Statutory Sick Pay for Part Time Employees A Clear UK Guide

Posted by Robin on 20 Jan, 2026 in

Yes, part-time employees are absolutely entitled to Statutory Sick Pay (SSP) in the UK, as long as they meet the specific eligibility criteria. Entitlement is not based on the number of hours worked, but on having an employment contract and earning above a minimum amount. This means a part-time worker has the same basic right to SSP as a full-time colleague.

Do Part Time Employees Get Statutory Sick Pay

It’s one of the most stubborn myths in UK employment law: the idea that Statutory Sick Pay is just for full-time staff. Let's put that one to bed right now—it's completely wrong. Your part-time employees have a legal right to SSP, just like anyone else on your payroll.

The key is to stop thinking about hours worked and start focusing on whether the eligibility rules are met. Think of it like a height restriction for a theme park ride. It doesn't matter who the person is; what matters is whether they meet the specific measurement to get on safely. SSP works in a similar way. An employee’s contract type is irrelevant; what counts is whether they tick the legal boxes.

The Earnings Threshold: A Historical Barrier

For years, the biggest hurdle for many part-time workers has been the Lower Earnings Limit (LEL). This is the minimum amount an employee must earn on average each week to qualify for certain statutory payments, including SSP.

Historically, this earnings floor created a big gap in the UK's workplace safety net. Many people in low-paid or short-hours roles earned just under this threshold, leaving them with zero financial support if they fell ill. This directly impacts your responsibilities as an employer.

Understanding this earnings rule is central to managing Statutory Sick Pay for part-time employees correctly. It’s the single most common reason a part-time worker might not qualify, making it a critical detail for any HR manager or business owner to grasp.

Recent legislative changes are starting to transform this landscape, aiming to expand SSP access to more workers. These reforms are set to remove the LEL as a barrier, which will fundamentally change how you assess eligibility for your lowest-earning team members. This guide will walk you through these rules, making sure you have the clarity you need to manage your team fairly and legally.

For a broader look at the rules that apply to all employees, not just part-timers, you can check out this complete guide to Statutory Sick Pay.

The Essential SSP Eligibility Rules for Part Time Staff

Figuring out that your part-time staff are entitled to Statutory Sick Pay (SSP) is the easy part. The real challenge is knowing exactly who qualifies and when. Thankfully, eligibility isn’t a grey area; it’s a clear checklist of conditions set out in UK law.

Think of it like a series of gates an employee must pass through. If they clear all four, their entitlement to SSP is locked in, and your obligation to pay it begins.

The Four Pillars of SSP Eligibility

For a part-time employee to qualify for SSP, they need to tick all of these boxes:

- Be an employee: This is straightforward. They need an employment contract (sometimes called a 'contract of service') and must have done at least some work under it. This covers most part-time staff, no matter their hours.

- Meet the sickness threshold: They must be too ill to work for at least four days in a row. This is officially known as a Period of Incapacity for Work (PIW), and importantly, it includes non-working days like weekends or their usual days off.

- Provide proper notification: The employee has to let you know they're sick within your company’s time limit. If you don’t have one specified, the default is seven days.

- Meet the earnings threshold: Their average weekly earnings must hit the Lower Earnings Limit (LEL).

That last point—the earnings threshold—has always been the biggest hurdle for part-time workers, and it’s right in the middle of a massive shake-up.

The Lower Earnings Limit: A Changing Landscape

For years, the Lower Earnings Limit has been a major sticking point. To get SSP, an employee’s average pay has to reach a minimum weekly figure, which is £123 for the 2024/25 tax year. Anyone earning less than this, often those in low-paid roles or working just a few hours a week, was left high and dry without any sick pay protection.

This rule has had a huge impact. Part-time workers in the UK have historically been left behind, with estimates suggesting around two million employees couldn't qualify for SSP because of these earnings rules. The LEL alone has shut out approximately 1.3 million low-paid workers from receiving any sick pay. You can learn more about the impact of SSP reforms in this factsheet.

But all that is about to change.

The Employment Rights Act 2025: A Watershed Moment

This landmark piece of legislation is set to completely remove the Lower Earnings Limit as a requirement for SSP. It’s a huge step forward in protecting part-time and low-income workers.

From April 2026, eligibility will no longer be tied to this minimum earnings floor. This will open up SSP access to millions of people who were previously excluded.

The End of Waiting Days

Another game-changing reform from the same act is the scrapping of 'waiting days.' Under the old system, SSP wasn’t paid for the first three qualifying days of sickness. An employee had to be sick for four days just to start getting paid from day four. For short illnesses, this often meant they got nothing at all.

That system is now gone. The Employment Rights Act 2025 has removed this three-day barrier completely.

This means that for any eligible employee—including your part-time staff—SSP is now payable from the very first qualifying day of their sickness absence. It provides immediate financial support and makes life much simpler for employers, getting rid of a layer of complexity that often led to confusion and payroll headaches.

How to Calculate SSP for Part Time Employees

Figuring out Statutory Sick Pay for part-timers, especially those with shifting hours, can feel like you're trying to solve a tricky puzzle. But it's not as complex as it seems once you break it down. The whole process really boils down to one key figure: the employee's Average Weekly Earnings (AWE).

The AWE isn’t just a random snapshot of their pay. It's calculated over a specific timeframe called the ‘relevant period’—for most people, that’s the eight-week window right before they went off sick. Nail this figure, and the rest of the calculation falls into place.

This approach ensures that even employees with fluctuating hours get a fair amount that reflects what they'd typically earn. Once you’ve got the AWE, you can check if they hit the earnings threshold and work out the right SSP payment.

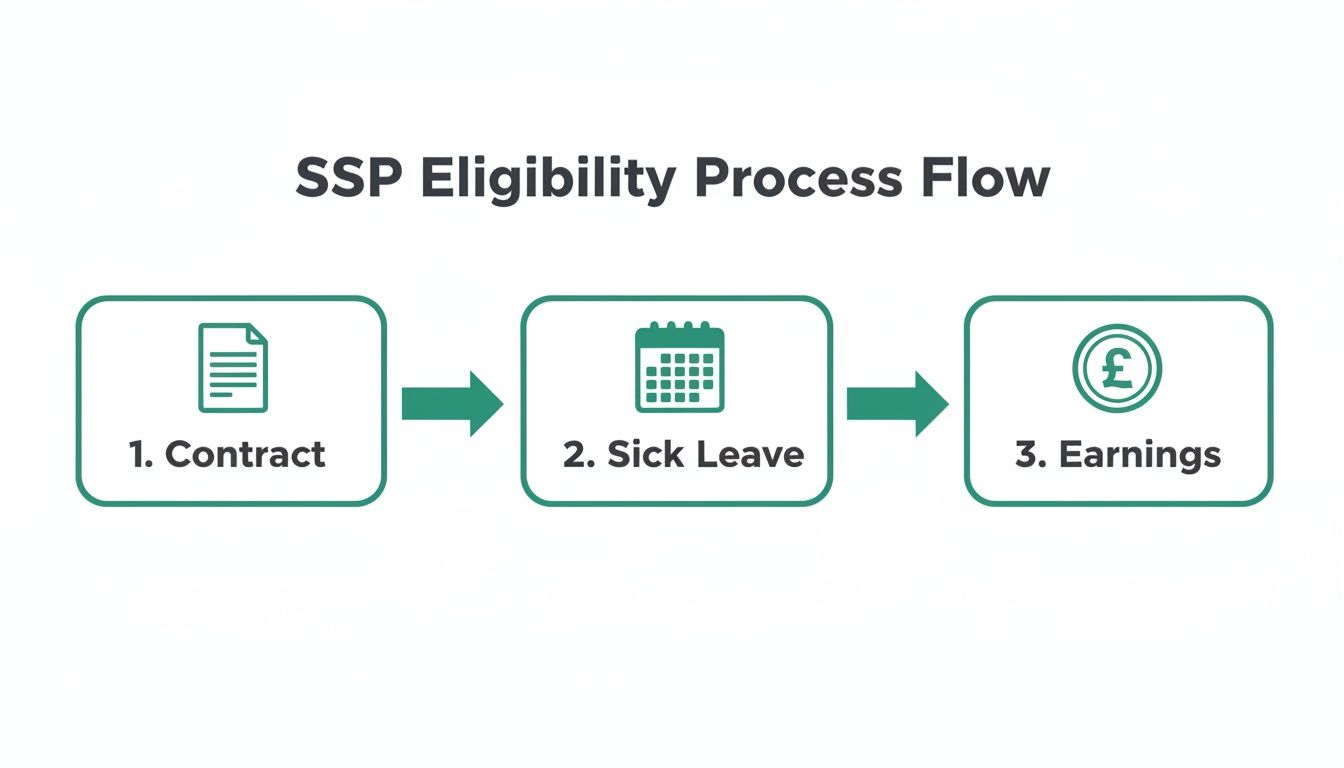

Before you even touch a calculator, there are three essential checks to run through, as this flowchart shows.

As you can see, you first need to confirm the employee's contract status, the duration of their sickness, and their earnings. Think of these as the three gates they need to pass through before any SSP is paid out.

A Step-By-Step SSP Calculation Example

Let's walk through a real-world scenario to see how it works in practice. Meet Sarah, a part-time employee who works fixed hours and earns £150 per week.

- Check Eligibility: First off, Sarah has an employment contract. She's also been off sick for five consecutive days, which means she's met the 'Period of Incapacity for Work' requirement.

- Calculate AWE: Her earnings are consistent, so her AWE is a straightforward £150. This is comfortably above the Lower Earnings Limit (which is £123 for the 2024/25 tax year).

- Determine Qualifying Days: Sarah’s working week is Tuesday, Wednesday, and Thursday. These are her 'Qualifying Days'—the only days she can get SSP for.

- Calculate Daily Rate: The standard weekly SSP rate is £116.75 (for 2024/25). To get the daily rate, we divide this by her Qualifying Days. So, £116.75 / 3 = £38.92 per day.

- Calculate Total Payment: If Sarah was sick for all three of her working days in a single week, she would receive 3 x £38.92 = £116.76 in SSP for that week.

This example is pretty simple because Sarah's schedule is regular. For staff on zero-hours contracts or with irregular hours, that initial eight-week AWE calculation becomes absolutely critical to getting it right.

The New Rules for Lower-Earning Part Time Staff

There's a big change on the horizon, thanks to the Employment Rights Act, that will affect how you handle sick pay for your lowest-paid part-time staff. For years, anyone earning below the Lower Earnings Limit (LEL) got nothing. That’s all about to change.

The government is bringing in percentage-based sick pay for lower earners, which is a major shift. For staff earning below the old LEL, you'll soon pay them 80% of their normal weekly earnings or the flat weekly SSP rate—whichever is lower. It adds a new layer to the calculation, but it creates a much fairer system. The impact of this varies; for short absences, the removal of waiting days largely balances out any rate reduction, but for longer periods, some may receive slightly less. You can find more details about these statutory sick pay reform measures on GOV.UK.

To show you exactly what this means, let's compare the old and new systems for a part-time employee earning £100 a week who is off sick for one full week.

SSP Calculation Before vs After April 2026 Reforms (Low-Earning Part-Time Employee)

This table illustrates the financial impact of the Employment Rights Act 2025 on a part-time employee earning £100 per week, showing a one-week sickness absence.

| Scenario | SSP Entitlement (Pre-April 2026) | SSP Entitlement (Post-April 2026) |

|---|---|---|

| Eligibility | Ineligible (Below LEL) | Eligible (LEL removed) |

| Calculation Method | Not applicable | 80% of AWE (£100) = £80 |

| Payment for One Week Sickness | £0.00 | £80.00 |

| Difference in Employee's Pocket | - | + £80.00 |

The table makes the benefit crystal clear. An employee who previously would have received absolutely nothing will now get meaningful financial support. It's a massive improvement to the safety net for part-time workers.

This new calculation method means you'll need to be extra careful, especially as we move through the transition period. Getting the AWE right and applying the correct rate based on earnings is going to be vital for staying compliant and, most importantly, for properly supporting your entire team.

Managing Complex Part-Time Work Scenarios

Part-time work is wonderfully varied, but that variety can throw up some tricky payroll situations. Once you move beyond simple, fixed-hours roles, you run into all sorts of arrangements that can leave employers scratching their heads. Figuring out how to handle these specific cases is vital for staying compliant and, just as importantly, treating your team fairly.

The core principles of Statutory Sick Pay (SSP) don't change, but how you apply them needs a much closer look when you're dealing with irregular schedules. From zero-hours contracts to how SSP plays with your company’s own sick pay policy, getting the details right is non-negotiable. Let's break down these more nuanced scenarios one by one.

Navigating Zero-Hours and Term-Time Contracts

People on zero-hours contracts are absolutely entitled to SSP, as long as they meet the usual eligibility criteria. The most critical part of this puzzle is correctly calculating their Average Weekly Earnings (AWE) over the eight-week relevant period just before their sickness began. This calculation is your legal bedrock for figuring out if they meet the earnings threshold.

For these employees, keeping meticulous records isn't just good practice; it's a must. Without a clear log of hours worked and payments made, correctly calculating their AWE becomes a near-impossible task, putting you at serious risk of non-compliance.

A similar logic applies to term-time employees. They are eligible for SSP during their contracted working periods. However, if they fall ill during a school holiday or another time when they aren't contracted to work, they generally won't get SSP. This is because there are no 'Qualifying Days' of work for them to be sick from.

SSP Versus Contractual Sick Pay

Many businesses choose to offer more than the legal minimum, providing a more generous contractual sick pay scheme, sometimes called occupational sick pay. This is a fantastic employee benefit, but it’s vital to understand how it interacts with your statutory duties.

The most important rule to remember is this: SSP is the legal floor, not the ceiling. Your company policy can be more generous, but it can never be less generous. An employee who qualifies for SSP must receive at least that amount.

You can't just opt out of your SSP obligations, even with a great company scheme in place. Your contractual scheme has to be at least as good as the statutory one. For instance, if your company policy pays sick leave at a higher rate but has a longer waiting period than SSP, you still have to pay SSP for the days it covers that your scheme doesn't. A solid strategy for managing absence at work involves aligning these policies to avoid any confusion.

The Smart Way to Handle Offsetting

So, if you have a generous contractual scheme, do you have to pay that on top of SSP? Thankfully, no. This is where the concept of offsetting comes in. Offsetting allows you to include the SSP amount within your contractual sick pay payment.

Here’s how it works in practice:

- Calculate SSP Entitlement: First, work out what the employee is legally entitled to under SSP rules (e.g., £116.75 for the week).

- Calculate Contractual Pay: Next, calculate what they are due under your company policy (e.g., their full weekly wage of £250).

- Offset the Amounts: You then pay the higher amount (the contractual pay), which is considered to include the SSP portion. The employee receives £250 in total, satisfying both your company policy and your legal SSP obligation.

This ensures you are fully compliant without paying twice. The employee’s payslip should clearly show the SSP payment as part of their overall earnings to keep your records transparent. It's a fair, legal, and financially sensible approach that shows you're committed to your team's welfare while managing business costs effectively.

Your Employer Obligations for Payroll and Record Keeping

Getting Statutory Sick Pay (SSP) right is about more than just crunching the numbers correctly. True compliance hinges on solid admin. You need watertight processes for everything from how an employee notifies you they're sick to how the payment lands in their bank account.

As an employer, you have specific legal duties around payroll, record-keeping, and communication. Nailing these obligations protects your business from potential disputes and ensures your part-time staff get the support they're entitled to, right when they need it. This isn't just about ticking boxes; it's about building a foundation of trust.

Employee Notification and Fit Notes

The whole process kicks off the moment an employee is too ill to work. They have a duty to tell you, and you have the right to ask for proof if the sickness continues.

- Initial Notification: Your employees need to let you know they're sick within the timeframe you've set in your company policy. If you don't have one, the legal default is seven days.

- Self-Certification: For the first seven calendar days of sickness, an employee can simply "self-certify" that they are unwell. No doctor's note required.

- Fit Notes: If the absence stretches beyond seven days, you are well within your rights to ask for a 'fit note' (what we used to call a sick note) from a healthcare professional.

A clear, well-communicated sickness reporting policy is your best friend here. It makes sure everyone knows what's expected, which smooths out the entire process from day one.

Your Legal Record Keeping Duties

Keeping meticulous records isn't optional—it's a core part of managing SSP. HMRC can ask to see these records at any point, and not having them can lead to penalties. Good documentation is also your first line of defence in resolving any payment queries or employee disputes.

You are legally required to keep the following for at least three years after the end of the tax year they relate to:

- Records of all SSP payments you've made.

- The dates of each employee's sickness absence.

- Copies of any fit notes or other medical evidence they've provided.

Keeping these records up to date is a fundamental compliance task. In fact, understanding why accurate absence tracking is crucial for compliance is essential for any business managing part-time staff.

Integrating SSP into Your Payroll

Once you've confirmed an employee is eligible and worked out their SSP entitlement, the payment itself needs to be processed through your normal payroll run. SSP isn't some separate benefit; it's treated just like regular wages.

This means any SSP payment is subject to the usual deductions for PAYE tax and National Insurance contributions. This integration is vital for keeping your financial accounts accurate. For companies looking to tighten up their financial admin, adopting things like remote accounts payable workflows can help manage these obligations efficiently across the board.

It's also worth remembering the financial reality for many part-time workers. The weekly SSP rate is often a fraction of their usual income, which really underscores why paying it accurately and on time is so important.

Recent research highlights this strain, showing the current weekly SSP rate covers just 18% of the average household's weekly spending. This shows just how critical it is for employers to manage their payroll obligations without a hitch, as any delay or mistake can have a serious knock-on effect on an employee's financial wellbeing.

How Leavetrack Solves Your SSP and Absence Headaches

Let's be honest, managing statutory sick pay for part-time employees can feel like a constant administrative battle. Juggling spreadsheets, manually tracking qualifying days, and calculating Average Weekly Earnings for staff with irregular hours is a recipe for human error and compliance nightmares.

It’s a time-consuming process that pulls you away from the more strategic parts of your job. This is exactly where a proper absence management tool like Leavetrack comes in. Instead of wrestling with clunky spreadsheets and scattered records, you get a reliable system built to handle the complexities of leave and sickness automatically.

Automate Compliance and Ditch the Spreadsheets

The biggest problem with manual tracking is that it’s just not reliable. A single broken formula in a spreadsheet can throw off SSP payments, creating payroll chaos and opening the door to potential legal challenges. Leavetrack takes that risk off the table by keeping all your absence data in one secure, organised place.

This brings a few major advantages:

- Accurate Record-Keeping: It automatically builds a clear, indisputable audit trail for every sickness absence. This is crucial for meeting your legal duty to hold records for at least three years.

- Simplified Calculations: The system tracks qualifying days and earnings data, which turns complicated AWE calculations for part-time and zero-hours staff into a much simpler task.

- Instant Visibility: Managers can immediately see team absence patterns, helping them sort out cover for a sick part-time employee without any delay.

For a deeper look at the benefits, check out our guide on the three key benefits of absence management software for SMEs and see how it can genuinely change your day-to-day processes.

Get Deeper Insights with Clear Reporting

Beyond just tracking who is off and when, effective absence management gives you powerful data. Leavetrack’s reporting features turn all that raw data into insights you can actually use. You can start to spot trends, like recurring short-term absences or departments with higher-than-average sickness rates. This kind of visibility is gold for proactive workforce management.

The platform provides clear visual reports that pull all your absence data together.

This dashboard lets you filter by employee, team, or leave type, giving you the detail needed to support your team and manage resources properly. By stepping away from manual methods, you save countless hours and gain the confidence that your approach to statutory sick pay for part time employees is both compliant and fair.

Common Questions About SSP for Part Time Workers

Even once you've got your head around the main rules, real-world situations can still throw up some tricky questions. Let's face it, navigating the finer points of Statutory Sick Pay for your part-time staff is all about handling those one-off queries with confidence.

Here are some of the most common questions we see, along with quick, clear answers.

Can an Employee Claim SSP From Two Different Part Time Jobs?

Yes, they absolutely can. An employee’s eligibility for Statutory Sick Pay is looked at on a job-by-job basis. If they work for two different companies part-time and meet the qualifying criteria for both, they are legally entitled to receive SSP from each employer.

You never combine the earnings from their other job when working out their Average Weekly Earnings (AWE). Your calculation must be done completely independently, using only the earnings from their employment with your company.

What Happens If an Employee Gets Sick During Annual Leave?

This is a classic one. If a part-time employee becomes genuinely ill during a pre-booked holiday, they have the right to take that time as sick leave instead. Of course, they still have to notify you by following your usual sickness reporting procedure.

This is all about protecting an employee's right to their paid holiday. You would pay them SSP for the qualifying sick days, and they get to reschedule their annual leave for a later date. It stops them from losing out on their holiday entitlement just because they were unwell.

Are Part Time Staff on Fixed Term Contracts Eligible for SSP?

Yes, they are. Employees on fixed-term contracts have the exact same rights to SSP as your permanent team members, as long as they meet all the standard eligibility rules we’ve already covered. Their entitlement to SSP simply runs for the duration of their illness within the contract period.

The key difference, however, is that their right to SSP automatically ends when their fixed-term contract expires, even if they're still unwell.

Is SSP Paid for a Part Time Employee's Non Working Days?

No, SSP is only ever paid for the days an employee would normally be scheduled to work. In SSP jargon, these are called their ‘Qualifying Days’. So, a part-time worker who only works Monday to Wednesday, for example, cannot receive SSP for a Thursday or Friday.

But here’s the crucial bit: their non-working days do still count towards the four consecutive days of sickness needed to form a 'Period of Incapacity for Work'. This is what triggers their eligibility for SSP in the first place.

Juggling these complex rules for every part-time employee can quickly become a headache. Leavetrack takes the pain out of the process by automating absence tracking, keeping records in one place, and giving you the clarity you need to handle SSP with complete confidence. Discover how Leavetrack can save you time and ensure compliance.