Your Guide to the UK Holiday Allowance Calculator

Posted by Robin on 19 Jan, 2026 in

A holiday allowance calculator is really just a tool that does the heavy lifting for you, figuring out an employee's annual leave entitlement. It takes the statutory UK rules, like the minimum 5.6 weeks of paid holiday, and applies them to all sorts of work patterns. This makes sure you get fair and legally sound results, whether you're dealing with full-time staff or someone on a zero-hour contract.

Your Quick Guide to Calculating Holiday Allowance

Let's get straight to it. Sorting out staff holiday isn't just a box-ticking HR task—it's about being fair, staying on the right side of the law, and keeping your team happy. If you get it wrong, you’re looking at potential disputes and messy payroll errors. Get it right, and you build transparency and trust. This guide will walk you through the core principles you absolutely need to know.

Think of this as your go-to cheat sheet for quick, reliable answers. We’ll demystify the whole process with the essential formulas for your full-time, part-time, and irregular-hours staff, all laid out in a simple, digestible way.

The Foundation of UK Holiday Entitlement

Every calculation you make starts from the same place: the statutory minimum entitlement. Here in the UK, that’s 5.6 weeks of paid annual leave per year for most workers. This right got a significant boost back in April 2009, marking a substantial increase for many people who previously only got the bare minimum.

Remember, this entitlement is the legal floor, not the ceiling. Lots of companies offer more as a contractual perk, but nobody can legally receive less. The real challenge comes when you have to apply this 5.6-week rule to all the different work schedules in your team.

A common trip-up is assuming bank holidays are automatically given on top of the 28 days. In reality, an employer can include the eight bank holidays within the statutory 5.6-week allowance, as long as the employment contract makes this crystal clear.

To help you instantly find the right approach for your team, the table below summarises each of the main calculation methods.

Holiday Calculation Methods at a Glance

This table breaks down the different ways to calculate holiday pay based on how your employees work. It’s a handy reference to make sure you’re applying the correct logic for each person.

| Employment Type | Calculation Method | Example Scenario |

|---|---|---|

| Full-Time | (Weeks of entitlement) x (Days worked per week) = Total days | An employee working 5 days a week gets 5.6 weeks x 5 days = 28 days. |

| Part-Time (Fixed Days) | (Full-time entitlement / 5 days) x (Days worked per week) = Total days | A team member working 3 days a week gets (28 / 5) x 3 = 16.8 days. |

| Irregular Hours | (Hours worked) x (12.07%) = Holiday hours accrued | A zero-hour worker clocks 50 hours in a month, accruing 50 x 0.1207 = 6.035 hours of leave. |

| Leavers/Starters | (Full annual entitlement / 12) x (Months worked) = Pro-rata entitlement | An employee leaves after 6 months. Their pro-rata entitlement is (28 / 12) x 6 = 14 days. |

Each method ensures fairness and compliance, but it’s crucial to pick the right one for the right situation. Using the wrong formula is one of the easiest ways to get holiday calculations wrong.

While our guide focuses on UK holiday allowance, it can be useful to see how other employee benefits are managed. For instance, looking at tools like a UAE End of Service Benefits Calculator can give you a broader perspective on handling employee entitlements in a global context.

Understanding Your Legal Holiday Obligations

Getting holiday allowance right isn’t just about keeping your team happy; it's a fundamental part of UK employment law. You need to get your head around the difference between what's legally required (statutory leave) and what your company chooses to offer on top (contractual leave). Nail this, and you're not just compliant, you’re also in a much better position to attract and keep great people.

Think of it like building a house. Statutory leave is the foundation. It’s non-negotiable, mandated by law, and ensures everything is safe and stable. Contractual leave, on the other hand, is the extra bedroom or the fancy landscaped garden you add to make the house more appealing. Every business has to lay the foundation, but the extras are what can really make you stand out.

Statutory vs Contractual Leave Explained

The legal baseline in the UK is 5.6 weeks of paid holiday per year. This is the absolute minimum you must provide to nearly all workers, whether they're full-time, part-time, or on zero-hour contracts.

For a typical full-time employee working five days a week, this works out to 28 days—a number you'll see a lot, as it's the common cap for the statutory minimum.

Contractual leave is simply any paid time off you offer above this legal minimum. Offering more than 28 days can be a powerful perk, showing your team that you genuinely care about their work-life balance and wellbeing.

It’s a common myth that statutory leave has to be given on top of bank holidays. An employer can absolutely include the eight UK bank holidays within the 28-day minimum, as long as this is crystal clear in the employment contract.

Why a Clear Policy is Your Best Defence

When it comes to holiday management, ambiguity is your worst enemy. A vague or non-existent policy is a recipe for disputes, misunderstandings, and even a trip to an employment tribunal.

Your employment contracts and company handbook need to be explicit. They should clearly state:

- The total number of holiday days your team gets.

- Whether this allowance includes bank holidays or not.

- The process for booking and getting leave approved.

- Any rules about carrying over unused days into the next leave year.

Putting this all down in writing protects both you and your employees, creating a transparent framework that everyone can follow. This clarity is something we explore in more detail in our guide to UK statutory holiday allowance, which really gets into the nitty-gritty of legal compliance.

The Current UK Holiday Landscape

Interestingly, UK annual leave allowances have been pretty stable for a while now. Recent data shows an average of just over 23 days (not including bank holidays) since 2019. Many companies sweeten the deal by offering packages of 25-30 days plus the standard 8 bank holidays, bringing the total to a much more attractive 33-38 days.

This stability shows that while the legal minimum acts as a safety net, plenty of businesses see the competitive advantage in being more generous. To get a better sense of your obligations, it can even be helpful to look at how other countries do things by reviewing NZ employment law basics, as different frameworks offer useful perspective.

Ultimately, a well-defined policy—whether you stick to the statutory minimum or offer an enhanced package—is the cornerstone of solid, stress-free leave management.

Getting Part-Time Holiday Calculations Right

Calculating holiday for part-time employees is probably the number one spot where well-meaning managers make costly mistakes. It's a classic headache for HR and team leads alike, but it doesn't have to be. Once you get your head around the core idea of 'pro rata', you’ll find it’s quite straightforward and, more importantly, fair for everyone.

The principle is simple: your part-time staff get the exact same holiday entitlement as full-timers, just scaled down to match the days or hours they actually work. They are legally protected from being treated any less favourably. So, if a full-time employee is entitled to 5.6 weeks of paid leave, so is a part-timer. The only difference is their "week" is shorter.

The Pro Rata Formula for Staff on Fixed Days

Let's start with the most common scenario: part-time staff who work the same set days every week. The maths here is refreshingly simple, and you won't need a fancy calculator to get it right.

Here’s the go-to formula:

5.6 weeks x (the number of days they work each week) = Their annual holiday entitlement in days

This simple sum ensures their allowance is perfectly proportional to a full-time employee working a five-day week, who would get 5.6 x 5 = 28 days.

Let's see how this works in the real world.

Example 1: The Three-Day Week

Sarah works Tuesday, Wednesday, and Thursday every week. To figure out her holiday, we just plug her days into the formula:

5.6 weeks x 3 days = 16.8 days of paid holiday for the year.Example 2: The Four-and-a-Half-Day Week

David works full days Monday to Thursday and finishes at lunchtime on Friday. That's 4.5 days a week. So, his calculation is:

5.6 weeks x 4.5 days = 25.2 days of paid holiday.

One crucial point: you can’t round these figures down. An employee is entitled to every last bit of their holiday. For the sake of simplicity, many employers round up to the nearest half or full day. In our examples, Sarah might get 17 days and David 25.5 days.

What About Irregular Work Patterns?

Things get a bit trickier when an employee works a set number of hours but spreads them differently each week. Imagine someone contracted for 20 hours a week who works two long shifts one week and four shorter ones the next. Trying to calculate their leave in "days" just doesn't work—it quickly becomes confusing and unfair.

The solution? Switch to calculating their holiday entitlement in hours.

To get a baseline, think about a full-timer. You'd convert their 28 days into hours by multiplying by their daily hours. For a standard 8-hour day, that's 28 days x 8 hours = 224 hours of leave. For a part-timer, you just multiply their weekly hours by 5.6.

Here’s how it looks for someone on a flexible weekly schedule:

- Example: The Irregular 20-Hour Week

Maria is contracted for 20 hours a week, but her daily schedule is always changing. Calculating her holiday entitlement in hours is the only fair way:

5.6 weeks x 20 hours = 112 hours of paid holiday per year.

This method keeps things accurate. When Maria books a day off, you simply deduct the hours she was scheduled to work that day. If she was down for a 7-hour shift, 7 hours come off her 112-hour balance. It's a much cleaner and more precise approach than guessing with days.

Getting these calculations spot-on is vital for trust and legal compliance. While these formulas are great for one-off checks, using an automated system can completely remove the risk of human error, especially as your team grows and schedules become more varied. For a deeper look into the nitty-gritty, our guide explains how to calculate pro rata holiday with a UK focus, covering even more complex situations to ensure every calculation is fair and fully defensible.

Calculating Leave for Irregular and Zero-Hour Contracts

Alright, let's tackle what is easily the trickiest part of managing holiday leave: calculating entitlement for people on zero-hour contracts or those with irregular work patterns.

If you’ve ever tried to apply the standard pro-rata logic here, you’ll know it just doesn't fly. Their hours go up and down, so you need a different way to figure out their holiday entitlement to keep things fair and, crucially, legal. This is where so many businesses get tangled up, often relying on monster spreadsheets that are just begging for a human error to creep in.

Thankfully, you don't have to guess. There are two established methods for handling this, and knowing which one to use (and when) will make sure your calculations are spot on.

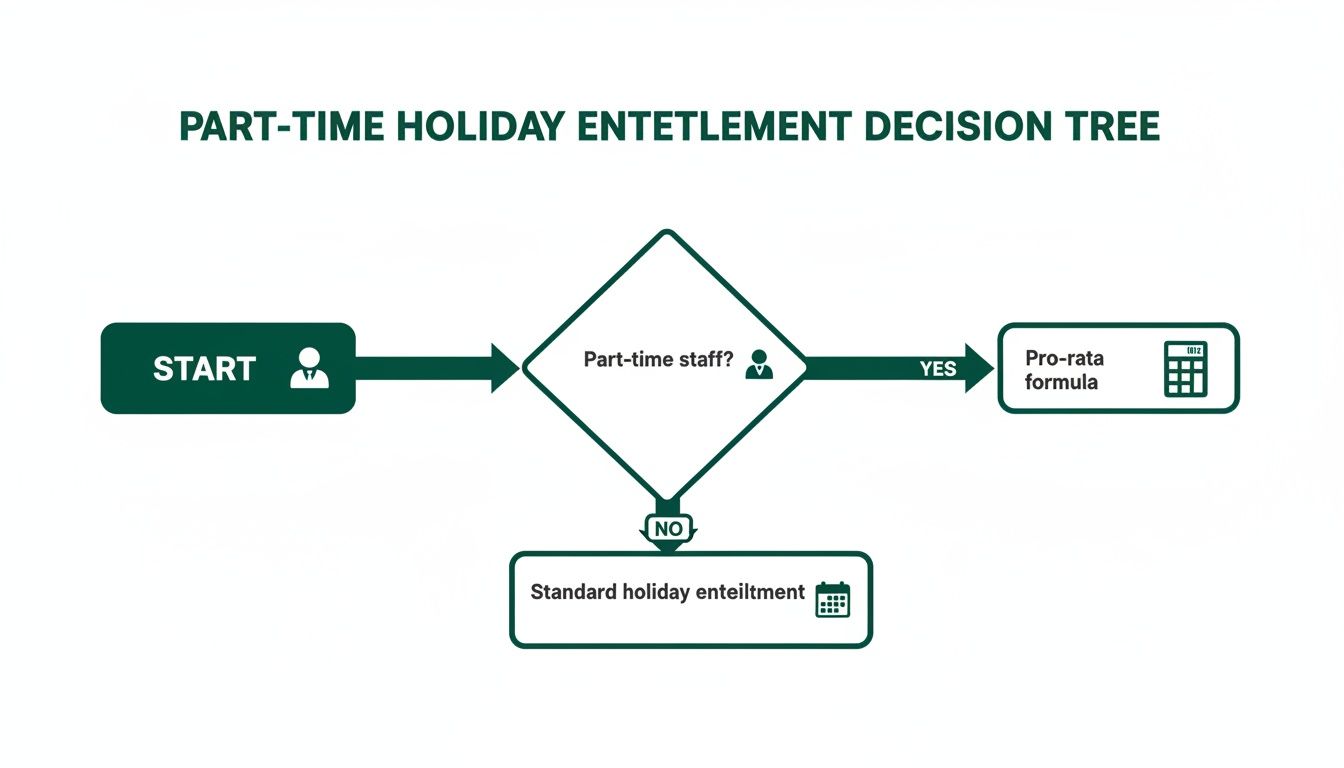

This flowchart gives you a quick visual on how to approach holiday calculations, pointing you towards the right formula when you’re dealing with part-time staff.

As the guide shows, the first move is always to figure out the work pattern. That single piece of information dictates the entire calculation method you need to follow.

The 52-Week Reference Period Method

When it comes to working out holiday pay—the actual cash you pay a worker when they take their leave—the law is very clear: you must use a 52-week reference period. This approach makes sure the pay someone gets for a week off reflects their average weekly earnings over the last year.

The process involves looking back at the last 52 weeks where the employee actually earned money. It's really important to ignore any weeks where they didn't work at all and weren't paid.

Here's how it breaks down:

- Look Back 52 Weeks: Start from the week just before the holiday begins and count back 52 weeks.

- Discount Zero-Pay Weeks: If there are any weeks in that period where the employee earned nothing, you skip them. You then have to go back further until you have a full 52 weeks of pay data (the law allows you to go back a maximum of 104 weeks to find them).

- Calculate the Average: Add up the total pay from those 52 weeks and divide by 52. This gives you the average weekly pay, and that’s the figure you use to pay them for one week of holiday.

This isn't just a suggestion; it's the legally required way to set a worker's holiday pay rate. It stops them from being penalised for taking a holiday during a quiet spell.

The 12.07% Holiday Accrual Method

While the 52-week period is all about the pay, the 12.07% method is used to work out holiday entitlement—the amount of leave they actually earn. The whole idea is that holiday time is accrued as a percentage of the hours someone works.

So, where does that very specific 12.07% number come from?

It’s pretty simple, actually. A standard year has 52 weeks. Statutory holiday entitlement is 5.6 weeks. That leaves 46.4 working weeks (52 - 5.6). The percentage is just the holiday weeks divided by the working weeks:

(5.6 holiday weeks / 46.4 working weeks) x 100 = 12.07%

So, for every hour an employee works, they earn 12.07% of that hour as paid time off.

Worked Example: Accrual in Action

Let's say an employee on a zero-hour contract works 60 hours in a month. To figure out how much holiday they've earned, you just multiply their hours by the accrual rate:

60 hours x 12.07% = 7.24 hours of paid leave.

That time is then added to their running holiday balance.

This method is incredibly handy for tracking entitlement as it builds up. However, it's worth noting that recent government guidance has clarified its use. It's now primarily intended for irregular-hour and part-year workers for leave years that started on or after 1st April 2024. For a much deeper dive, you can check out our post on holiday entitlement on a zero-hour contract in our complete guide.

Irregular Hours Holiday Calculation Methods Compared

Trying to keep these two methods straight can feel like a headache, which is why a proper holiday allowance calculator can be a lifesaver. It takes the guesswork and the risk of a slip-up with a manual calculation completely off your plate.

To make it clearer, here’s a simple comparison of the two approaches.

| Calculation Method | When to Use | Key Consideration |

|---|---|---|

| 52-Week Reference Period | To calculate the rate of pay for a week of holiday taken by an irregular-hour worker. | This is a legal requirement for determining how much to pay someone for their leave. It's all about their average earnings. |

| 12.07% Accrual Method | To calculate the amount of holiday entitlement (in hours) that an irregular-hour or part-year worker earns as they work. | This method is for working out how much leave has been accrued, not the pay rate for that leave. |

At the end of the day, if your business relies on a flexible workforce, managing these calculations by hand is not just a huge time drain—it’s a compliance risk waiting to happen. An automated system like Leavetrack handles all this complexity for you, ensuring you stay on the right side of the law and that your team gets the exact holiday pay they've rightfully earned.

Handling Holiday Pay for New Starters and Leavers

Holiday allowance isn't just about managing a full leave year. You also have to get it right when people join or leave part-way through. These moments really count – getting the numbers right for a new starter sets a professional, welcoming tone. For someone leaving, it ensures a smooth, compliant offboarding process.

Nailing the pro rata calculations is key to preventing pay disputes and making sure that final salary payment is spot on.

The principle behind it is beautifully simple: an employee’s holiday entitlement builds up steadily throughout the year. For every month they work, they earn one-twelfth of their total annual allowance. This straightforward logic is the foundation for every starter and leaver calculation you’ll ever do.

Calculating Entitlement for New Starters

When a new employee joins your team, their holiday allowance for the rest of the year needs to be worked out on a pro rata basis. The simplest way is to figure out their monthly allowance and multiply it by the number of full months they’ll be working.

Here’s the formula:

(Total Annual Entitlement / 12) x Number of Months Worked = Accrued Entitlement

Let's see it in action.

Example: Employee Starts in March

Imagine your company's leave year runs from January to December. A new full-timer, who gets 28 days a year, starts on 1st March. They'll be with you for 10 months of the leave year (from March to December).- First, work out the monthly accrual: 28 days / 12 months = 2.33 days per month

- Next, calculate their allowance for the rest of the year: 2.33 days x 10 months = 23.3 days

In this case, the new starter is entitled to 23.3 days of holiday. It’s always good practice to round this up to the nearest half or full day, so you’d give them 23.5 days.

Calculating Final Holiday Pay for Leavers

The process for people leaving the business is almost identical, but this time you’re focused on what they've earned up to their final day. This calculation is a legal requirement and a critical part of their final pay packet.

First, you work out their total accrued leave for the part of the year they've worked. Then, you subtract any holiday they’ve already taken. The result tells you if you owe them money for untaken days or, if your contract allows it, if you can deduct pay because they’ve taken too much.

Crucial Takeaway: An employee is legally entitled to be paid for any unused statutory holiday they have accrued when they leave. Whether you pay out any extra contractual holiday depends entirely on the wording of their employment contract.

Let’s walk through an example.

Example: Employee Leaves in October

An employee with a 28-day annual allowance resigns, and their last day is 31st October. They've worked 10 full months of the leave year and have already used 18 days of holiday.- Calculate Accrued Leave: Just like our new starter, their accrued leave is (28 / 12) x 10 = 23.3 days.

- Determine Untaken Leave: They've earned 23.3 days but only taken 18. This leaves 23.3 days - 18 days = 5.3 days untaken.

- Calculate Final Payment: You must pay them for these 5.3 days. For a salaried employee earning £30,000, you’d calculate their day rate like this:

- £30,000 / 52 weeks = £576.92 per week

- £576.92 / 5 days = £115.38 per day

- Final Holiday Pay: 5.3 days x £115.38 = £611.51

This £611.51 would then be added to their final salary payment. While you can do these sums manually, a reliable holiday allowance calculator or an automated system like Leavetrack eliminates the risk of human error, guaranteeing accuracy and compliance every single time.

Common Holiday Calculation Mistakes and How to Avoid Them

Even with the best formulas, it’s frighteningly easy for small miscalculations to snowball into major payroll headaches and unhappy team members. Let's be honest, managing annual leave can feel like navigating a minefield. But knowing where the traps are is half the battle.

Getting these calculations right isn’t just about the numbers. It’s about being fair, staying on the right side of the law, and building a foundation of trust with your people. Let’s walk through the most common slip-ups that catch out even the most careful managers.

Mistake 1: Rounding Down Entitlements

It might seem like a tiny detail, rounding an employee’s entitlement of 16.8 days down to 16.5 or even 16. But this is a critical legal mistake. Your employees are entitled to every last fraction of the holiday they've earned, and rounding down effectively short-changes them.

- The Fix: Always round up, never down. The accepted best practice is to round up to the nearest half or full day. So, that 16.8 days becomes a clean 17 days.

- Prevention: Make "always round up" a golden rule in your holiday policy. Better yet, an automated holiday allowance calculator or a system like Leavetrack removes human error from the equation completely.

Mistake 2: Mishandling Bank Holidays for Part-Timers

This is a classic. A common error is to only give a part-time employee a bank holiday off if it happens to fall on one of their normal working days. This creates an unfair system almost immediately. Imagine someone who works Tuesday to Thursday—they’ll miss out on every single Monday bank holiday, while their colleague working Monday to Wednesday gets the benefit each time.

All part-time workers are entitled to a pro-rata allowance of bank holidays, regardless of which days they normally work. Fairness is a legal requirement, not an optional extra.

The correct way to handle this is to calculate their pro-rata bank holiday entitlement and add it to their total annual leave pot. If they are scheduled to work on a bank holiday, they simply book it off using this allowance. If they aren’t scheduled to work, their allowance remains untouched for them to use whenever they like. Simple, fair, and compliant.

Mistake 3: Forgetting About Carried-Over Leave

Forgetting to track leave carried over from the previous year is another frequent tripwire. When an employee eventually leaves, this untracked holiday time can throw your final pay calculations into disarray, as their actual entitlement was higher than your records showed.

- The Fix: Make sure your records for the current leave year have a crystal-clear entry for any days brought forward from the last one.

- Prevention: A centralised leave management system is your best defence here. It creates a single source of truth for each employee's total holiday pot, including any carried-over days. This guarantees that final calculations for leavers are always spot on, preventing disputes and ensuring a smooth offboarding.

Your Holiday Allowance Questions Answered

Even with the best tools, you’re bound to run into some tricky questions about holiday allowance. Let's tackle some of the most common queries that trip up managers, so you can handle them with confidence.

Can We Include Bank Holidays in Statutory Leave?

Yes, you can. It’s perfectly legal for an employer to include the eight UK bank holidays as part of an employee’s minimum 5.6 weeks (28 days) of paid leave.

The key, however, is clarity in the employment contract. If a contract says "20 days plus bank holidays," the total entitlement is clearly 28 days. But if it just says "28 days annual leave," the law assumes this figure already accounts for bank holidays. Just remember, for your part-time staff, their bank holiday entitlement must always be worked out on a pro rata basis to keep things fair.

How Is Holiday Entitlement Affected by Maternity Leave?

This is a big one, and it’s simpler than many people think: holiday entitlement continues to build up as normal throughout the entire period of both Ordinary and Additional Maternity Leave. It’s not just the statutory minimum that accrues; it's their full contractual entitlement.

It is illegal to treat an employee unfavourably because they are taking maternity leave. The best approach is to encourage them to use up any accrued leave before their maternity leave starts. If that’s not possible, formally agree it can be taken when they return, making sure they don’t lose out on any of their hard-earned time off.

What Happens to Unused Holiday When an Employee Leaves?

When someone leaves your team with more holiday accrued than they’ve managed to take, you are legally required to pay them for those untaken days. This payment is based on their pro-rata entitlement up to their very last day and has to be included in their final payslip.

What about the other way around? If an employee has taken more leave than they’ve actually accrued, you might be able to deduct the value of those extra days from their final pay. But – and this is a crucial ‘but’ – you can only do this if you have a specific clause in their employment contract that allows for it. Without that clause, you have no legal right to reclaim the money.

Juggling these nuances manually is a huge time sink and a genuine compliance risk. Leavetrack takes care of all these holiday calculations automatically – from pro rata and accruals to new starters and leavers – so your records are always accurate and legally sound. See how much time you could save by checking out Leavetrack today.