Uk Law Holiday Entitlement: uk law holiday entitlement Made Clear for Businesses

Posted by Robin on 31 Dec, 2025 in

When it comes to UK employment law, holiday entitlement is a cornerstone right, designed to make sure everyone gets a proper break. The foundational rule is pretty simple: almost every worker gets a minimum of 5.6 weeks of paid annual leave. For someone working a standard five-day week, that works out to a straightforward 28 days off per year.

Getting to Grips with Your Core Holiday Entitlement

Diving into the nitty-gritty of UK holiday law can feel a bit daunting at first, but the core principle is all about guaranteeing workers get enough rest away from their job. This isn't just a perk for full-time, permanent staff; it's a legal safeguard that casts a wide, inclusive net.

The bedrock of this right is the Working Time Regulations 1998. This bit of legislation sets out the absolute minimum paid holiday employers have to provide. Think of it as a safety net, making sure there's a consistent standard whether you're in a tiny startup or a massive corporation.

The Universal 5.6 Weeks Rule

At its heart, the law doesn't really talk about days—it talks about weeks. Every worker, whether they're with an agency or on a zero-hours contract, is legally entitled to 5.6 weeks of paid holiday. It's a clever approach because it means the entitlement can scale fairly, no matter how someone's working pattern is structured.

For example, a full-timer on a five-day week gets 5.6 weeks multiplied by 5 days, which equals those 28 days. This simple calculation is the baseline for millions of people across the country. It's a crucial part of the employment package, as we break down in our comprehensive guide to statutory holiday entitlement in the UK.

The whole point of statutory holiday is to protect people’s health and safety. It’s a legal recognition that time away from work isn’t just a nice-to-have, but a necessity for productivity, mental health, and a decent work-life balance.

To give you a quick reference, here’s how that minimum entitlement breaks down for different working patterns.

Statutory Holiday Entitlement at a Glance

| Working Days per Week | Minimum Paid Holiday Days per Year |

|---|---|

| 5 days | 28 days |

| 4 days | 22.4 days |

| 3 days | 16.8 days |

| 2 days | 11.2 days |

| 1 day | 5.6 days |

As you can see, the 5.6-week rule provides a consistent baseline, scaling down proportionally for part-time workers.

How Do Bank Holidays Fit In?

One of the most common points of confusion is how bank holidays are handled. It’s something that absolutely needs to be crystal clear in your employment contracts.

There's no automatic legal right for an employee to have bank holidays off as paid leave. An employer can choose to include the eight annual bank holidays (in England and Wales) as part of that total 28-day pot.

- Inclusive Approach: The contract says the entitlement is 28 days, which includes bank holidays. This is how most companies do it.

- Exclusive Approach: The contract offers 28 days plus bank holidays, giving a more generous total of 36 days off.

The key thing here is clarity. As long as the total paid leave meets or exceeds the statutory minimum of 5.6 weeks, you're compliant. This minimum applies across the board—to employees, agency staff, and even those on irregular hours, ensuring everyone is protected. You can always dig into the official government guidance on holiday entitlement rights to see these protections laid out in full.

Calculating Holiday For Different Working Patterns

Once you step away from the straightforward five-day working week, the simple "28 days" calculation needs a bit more finesse. The good news? The core principle of 5.6 weeks of paid holiday is your constant. It’s the bedrock that ensures fairness across your entire team, no matter their working pattern.

Getting the maths right is absolutely crucial for staying compliant with UK law holiday entitlement and, just as importantly, for treating everyone fairly. The trick is to shift your mindset from days to weeks. This single change makes it so much easier to apply the same legal standard to part-timers and those with irregular hours, without getting lost in a maze of exceptions.

Calculating For Part-Time Workers

For part-time staff who work the same number of days each week, the calculation is a simple pro-rata sum. All you need to do is multiply the number of days they work each week by the statutory entitlement of 5.6 weeks.

Let's walk through a quick example:

- An employee works 3 days a week.

- Their holiday entitlement is 3 days × 5.6 weeks = 16.8 days of paid leave per year.

It's very common practice—and perfectly legal—to round this figure up to the nearest half or full day to keep things simple for payroll. In this case, 16.8 days would become 17 days. Just remember, you must never round down, as that would take the employee below their legal minimum entitlement.

An employer must ensure that a part-time worker's holiday entitlement is proportional to that of a full-time worker. This prevents any unfair treatment and is a core requirement of the Part-time Workers (Prevention of Less Favourable Treatment) Regulations 2000.

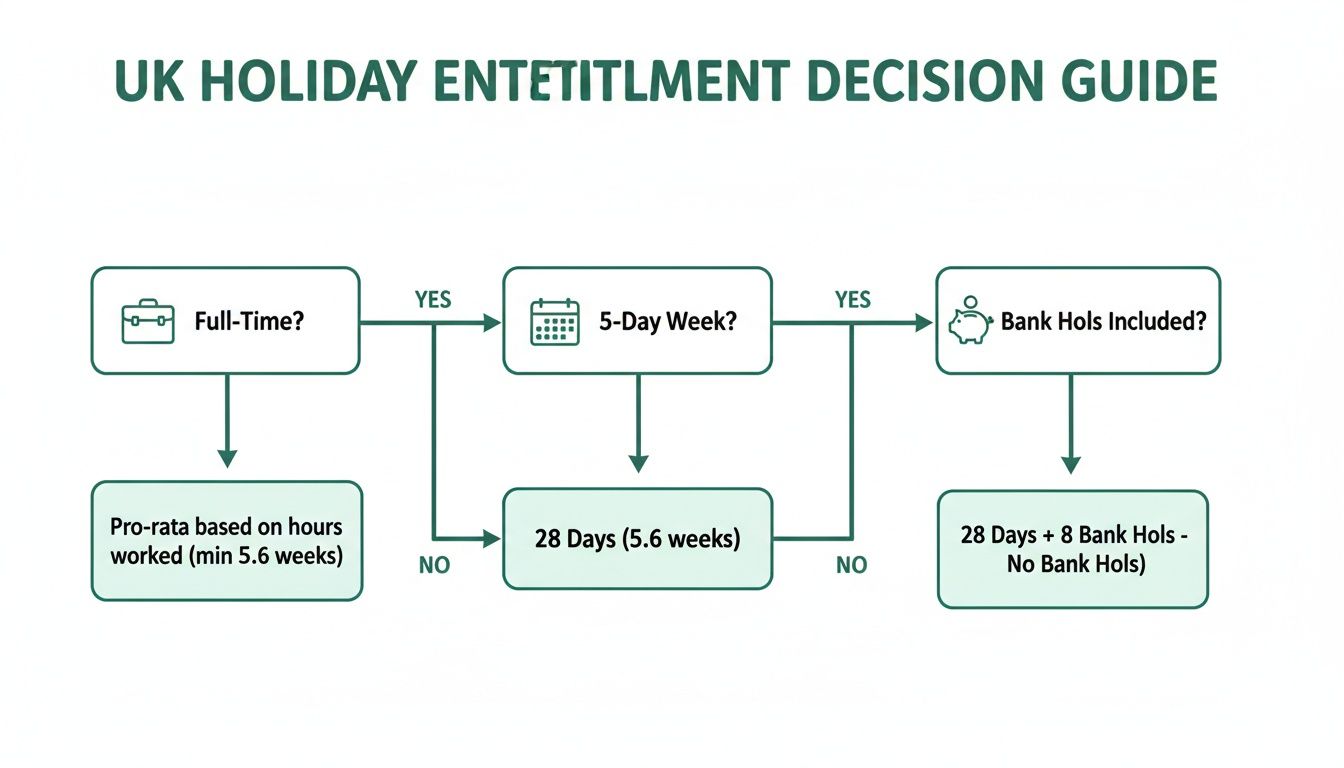

This decision tree gives you a quick visual guide for figuring out the right calculation method based on how an employee works.

As you can see, the starting point is always the worker's schedule and status, which then points you towards the right way to calculate their leave.

How Holiday Accrual Works

Holiday entitlement doesn't just appear out of thin air on day one. It's earned progressively throughout the leave year in a process known as accrual. For someone new to the company, their entitlement builds up at a rate of 1/12th of their annual total each month they work.

For example, a full-time employee with 28 days of leave will accrue roughly 2.33 days of holiday for each full month on the job (28 ÷ 12). After three months, they'll have earned around 7 days of leave. While many employers are happy to let staff take holiday before it's officially accrued, this system protects the business if someone decides to leave part-way through the year.

Handling Irregular Hours And Zero-Hours Contracts

Things get a little different when calculating leave for workers with no fixed hours, like casual staff or those on zero-hours contracts. Because their hours can swing wildly from one week to the next, a day-based pro-rata calculation just doesn't work.

Instead, the UK law holiday entitlement for these workers is based on the hours they've actually worked. The statutory 5.6 weeks of holiday works out to be 12.07% of hours worked over a year.

Here’s the formula you’ll need:

(Total hours worked in a pay period) × 12.07% = Holiday hours accrued

Let’s say a zero-hours worker clocks in 50 hours in a month. Their holiday accrual for that period would be:

50 hours × 0.1207 = 6.035 hours of paid holiday.

This percentage-based approach ensures their leave is always directly proportional to the amount of work they've done. For a deeper dive, our complete guide to holiday entitlement on a zero-hour contract breaks down more complex scenarios and highlights common traps to avoid.

What to Include in Holiday Pay Calculations

Figuring out an employee’s holiday pay should be simple. In reality, it’s often far more complex than just looking at their basic salary. Getting this wrong is one of the most common tripwires in managing UK law holiday entitlement, and it can lead to some hefty financial penalties if you’re not careful.

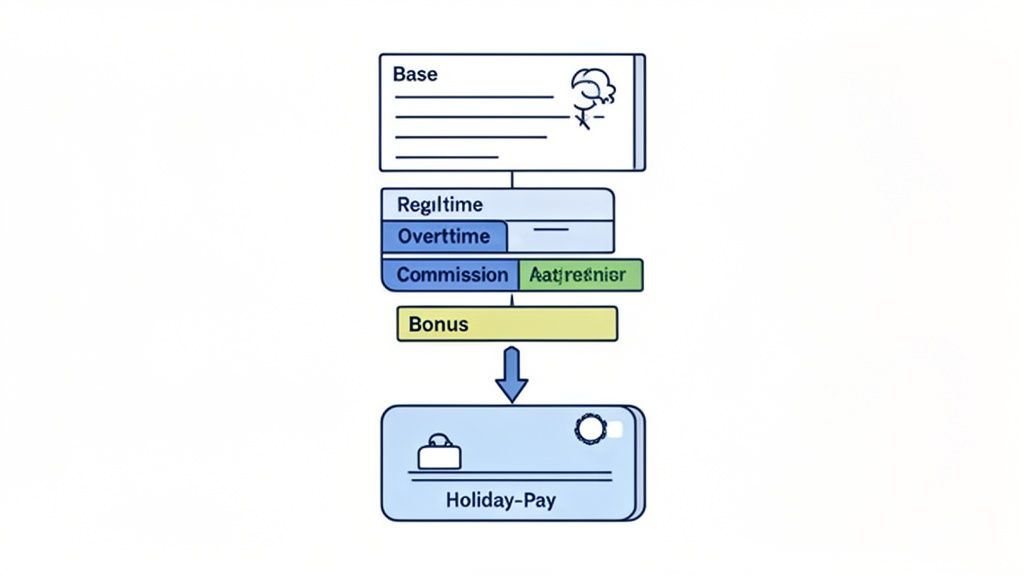

The core principle is simple enough: an employee’s holiday pay should reflect what they would have normally earned if they were at work. This means you need to look beyond the fixed salary figure on their contract to ensure they aren't financially penalised for taking the time off they're legally entitled to.

Over the years, landmark legal cases have completely reshaped the definition of a 'week's pay' for holiday purposes. The law now requires employers to include a whole host of other payments that form part of someone's regular, normal earnings.

Defining Normal Remuneration

The key phrase to get your head around is ‘normal remuneration’. This isn't just about guaranteed, contractual pay. It’s about building a fair picture of an employee’s typical earnings over a set period. If someone consistently earns more than their basic pay through other means, that extra income has to be factored into their holiday pay.

This all stems from European court rulings which established that holiday pay must correspond to normal pay. Why? To prevent any kind of disincentive to taking leave. For many businesses, this means adjusting payroll processes to capture all relevant earnings, not just the base salary.

It's a crucial step for compliance. For a more detailed look at the maths, our UK holiday pay calculator guide offers a simplified breakdown of the formulas involved.

A worker must receive their normal pay during periods of annual leave. Excluding payments like regular overtime or commission from holiday pay calculations is unlawful, as it could deter them from exercising their right to take leave.

What Payments Must Be Included

So, what exactly counts towards this 'normal' pay? Thankfully, a string of employment tribunal cases has made the list much clearer. Your calculations must consistently account for payments that are intrinsically linked to the performance of an employee's tasks.

Here's a practical checklist of what you must include:

- Regular Overtime: This covers both compulsory and voluntary overtime, as long as it's worked regularly enough to be considered 'normal'.

- Commission Payments: If an employee’s pay regularly includes commission, this has to be averaged out and included.

- Performance-Based Bonuses: Bonuses directly tied to the work an employee does (like hitting sales targets) should be part of the calculation.

- Certain Allowances: Things like shift allowances or standby payments that are a regular feature of an employee’s wage packet must be included.

What Can Be Excluded

Not every single payment an employee receives needs to be factored into their holiday pay. The real difference lies in whether the payment is regular and linked to their work.

Generally, you can exclude the following:

- Discretionary Bonuses: A one-off bonus that isn't linked to performance, such as a Christmas bonus given to all staff, typically doesn't need to be included.

- Expenses: Payments that are purely a reimbursement for costs the employee has incurred (like travel expenses) aren't part of their remuneration.

- Occasional Overtime: A rare, one-off shift of overtime probably wouldn't be considered regular enough to be included.

Making the right call between these categories is absolutely essential for staying on the right side of the law. It’s always best to err on the side of caution; if a payment is made with any kind of regularity, it's much safer to include it.

Juggling Sickness, Family Leave, and Holiday Carryover

Life rarely sticks to a neat schedule. Sometimes, an employee's well-laid holiday plans get completely derailed by an unexpected absence, like long-term sickness or the arrival of a new baby. Knowing how these situations affect holiday entitlement is crucial for treating your team fairly and staying on the right side of the law.

The default rule for most businesses is a straightforward ‘use it or lose it’ policy for annual leave. This is perfectly legal, as long as you’ve given your staff plenty of chances to take their holiday during the year. But this rule isn't set in stone. The law carves out some very specific exceptions where employees must be allowed to carry over their statutory holiday.

These exceptions are there to protect people who physically can't take their holiday due to circumstances way beyond their control. Forgetting to book that trip to Spain doesn't make the cut, but being off on long-term sick leave absolutely does.

The Impact of Sickness on Holiday Entitlement

When an employee is off sick, their statutory holiday entitlement keeps ticking up, just as if they were in the office every day. This is a fundamental right. Someone on sick leave for six months will still build up half a year's worth of holiday time.

So, what happens if they’re too unwell to actually take this holiday during the leave year?

- An employee can choose to take paid holiday while they're off sick. This might be a good option for them if their statutory sick pay (SSP) has run out, for example.

- If they can't take it (or simply don't want to), they have the right to carry over the untaken part of their four weeks of statutory leave into the next leave year. This is the portion of leave derived from EU law.

- This carried-over holiday must be used within 18 months from the end of the leave year in which it was accrued.

It's a common myth that holiday rights are put on hold during sick leave. The law is crystal clear: entitlement continues to build up. If an employee can't take it because of their illness, they can't be penalised by losing it.

This protection ensures that being ill doesn't unfairly eat into an employee's right to proper rest and recovery. The key is to track this accrual accurately, so you have a clear picture of what they're owed when they’re ready to return.

Family Leave and Holiday Accrual

Similar rules are in play for employees on other kinds of statutory leave, especially maternity leave. An employee on maternity, paternity, or adoption leave continues to accrue their full contractual holiday entitlement for the entire time they're away.

Because it’s legally impossible for someone to be on maternity leave and annual leave at the same time, any holiday they can't take during the leave year must be carried over.

Let's imagine a quick example:

An employee with a January-December holiday year goes on maternity leave in April and returns the following April. She will have accrued her full 28 days of holiday while she was away. She has to be allowed to carry over all of this untaken leave into the new holiday year.

Creating a Fair and Compliant Carryover Policy

While the law forces your hand on carryover for sickness and family leave, many businesses choose to offer a more flexible general policy anyway. It can be a fantastic perk, but it needs to be clearly defined to avoid any confusion.

Your holiday policy should spell out:

- General Rule: A clear ‘use it or lose it’ clause for normal day-to-day circumstances.

- Statutory Exceptions: A section explaining that holiday will be carried over when someone is prevented from taking it by long-term sickness or family leave, as required by law.

- Discretionary Carryover: If you let people carry over a few days voluntarily (say, up to five days), define the rules. Be specific about the deadline for using this carried-over leave in the new year (e.g., by 31st March).

Getting these rules down in writing in your company handbook prevents misunderstandings and makes sure everyone is treated the same. It gives your managers a solid framework to work from and gives employees the transparency they need to plan their time off, building a culture of fairness and respect.

Managing Holiday Entitlement When Employment Ends

When an employee leaves your company, tying up the loose ends on their holiday entitlement is a critical part of the offboarding process. Getting this final calculation right isn’t just good HR practice; it’s a legal requirement. A clean, accurate calculation ensures a smooth exit and prevents potential disputes down the line.

The process really boils down to two things: figuring out how much holiday the employee has accrued up to their last day, and then comparing that against how much they’ve actually taken. This tells you whether you owe them pay for any unused days or, in some cases, if they owe you.

Calculating Final Holiday Pay Owed

Every employee has the right to be paid for any statutory holiday they've earned but haven't used when their employment ends. This is actually the only time UK law permits you to pay an employee in lieu of them taking their statutory leave.

The calculation itself is pretty straightforward. You just need to work out what portion of the holiday year the employee has been on your payroll.

- Determine the Proportion of the Year Worked: Divide the number of days they were employed during the leave year by 365.

- Calculate Accrued Entitlement: Multiply this fraction by their total annual entitlement (e.g., 28 days).

- Find the Difference: Subtract the number of holiday days the employee has already taken from the amount they've accrued.

Let's imagine an employee who works a five-day week leaves exactly halfway through the holiday year. They would have accrued 14 days of leave (which is 0.5 of their 28-day annual entitlement). If they'd only taken 10 days off, you'd owe them payment for the remaining 4 days.

By law, payment for any untaken statutory holiday must be included in an employee's final payslip. This ensures that their right to paid leave is honoured, even upon termination of their contract.

When an Employee Has Taken Too Much Holiday

It's also entirely possible for an employee to have taken more holiday than they've actually earned when they leave. This often happens if someone takes a long break early in the leave year and then hands in their notice shortly after.

In this scenario, you might be able to deduct the value of the excess holiday from their final pay. But—and this is a big but—you can only do this if you have a clear, unambiguous clause in their employment contract that explicitly allows for it.

- Contractual Clause: The contract must state that the company reserves the right to deduct money from their final salary for any holiday taken beyond what has been accrued.

- No Clause, No Deduction: Without that specific wording in the contract, you have no legal grounds to reclaim the pay for the extra days they took.

Having a well-drafted employment contract is your best defence here. It gives you the legal standing to make the necessary adjustments to their final pay, making the process fair for everyone involved. A clear policy avoids arguments and potential claims of unlawful deduction from wages, making the whole offboarding experience that much smoother.

To help ensure you cover all the bases, we've put together a simple checklist to guide you through the leaver holiday pay calculation.

Leaver Holiday Calculation Checklist

| Step | Action Required | Key Consideration |

|---|---|---|

| 1 | Confirm Termination Date | The final day of employment is the cut-off point for accrual. |

| 2 | Verify Annual Entitlement | Check the contract for their full annual holiday allowance (e.g., 28 days). |

| 3 | Calculate Days Worked in Leave Year | Count the number of calendar days from the start of the leave year to their termination date. |

| 4 | Determine Accrued Leave | (Days Worked / 365) x Full Annual Entitlement. |

| 5 | Check Leave Taken | Review your records (ideally from a system like Leavetrack) for all holiday days taken in the current leave year. |

| 6 | Calculate the Balance | Subtract leave taken from accrued leave. A positive number means pay is owed to the employee. A negative number means they've taken too much. |

| 7 | Review the Employment Contract | If leave is overdrawn, check for a specific clause allowing deductions from final pay. No clause = no deduction. |

| 8 | Process in Final Payroll | Ensure any payment for untaken leave (or deduction for excess leave, if permitted) is correctly processed in their final payslip. |

Following these steps methodically will help you handle final holiday pay accurately and professionally, ensuring you meet your legal obligations and part ways with the employee on good terms.

Making Holiday Management Simple and Compliant

Let's be honest, managing UK law holiday entitlement can feel like a full-time job. Juggling pro-rata calculations for part-timers, tracking leave accrued during sick leave, and making sure everything is above board is a huge administrative headache. Relying on spreadsheets is a recipe for human error, inconsistent rules, and a total lack of clarity for everyone. This is where the right software can be a game-changer.

A proper leave management system takes this compliance nightmare and turns it into a simple, automated process. Forget about manually calculating accruals or double-checking balances. The software handles all the heavy lifting, ensuring every employee's entitlement is tracked perfectly and in real-time. This cuts out the guesswork and frees up precious time for your HR team and managers.

Automated Accuracy and Centralised Control

The real magic of a system like Leavetrack lies in its automation. It automatically calculates and updates holiday entitlement based on the specific rules you define for different working patterns. Whether you have a full-time employee or someone on a zero-hours contract, the calculations are always spot on.

This automation flows through the entire leave management process:

- Central Planner: A shared digital calendar gives you an instant snapshot of who is off and when, helping you prevent clashes and make sure you always have enough cover.

- Simplified Approvals: Managers can approve or deny requests with a single click, often straight from their email or tools like Slack. No more chasing paper forms.

- Reliable Records: Every request, approval, and absence is logged, creating a solid audit trail that keeps payroll and compliance checks straightforward.

This kind of organisation helps sidestep common problems. We know from surveys that many UK workers end up forfeiting holidays because of poor planning or overwhelming workloads—issues that a clear digital system can directly solve.

From Compliance Burden to Business Benefit

At the end of the day, using a dedicated tool isn't just about ticking legal boxes. It’s about building a more transparent and efficient workplace. Employees can check their own balances and book time off with ease, giving them the power to manage their leave responsibly. Managers get immediate clarity on team availability without ever having to open a spreadsheet.

By automating the tedious parts of holiday tracking, you create a system that is not only compliant by design but also fairer and more transparent for everyone involved. It builds trust and cuts down on the administrative friction that so often surrounds annual leave.

This simple shift allows HR and team leaders to step away from repetitive admin and focus on more strategic work. For any business wanting to stay on top of its obligations, understanding the bigger picture of general legal compliance in employment is crucial. A robust system provides the solid data and structure needed to support these wider efforts, turning a complex legal duty into a smooth, reliable part of your business.

Frequently Asked Questions About Holiday Entitlement

Even when you feel you’ve got a handle on the basics, certain situations can still throw a spanner in the works. Let's tackle some of the most common questions that pop up for employers and employees about UK law holiday entitlement, giving you clear, straightforward answers for day-to-day management.

Can Employers Dictate When Staff Take Leave?

In short, yes. An employer can absolutely tell employees when they must take their holiday. The most classic example is a company-wide shutdown over the Christmas break.

There’s a catch, though. If you’re going to require staff to take leave on specific dates, you have to give them fair warning. The rule of thumb is that the notice period must be at least double the length of the leave you're enforcing. So, for a one-week Christmas shutdown, you need to give everyone at least two weeks' notice.

How Does Holiday Entitlement Work in the First Year?

For new starters, holiday entitlement doesn't just appear on day one; it builds up gradually. During an employee's first year, their statutory holiday accrues at a rate of 1/12th of their total annual entitlement for each month they work.

After three months on the job, a new employee will have earned a quarter of their total annual leave. While many employers are flexible and let staff book holidays before they’ve technically accrued the time, this is a gesture of goodwill, not a legal requirement. This accrual system is there to protect the business if someone leaves part-way through the year having taken more leave than they've earned.

The only time you can legally pay an employee in lieu of their statutory holiday is when their employment ends. This practice, often called 'rolled-up holiday pay', is otherwise unlawful for the minimum 5.6 weeks of statutory leave.

This rule exists for a very good reason: to make sure the core purpose of annual leave—giving people a proper rest—is always met while they're still employed.

Do Bank Holidays Count Towards the Minimum Leave?

This is a huge point of confusion, but the answer is surprisingly simple: it all comes down to the employment contract. An employer can choose to include the eight bank holidays (in England and Wales) as part of the statutory 5.6 weeks of annual leave.

There's no automatic legal right to have a paid day off on a bank holiday. Your contract must spell it out clearly one way or the other:

- Included: The contract might say "28 days of annual leave, including bank holidays."

- In Addition: Or, it could state "28 days of annual leave, plus bank holidays."

As long as the total paid time off meets or beats the statutory minimum, either approach is perfectly legal. The key is to be crystal clear in your written terms of employment to avoid any arguments down the line.

Trying to manage all these nuances with spreadsheets is a recipe for headaches and compliance risks. Leavetrack automates accruals, puts requests in one place, and gives everyone total clarity, making sure your holiday management is always fair, transparent, and compliant. Discover a simpler way to handle leave at https://leavetrackapp.com.