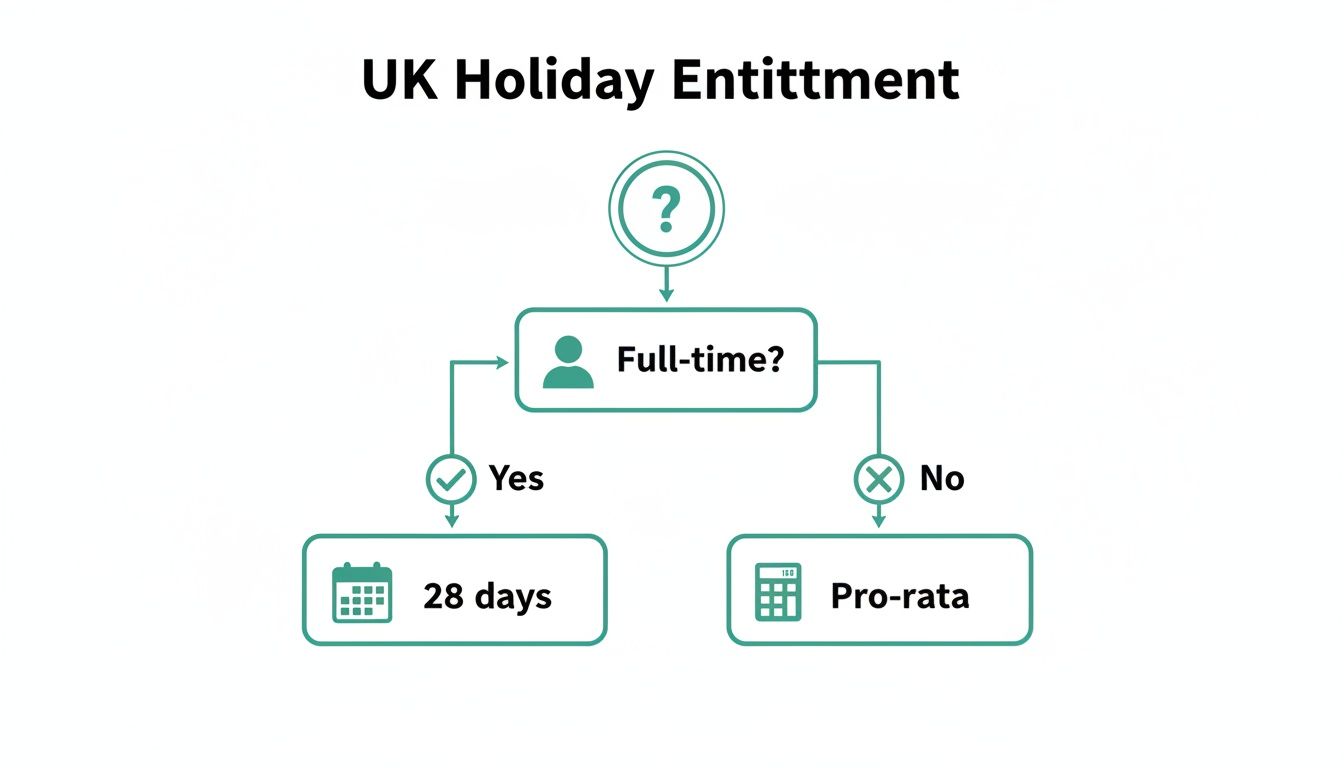

This flowchart gives you a quick visual on where to start when figuring out an employee's holiday entitlement.

As you can see, the first question is always whether the person is full-time. If not, you’ll need to do a pro-rata calculation to make sure their holiday allowance is proportional to the hours they put in.

Part-Time and Fixed-Term Workers

Calculating holiday for a part-time employee is just a bit of simple multiplication. If your full-time staff, working five days a week, get 28 days off, then someone working three days a week is entitled to 60% of that.

The calculation looks like this: 28 days x (3 ÷ 5) = 16.8 days. Most employers round this up to the nearest half or full day, so you’d grant them 17 days. Easy.

The same logic works for fixed-term contracts. An employee on a six-month contract gets half of the annual allowance, which is 14 days (28 ÷ 2). Their entitlement is directly tied to how long they’re with you during the leave year.

The Challenge of Irregular Hours and Part-Year Work

Things get a little trickier for workers with no set hours, like those on zero-hours contracts or people who only work during term time. For these roles, holiday entitlement builds up based on the hours they actually work.

Thankfully, the government has recently clarified the rules to make life simpler. For leave years starting on or after 1 April 2024, you can use a consistent accrual method. Holiday is calculated as 12.07% of the hours worked in a pay period.

Why 12.07%? This figure isn’t random. It represents the statutory 5.6 weeks of holiday as a percentage of the remaining 46.4 working weeks in a year (5.6 ÷ 46.4 = 12.07%). It's the standard, government-approved multiplier for this exact situation.

Using this method ensures that someone's holiday entitlement scales perfectly with the hours they work. It’s a fair system that prevents you from either underpaying or overpaying them for their time off.

Putting the 12.07% Method into Practice

Let's walk through a real-world example. Say you have an events team member on a zero-hours contract who helps out during busy periods.

- Scenario: In May, they work a total of 80 hours.

- Calculation: 80 hours x 12.07% = 9.66 hours of paid holiday accrued.

- Result: They've earned just under 10 hours of paid leave for their work that month.

You'd run this calculation at the end of each pay period, letting their entitlement build up over time. It brings much-needed clarity, especially in sectors like hospitality and events where work patterns can fluctuate wildly. To dig deeper into these rules, you can learn more about how to manage holiday entitlement on a zero hour contract in our detailed guide.

Another classic example is a term-time worker, like a school canteen assistant, who works 39 weeks a year. They are still entitled to their 5.6 weeks of holiday, but they must take it during school holidays. Their holiday pay would then be calculated using their average earnings over a 52-week reference period.

By getting comfortable with these calculation methods, you can confidently manage the legal holiday entitlement UK regulations for every single person on your team, no matter their contract. This approach cuts down on errors, prevents disputes, and makes sure every employee feels they’re being treated fairly.

Managing Holiday Pay and Rolled-Up Pay

Figuring out the hours an employee is owed is one thing, but making sure you pay them correctly for that time off is where the rubber really hits the road for compliance. The law is pretty straightforward: when an employee is on holiday, they must receive their 'normal' pay. Sounds simple, right? But 'normal' can get complicated, fast, because it’s not just about their basic salary.

For many people, their regular income is a mix of different elements, and holiday pay needs to reflect that. You’ve got to account for payments they would have otherwise earned if they'd been at work. This means factoring in things like regular overtime, commission, and performance-related bonuses. If you overlook these, you’re looking at underpayment and a potential trip to a tribunal.

Calculating a Week's Pay

So, what exactly is a 'week's pay' for someone whose income bounces around? The law gives us a clear method: the 52-week reference period. To get this right, you have to look back over the last 52 weeks that the employee actually got paid and calculate their average weekly earnings.

This approach effectively smooths out any peaks and troughs in their pay, giving you a fair picture of their normal remuneration. It ensures that an employee who regularly puts in extra hours doesn’t take a financial hit just for taking a well-earned break. For a deep dive into the nuts and bolts, check out our UK Holiday Pay Calculator Made Simple guide.

This 52-week rule isn't just for a few edge cases. It applies to any payment that’s fundamentally linked to the tasks they’re required to do under their contract. The main things to include are:

- Compulsory Overtime: If overtime is a requirement of the job, it must be in the calculation.

- Voluntary Overtime: Even if it’s not required, if it’s worked with enough regularity, it should be included too.

- Commission Payments: Sales commissions that are a regular part of their earnings have to be factored in.

- Performance Bonuses: Any bonus tied directly to the work they do should be part of the mix.

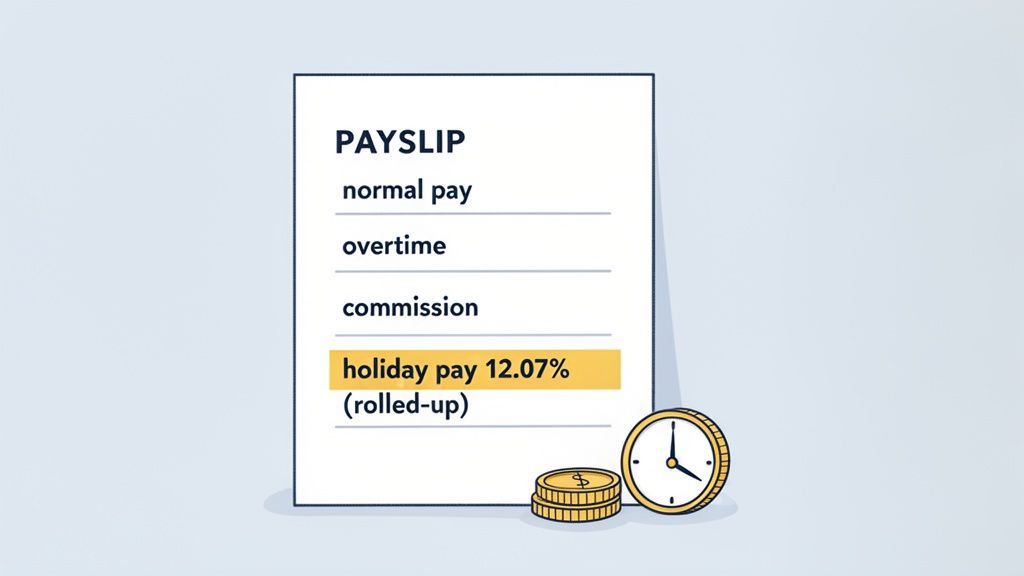

The Return of Rolled-Up Holiday Pay

You might remember that for a long time, 'rolled-up holiday pay' was a no-go. This is the practice of adding a bit extra to a worker's regular pay packet to cover their holiday pay, instead of paying them when they actually take leave. For years, it was deemed unlawful.

However, recent legal reforms have completely changed the game for certain groups of workers, bringing this method back into compliant territory.

Big changes to UK holiday entitlement came into effect from January 2024, overhauling the rules for irregular hours and part-year workers. The new system introduces a simplified 12.07% accrual rate, which is applied to the hours they’ve worked at the end of each pay period (capped at 28 days a year). This makes 'rolled-up' holiday pay a legitimate option again, allowing these workers to receive their holiday pay with each payslip and cutting down on the admin headache for employers.

It's a practical fix for managing the legal holiday entitlement UK rules for roles where hours are all over the place.

How Rolled-Up Pay Works in Practice

Putting rolled-up holiday pay into practice has to be done carefully. It’s not just a case of paying a bit extra. You need to add a specific uplift of 12.07% to a worker's pay for the hours they worked in that pay period. This payment replaces the pay they would get when they take a holiday.

Key Compliance Point: For rolled-up holiday pay to be lawful, it must be clearly itemised on the worker's payslip. Simply absorbing it into their hourly rate is not sufficient and could expose your business to claims of underpayment.

Let's say an irregular-hours worker earns £500 in a month. Here’s how you’d calculate their rolled-up holiday pay:

- Calculation: £500 x 12.07% = £60.35

- Payslip: The payslip must show the £500 for their work, plus a separate, clearly labelled line for the £60.35 holiday pay.

This transparency isn't optional. It’s proof that you’re meeting your legal duties and helps the worker see exactly what they're being paid for. Getting this wrong is a costly mistake waiting to happen, so your payroll process needs to be spot on.

Rules for Carrying Over Annual Leave

“What happens to my leftover holidays?” It’s one of the most common questions you’ll hear as the leave year draws to a close. The simple answer is that the law expects people to take their holiday entitlement within the year it’s earned. But real life is rarely that neat.

To get your head around the carry-over rules, you first need to know that the statutory 5.6 weeks of leave are split into two pots. This split is a hangover from EU law, but it’s still crucial for figuring out what can and can’t be carried forward.

- Pot 1 (EU-derived leave): The first 4 weeks of annual leave come from the European Working Time Directive.

- Pot 2 (UK-specific leave): The extra 1.6 weeks are an additional entitlement granted under UK law.

Generally, an employee can only carry the extra 1.6 weeks into the next leave year, and only if you’ve agreed to it in writing. The core 4 weeks? They’re a ‘use it or lose it’ deal. But, like most rules, there are some important exceptions.

When Carrying Over Leave Is a Legal Right

Sometimes, the law steps in and overrides your company policy, giving employees a legal right to carry over their holiday. This usually happens when someone has been genuinely unable to take their leave for reasons completely out of their control. These protections ensure nobody is forced to choose between resting and dealing with a major life event.

Simply forgetting to book time off or being too busy at work won’t cut it. The circumstances have to be significant and legally recognised.

Important Takeaway: The law ensures an employee doesn’t have to sacrifice their right to rest (annual leave) because they need to recover from a serious illness or take statutory family leave. They’re entitled to both.

Here are the main scenarios where carrying over becomes a legal right:

- Long-term Sickness: If an employee is on long-term sick leave, they still accrue their holiday. If they’re too ill to take it, they have a right to carry over up to 4 weeks of that leave.

- Statutory Family Leave: This covers maternity, paternity, adoption, or shared parental leave. Any of the 5.6 weeks of statutory leave that an employee can’t take because they’re on this type of leave can be carried forward to the next year.

These rules make sure the legal holiday entitlement UK regulations are applied fairly, even when someone is away from work for a long stretch.

How Long Do They Have to Use Carried-Over Leave?

Just because leave can be carried over doesn't mean it sits on the books forever. There are clear deadlines, and knowing them is essential for managing your team’s leave balance and staying compliant.

For leave carried over due to long-term sickness, the rule is very specific. The employee must use the holiday within 18 months from the end of the leave year in which it was accrued.

Let’s walk through an example: Imagine an employee is off sick from June 2024 right through to April 2025. Your company’s leave year is January to December.

- They accrue their full holiday entitlement for the 2024 leave year.

- They can’t take it because they’re unwell.

- They have the right to carry over up to 4 weeks of this leave.

- They must then use this carried-over leave by the end of June 2026 (18 months after the end of the 2024 leave year).

This 18-month window gives everyone plenty of time to plan for the leave once the employee returns. For leave carried over due to maternity or other family leave, the rule is simpler: it just has to be taken in the following leave year.

Creating a Fair and Compliant Carry-Over Policy

While the law sets the minimum, you’re free to offer more generous terms in your holiday policy. A well-defined policy provides clarity for everyone and helps you manage staffing levels without any nasty surprises.

When building your policy, think about:

- How many days can be carried over? You could stick to the statutory minimum of 1.6 weeks (that’s 8 days for a full-timer) or offer more as a contractual perk.

- What’s the deadline for using it? A common approach is to require carried-over leave to be used within the first three months of the new leave year (e.g., by 31st March). This stops a huge bank of leave building up and causing resourcing headaches later on.

- What's the approval process? Clarify if a manager needs to sign off on it and if there are any blackout periods where carried-over leave can’t be booked.

Having a clear, written policy managed through a system like Leavetrack is the best way to prevent arguments and ensure fairness. It lets you track carried-over leave automatically, cutting down on the admin and making sure your business stays compliant.

Sickness, Maternity, and Leaving a Job: The Tricky Scenarios

Holiday entitlement rarely exists in a vacuum. It often bumps up against other types of leave and big moments in the employee lifecycle, creating some genuinely tricky situations that need careful handling. Getting these interactions right is key to being fair and, crucially, staying on the right side of the law.

An employee’s right to paid holiday doesn’t just switch off when they’re away from work for a long time. This is a common point of confusion. The bottom line is that holiday entitlement still accrues during sick leave and statutory family leave, like maternity or paternity. Workers are protected from losing this fundamental benefit just because they are unwell or starting a family.

This principle is incredibly important. It means an employee on long-term sick leave doesn't have to choose between their health and their holiday. They can even ask to take annual leave during their sickness absence, which some people do to top up their statutory sick pay.

Holiday Accrual During Sickness and Family Leave

When an employee is off on long-term sick leave, their statutory holiday entitlement keeps building up just as if they were at their desk. The exact same rule applies to anyone on maternity, paternity, adoption, or shared parental leave. They aren't penalised for taking this protected time away.

So, what happens if they can't use it? If an employee is unable to take their holiday because they’re on sick leave, they have the right to carry over up to four weeks of that leave. For statutory family leave, any of the full 5.6 weeks that couldn’t be taken can be carried forward into the next holiday year.

Crucial Insight: Holiday entitlement is a fundamental worker's right that is preserved during periods of sickness and statutory family leave. An employee cannot be asked to forfeit this time, ensuring they can still benefit from paid rest upon their return.

This protection is a cornerstone of the legal holiday entitlement UK framework. It reinforces that sick leave and annual leave serve two very different purposes—one is for recovery, the other is for rest and relaxation.

Handling Leave When an Employee Resigns

When someone leaves the company, one of the last bits of admin is sorting out their final holiday pay. This is a classic area for disputes, so having a clear, consistent process is absolutely vital for a smooth exit.

The calculation itself is pretty straightforward. It's based on how much leave the employee has accrued up to their last day, minus any holiday they’ve already taken. This makes sure they get paid for any time they've earned but not used.

A standard way to work this out is:

- Calculate the proportion of the leave year worked: (Number of days from the start of the leave year to their leaving date) ÷ 365 days.

- Determine accrued holiday: (Total annual entitlement) x (Proportion of the year worked).

- Final Payout: (Accrued holiday) - (Holiday already taken) = Days to be paid out in their final salary.

For example, an employee with a 28-day entitlement who leaves exactly halfway through the year would have accrued 14 days. If they’d only taken 10 days, you’d owe them payment for the remaining four.

What if an Employee Has Taken Too Much Leave?

Now and then, you get the opposite problem—an employee leaves having taken more holiday than they’ve actually accrued. This often happens when someone takes a big holiday early in the year and then hands in their notice.

Whether you can reclaim the cost for this "borrowed" time depends entirely on one thing: what’s in their employment contract.

To recover the money, you must have a specific, clearly worded clause in the contract that explicitly gives you the right to deduct the value of unearned holiday from their final pay. If that clause isn't there, any deduction would be unlawful, and you could be facing a claim. It’s as simple as that.

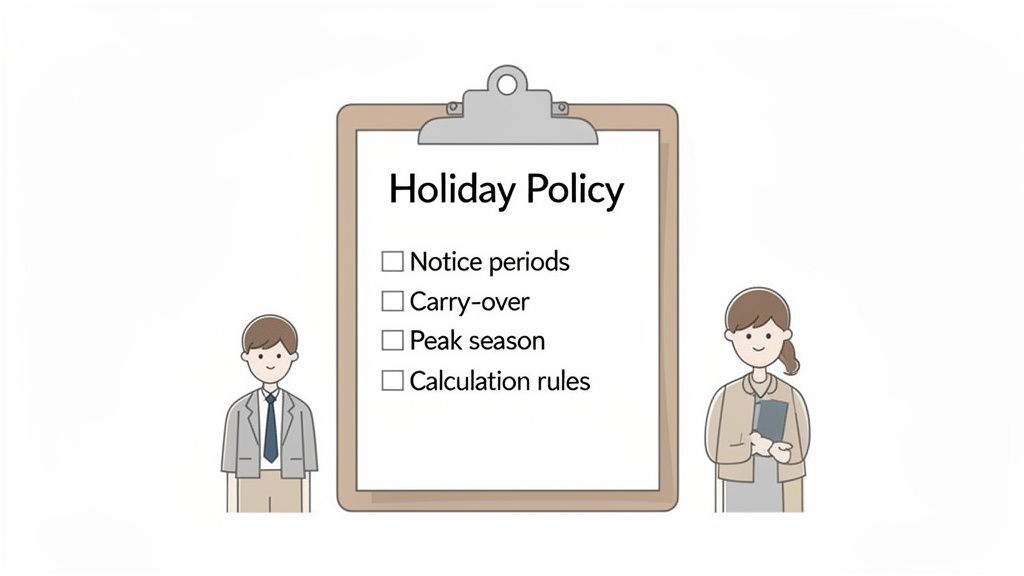

Creating a Compliant and Clear Holiday Policy

Getting your head around the legal theory is one thing, but turning that knowledge into a clear, fair, and practical holiday policy is where the real work begins. This is how you prevent future headaches. A solid annual leave policy is far more than just a document; it's the tool that brings clarity to your team, guarantees everyone is treated the same, and protects your business from disputes.

Think of your policy as the company's rulebook for time off. It closes the gap between the law and day-to-day operations, answering the common questions before they even get asked. This document needs to be easy for everyone to find, simple to understand, and applied consistently across the board, from the newest hire right up to senior management. Without it, you’re opening the door to misunderstandings, claims of unfairness, and a whole lot of admin pain.

Essential Components of Your Holiday Policy

A really good holiday policy leaves no room for doubt. It must clearly spell out how to request, approve, and manage leave. When it's structured well, it becomes the single source of truth, saving managers time and cutting down on employee frustration.

Here are the absolute must-haves for your policy:

- Leave Year Dates: State clearly when your company’s holiday year runs (e.g., 1st January to 31st December).

- Entitlement Details: Specify the total holiday allowance. Explain how it’s calculated for different working patterns and make it clear whether bank holidays are included or are on top.

- Request Process: Detail how your team should request leave (for example, through a system like Leavetrack) and the notice period they need to give.

- Approval Workflow: Explain who signs off on requests and how long they can expect to wait for an answer.

- Rules for Peak Times: Outline any restrictions on taking leave during busy periods or "blackout dates" to keep the business running smoothly.

- Carry-Over Rules: Define your company's stance on carrying over unused leave, including any limits and deadlines.

A clear, accessible policy is your first line of defence against disputes. By setting expectations upfront, you create a transparent system where employees and managers understand their rights and responsibilities, which is fundamental to maintaining a fair workplace.

Practical Implementation and Tools

With a solid policy in place, the next job is putting it into action. This really means moving away from messy spreadsheets and paper forms and toward a more reliable system. Using a central platform helps enforce your policy rules automatically, ensuring you stay compliant with legal holiday entitlement UK regulations.

For instance, this dashboard from Leavetrack gives you a clear visual overview of team leave, making it simple to track requests and balances at a glance.

This kind of visibility allows managers to make informed decisions about approvals, preventing staff shortages and ensuring requests are handled fairly. To help you get started, you can find some great inspiration and best practices by checking out our template annual leave policy, which really simplifies the process of creating your own guidelines.

Your Holiday Entitlement Questions, Answered

Let's be honest, the finer points of UK holiday law can get a bit tricky. It’s no surprise that a few common questions pop up time and time again for both managers and their teams. Here are some quick, straightforward answers to the queries we hear most often.

Can an Employer Refuse a Holiday Request?

In short, yes. A manager can turn down a holiday request, but not on a whim. There has to be a solid business reason behind the decision. This could be anything from making sure there’s enough cover during a peak period to preventing too many team members from being off at once.

Your company’s holiday policy should clearly state how much notice an employee needs to give. As long as the business gives the correct notice for the refusal, it's perfectly legal. The rule of thumb is that the notice must be at least as long as the leave requested. So, to refuse a one-week holiday request, you need to let the employee know at least one week before their holiday was due to start.

Does Holiday Entitlement Expire if Unused?

For the most part, yes. The statutory minimum of 5.6 weeks generally operates on a 'use it or lose it' basis within the leave year. The goal is to make sure people are actually taking their rest. However, there are a few important exceptions where the law protects an employee's right to carry leave over.

If an employee couldn't take their holiday because they were on long-term sick leave or statutory family leave (like maternity), they must be allowed to carry it over. Any extra leave your company offers can also be carried over if that’s part of the employment contract.

Can We Pay Employees Instead of Them Taking Leave?

This is a firm no while they are still employed with you. Payment in lieu of holiday (or PILOH) is only allowed when an employee is leaving the company. For the statutory minimum of 5.6 weeks, you can't just pay someone for the time instead of them taking a proper break.

The law is built on the principle that employees need rest to stay healthy and productive. Paying them for untaken leave would completely undermine that. The only time a payout for untaken statutory leave is permitted is in their final paycheque after their employment has ended.

Keeping on top of these rules doesn't need to be a constant source of stress. With a tool like Leavetrack, you can get the system to handle the heavy lifting—automating accruals, tracking balances, and gently enforcing your policy. It’s the simplest way to ensure every employee gets their correct legal holiday entitlement without the manual headache. Take the complexity out of absence management by visiting https://leavetrackapp.com.